Now is the perfect time to do something really stupid, like putting zero percent down on a mortgage.

Totally stupid timing

Morningstar Report One of the largest U.S. lenders is offering 0% down payment mortgages to first-time homebuyers..

A new program launched by United Wholesale Mortgage, one of the largest mortgage lenders in the U.S., will allow homebuyers to purchase a home without making any down payment.

The new program is available to first-time homebuyers and those earning up to 80 percent of the area median income, according to a press release from the Pontiac, Michigan-based company.

UWM (UWMC) will offer qualified buyers a second mortgage loan of up to $15,000 in down payment assistance equal to 3 percent of the home purchase price. The loan accrues no interest and has no monthly payments.

“Homeownership is something we’re very passionate about,” UWM Chief Operating Officer Melinda Wilner told MarketWatch.

The company previously allowed homebuyers to put down as little as 1 percent, but it wants to go further to help homebuyers, Willner said, adding that the company expects its new zero-down payment program will attract more borrowers.

The International Monetary Fund reported in 2008 that poor underwriting practices were a major cause of the U.S. subprime mortgage crisis. But unlike the proliferation of low-dollar or no-down-payment loans that proliferated at the time — loans that lenders made to people who would eventually default and lose their homes — UWM’s program is different, Willner said.

“What worries me about this program is the silent second mortgage,” Anneliese Lederer, senior policy adviser at the nonprofit Center for Responsible Lending, told MarketWatch in an interview. “It’s great that it’s interest-free, but it’s a balloon payment and borrowers need to understand what a balloon payment is.”

According to the Consumer Financial Protection Bureau, a balloon payment is a larger-than-usual lump sum payment required by a lender at the end of a loan’s term.

The fine print at the bottom of the page on UWM’s website states that the second loan “has no minimum monthly payment requirements, has a term of 360 months, and is required to be paid in full as a balloon payment when the first loan is refinanced or refinanced.” [first mortgage], [or] Reward [first mortgage] Or final payment.”

Not like 2008?!

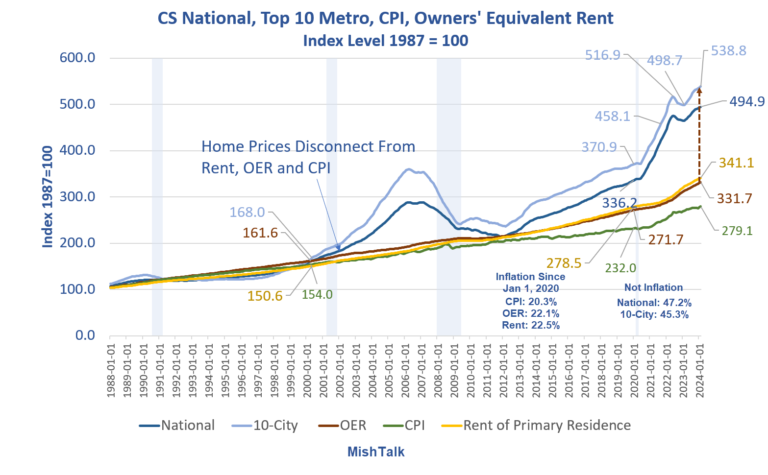

- Housing prices are soaring

- The economy is slowing

- Lenders have no cushion against falling home prices.

- There are signs that home prices are plummeting in many markets.

Sure, there aren’t the huge bogus loans of 2008, but mortgage affordability is at an all-time low and unemployment is starting to rise.

Doing anything to keep the bubble going

Additionally, these mortgages are only for people who earn 80% or less of the area median income.

How foolish is that? Typically, these borrowers have no down payment, no savings, and are already in dire straits.

It would make more sense to offer these mortgages to people who earn more than 120 percent of the area median income, have low debt levels, and don’t have enough for a down payment.

Vote buying

In his State of the Union address, President Joe Biden called on Congress to provide first-time homebuyers with up to $25,000 in down payment assistance.

These vote-buying schemes to keep the economy humming in order to win elections always come at the expense of those who fall for the scheme.

Job losses and unexpected debt can push these buyers over the edge.

There are many signs that an economic slowdown is underway.

Economic slowdown underway

May 24, 2024: Another big revision, this time to durable goods: what’s going on?

The Commerce Department revised March durable goods orders to +0.8% from +2.6%, now reporting a 0.7% increase versus expectations of -0.5%.

May 23, 2024: New home sales revised down sharply to fall 4.7%

New home sales have plummeted, and the Census Bureau has completely revised down last month’s fictitious 8.8% increase.

May 22, 2024: Target’s discretionary spending plummets, stock price falls 10 percent

Target CEO Brian Cornell said the results reflected “continued weakness in the discretionary spending sector.” [The key word above is continued.]

May 22, 2024: Existing home sales fall 1.9%, near 17-year stagnation Month

Existing home sales fell 1.9% in April and are down 1.9% from a year ago. Sales have remained stable for 17 months.

Key highlights

- Existing home sales fell 1.9% in April at a seasonally adjusted annual rate to 4.14 million units. Sales were also down 1.9% from a year earlier.

- The median existing home sales price increased 4.8% from March 2023 to $393,500. This marks the ninth consecutive month of year-over-year price increases and the highest price on record for a March month..

- Unsold existing home inventory at the end of April stood at 1.21 million units, up 9% from the previous month, and equivalent to 3.5 months’ supply at the current monthly sales pace.

Major negative revision in BLS monthly employment report for 2023

On April 24, the BLS released a little-read jobs report indicating that reported employment in 2023 may have been significantly overstated.

Commented on April 24th BLS monthly employment statistics and GDP for 2023 are expected to be revised significantly downwards

The BED report is based on records of 9.1 million private sector establishments. The Current Employment Statistics (CES) is a monthly employment report based on 670,000 establishments.

Of course, the BED report is more timely, but it is delayed, and the CES provides an opportunity for economists (and the president) to make a big fuss over numbers that could be wildly wrong.

CES Hyperbole

- CES hype for Q2 2023: 489,000 jobs

- CES hype for Q3 2023: 832,000 jobs

- Q2+Q3 overestimate: 1.321 million jobs

As a result, the BLS states that the BLS monthly employment reports for the second and third quarters of 2023 are overstated by a total of 1.321 million jobs.

Zero Percent Down Synopsis

An economic slowdown is underway (see previous 5 links).

Employment is overstated by 1.3 million, discretionary spending is stagnant, and UWM (UWMC) is offering zero down payment mortgages to the buyers most likely to face problems if something goes wrong.

For discussion on lead charts, see Home prices hit record high, don’t worry, it’s not inflation

The Case-Shiller National Home Price Index hit a record high in February, the most recent data available, and economists don’t consider this inflation.

Aside from the tail end of the 2008 housing bubble, there has never been a worse time in history to offer a zero down payment mortgage.