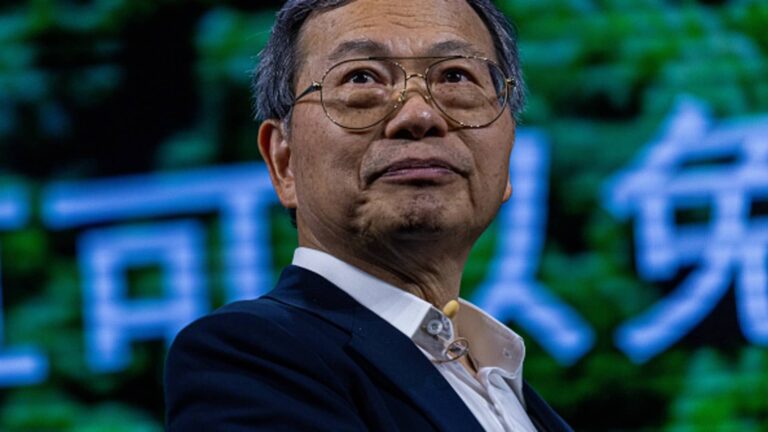

Charles Liang, CEO of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, Wednesday, June 5, 2024. The exhibition will run until June 7th.

Annabelle Chee | Bloomberg | Getty Images

super microcomputer It could be kicked off the Nasdaq as early as Monday.

This is the potential fate of server companies if they fail to submit a viable plan to comply with Nasdaq regulations. Supermicro is delayed in filing its 2024 year-end report with the SEC and has not yet replaced its accounting firm. Many investors expected transparency from Supermicro when it announced preliminary quarterly results last week. But they couldn’t figure it out.

A key element of that plan is when and how Supermicro will file its 2024 year-end report with the Securities and Exchange Commission, and why the delay occurred. The report, which many expected to be filed with the company’s June fourth quarter results, was never filed.

The Nasdaq delisting process marks a crossroads for Supermicro. Supermicro is one of the main beneficiaries of the artificial intelligence boom due to its long-standing relationship with the United States. Nvidia And demand for chipmakers’ graphics processing units is surging.

The former AI darling is reeling from a string of bad news. After Supermicro failed to submit its annual report over the summer, activist short seller Hindenburg Research targeted the company in August, alleging accounting fraud and export control issues. The company’s auditor, Ernst & Young, resigned in October, and Supermicro announced last week that it continues to search for a new auditor.

Stocks have been hit hard. The stock price soared more than 14 times from late 2022 to its peak in March of this year, but has since plummeted 85%. Supermicro stock is now at the same level as its May 2022 trading price after falling another 11% on Thursday.

If Supermicro does not submit a compliance plan by Monday’s deadline, or the exchange rejects the company’s submission, it could be delisted from the Nasdaq next. Supermicro could also obtain an extension from Nasdaq, giving it several months to comply. The company announced Thursday that it would provide the plan to Nasdaq in time.

A spokesperson told CNBC that the company “intends to take all necessary steps to achieve compliance with Nasdaq continued listing requirements as quickly as possible.”

The delisting issue will primarily affect the stock price, but it could also damage Supermicro’s reputation and standing with customers, who may simply want to avoid the drama and buy AI servers from competitors. I don’t know. Dell or HPE.

“Given that Supermicro’s accounting concerns have become more acute since the end of Supermicro’s quarter, its weakness ultimately “This could lead to bigger benefits for Dell in the next quarter.”

A Nasdaq representative said the exchange does not comment on the delisting process for individual companies, but the rules suggest the process could take about a year to finalize. said.

Compliance planning

On September 17, Nasdaq warned Supermicro that it was at risk of being delisted. This gives the company 60 days to submit its compliance plan to the exchange, and since the deadline falls on a Sunday, the effective date of the submission will be Monday.

If Supermicro’s plan is accepted by Nasdaq staff, the company will be eligible for an extension of up to 180 days to file its year-end report. Nasdaq wants to know whether Supermicro’s board investigated the company’s accounting issues, the exact reason for the late filing, and the timeline for any action taken by the board.

When evaluating compliance plans, Nasdaq considers several factors, including the reason for late filings, upcoming company events, the company’s overall financial condition, and the likelihood that the company will file an audit report within 180 days. He said he would consider it. The review may also consider information provided by external auditors, the SEC, or other regulatory authorities.

Supermicro last week said it was doing everything it could to remain listed on the Nasdaq and that a special committee of its board of directors had investigated and found no wrongdoing. Supermicro CEO Charles Liang said the company would receive the board committee’s report as early as last week. A company spokesperson did not respond when asked by CNBC if they had received the report.

If Nasdaq rejects Supermicro’s compliance plan, the company could request a hearing with the exchange’s public hearing panel to reconsider its decision. Supermicro will not be immediately removed from the exchange. The Hearing Committee’s request initiates a 15-day grace period before delisting, and the Committee may decide to extend the deadline by up to 180 days.

If the panel denies that request, or if Supermicro fails to obtain an extension and file an updated financial report, the company can still appeal the decision to another body at Nasdaq called the Listing Council. Yes, and exceptions can be made.

Ultimately, Nasdaq said the extension would be limited to 360 days from the company’s first late filing deadline.

poor track record

There is one factor that could hurt Supermicro’s chances of a contract extension. Exchanges consider whether a company has a history of violating SEC regulations.

According to the SEC, Supermicro misrepresented its financial statements from 2015 to 2017 and delayed releasing key tax returns. It was delisted from Nasdaq in 2017 and relisted two years later.

“According to the Nasdaq document, Supermicro plans to ‘consider the company’s unique circumstances, including past compliance history,’ when determining whether an extension is warranted,” said Matt Bryson, an analyst at Wedbush. “Partial indications are that an extension could be even more difficult to obtain,” Wedbush analyst Matt Bryson wrote. Notes from the beginning of this month. He has a neutral rating on the stock.

History reveals how long the delisting process can take.

Charles Liang, right, CEO of Super Micro Computer Inc. and co-founder and CEO of Nvidia Corp., at the Computex conference in Taipei, Taiwan, Wednesday, June 5, 2024, in Taipei, Taiwan. Mr. Jensen Huang.

Annabelle Chee | Bloomberg | Getty Images

Supermicro missed the June 2017 annual report filing deadline, which was extended until December, and a final public hearing was held in May 2018, which was again extended until August of the same year. Only after that deadline had passed was the stock delisted.

In the short term, the bigger concern for Supermicro is whether its customers and suppliers will bail out.

Compliance issues aside, Super Micro is a fast-growing company that makes one of the most sought-after products in the technology industry. Analysts say the company’s balance sheet is flush with cash, with sales more than doubling to nearly $15 billion last year, according to unaudited financial reports. Wall Street expects sales to grow even further in 2025, to about $25 billion, according to FactSet.

Supermicro said last week that application delays had “some impact on orders.” In the unaudited September quarter results, It was reported last week that the company’s growth was slower than Wall Street expected. We also guided the light.

The company has cited the lack of sufficient supply of NVIDIA’s next-generation chip, Blackwell, as one of the reasons for the poor performance, raising questions about Supermicro’s relationship with its most important supplier. He said that it is happening.

Ben Reitzes, an analyst at Melius Research, said, “I don’t think the Supermicro issue is a big deal for Nvidia, but it could take a toll on sales in the short term because customers are directing orders to Dell and other places.” “The amount may fluctuate from quarter to quarter.” In this week’s notes.

“We have spoken with NVIDIA and confirmed that we are not making any changes to our allocations,” Michael Steiger, Supermicro’s head of corporate development, told investors on a conference call last week. “We are maintaining this,” he said.