American Express Platinum Card and Business Platinum Card for American Express If you’re interested in the perks of luxury travel, you’ve established yourself as a card you should have. With similar benefits to overlapping reward structures, it is logical to question which of the two is best for you. Or, if you already have one of the cards, you may wonder if you should go to another card.

Even with each annual fee of $695, it can actually work out to make room for both cards in your wallet (see each Fees and fees Amex Platinum and Fees and fees (for Amex Business Platinum).

Each card has the advantage of complementing other cards, and travelers have no problem retrieving sudden annual fees.

Here are some reasons why you want both in your wallet:

Incredible welcoming value

Both cards come with a fairly welcome offer. Now new Business Platinum Card Card members can earn 150,000 Bonus Points After spending $20,000 in the first three months of your card membership.

in Amex Platinumnew card members can earn 80,000 points after spending $8,000 in the first six months of their card membership (but can target higher offers though Through the Card Match Tool – It can change at any time and not everyone is targeting the same offer).

Apply for both cards and earn a full welcome bonus and earn at least 230,000 membership reward points. Based on TPG March 2025 evaluationit’s worth $4,600. This is more than three times the total annual fee cost.

Related: Is Amex Business Platinum worth the annual fee?

Card Credit

Both cards have numerous credits to help card members gain value year by year. Registration is required for the perks of your choice. Terminology applies.

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news from TPG experts, detailed guides and exclusive deals

Typically, one of the easiest perks to use with a Platinum Card is credits in the annual airline fee statement, which receives each calendar year.

Each card has the latest version$200 Airline Fee Statement Credit Each calendar year (registration is required). It’s not generous though $300 annual travel credit Get it with Chase Sapphire Reserve® (This applies to any travel purchase), Amex Platinum card credits are still very useful.

In addition to airline fee credits, Personal Platinum Card Annual offers are included. Card members enjoy the following (some benefits require registration):

Regarding annual statement credits, Business Platinum It’s not even leaning forward. It offers Up to $400 with Dell Statement Credit Every calendar year (up to $200 per quarter), statement credits up to $360 per calendar year (up to $90 per quarter), Up to $200 per calendar year for Hilton Statement Credit (Up to $50 per quarter), up to $150 per calendar year for Adobe Statement Credit (qualified by Auto-Renewal), and up to $120 per calendar year for purchases with US wireless mobile phone providers ($10 per month). Dell and Adobe credits end in June. 30.

Business Platinum also matches your personal platinum by providing statement credits to both Clear Plus and Your Global Entries or TSA Precheck Application fees (can be used frequently to pay for travel companion applications). These credits are of the same value as Amex Platinum’s and are issued in the same time frame.

Registration is required for the perks of your choice. Terminology applies.

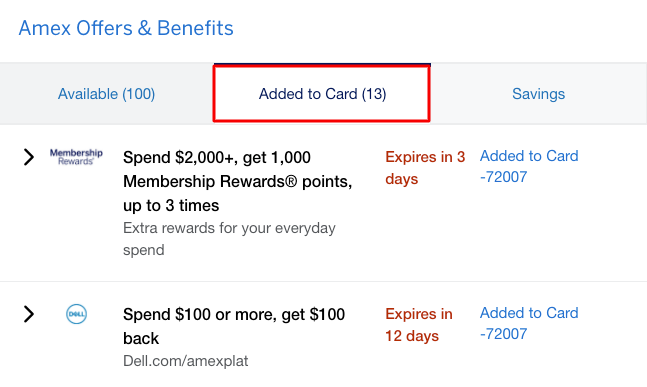

Amex Offer

All American Express Cards including platinum and Business Platinum Card and access included Amex Offer. Scroll down to “Amex Offers and Benefits” on your online account page or use the Amex app[オファー]Click on the tab to find available offers. They are aimed at each card member and come from merchants such as hotels, travel providers, restaurants, clothing, jewelry stores and more. These offers are typically:

- Use $x to get the number of bonus points.

- Use $x to retrieve $y.

- Get additional points for each dollar spent on the selected merchant.

Amex offers can do so many things, but stacking them can make it even better Online Shopping Portal Earn additional cashback or bonus points when you purchase.

Please note: Always read fine print on condition as using an online portal, promo code, or other savings method may not trigger your Amex offer depending on the terms of your offer.

That said, the good news is that you can stack Amex top offers along with other popular Amex perks, including some of the annual statement credits that come with your Platinum and Business Platinum cards. Eligibility for these offers is limited. You must register in the AMEX offering section of your account before redemption.

Related: The ultimate guide to Amex

Travel benefits

Card members have access to a variety of things Insurance contract when booking a trip And go shopping Includes their cards:

- Travel Cancellation and Discontinued Insurance*

- Travel delay insurance*

- Mobile phone protection*

- Baggage insurance**

- Purchase Protection**

- Return protection**

- Enhanced Guarantee**

*Eligibility and profit level vary by card. Conditions, conditions, and restrictions apply. For more information, please visit americanexpress.com/benefitsguide. Insurance is undertaken by the New Hampshire Insurance Company, an AIG company.

**Eligibility and profit level vary by card. Conditions, conditions, and restrictions apply. For more information, please visit americanexpress.com/benefitsguide. The policy is undertaken by Amex Assurance Company.

Some cards have eliminated these protections in recent years, so these benefits provide another reason to book a trip with the Amex Platinum.

Platinum Cards not only protect you from some travel disasters, but can also enhance your travel experience.

Platinum cards are accessible Global Lounge Collectionoffers free entry to card members Amex Centurion Lounge Additionally, there are many additional airport lounges available. Access is limited to eligible card members. Overall, the collection allows access to over 1,400 VIP lounge locations in 140 countries. This is an incredibly valuable benefit.

As certainly required by frequent flyers, Platinum cards also offer supplemental benefits to make travel a little easier. Platinum Travel Service Counselors set up their itinerary to make the most of your trip. Priority access is even a way to dive Exclusive seating for cultural and sporting events.

Registration is required for the perks of your choice. Terminology applies.

The Benefits of the Hotel

One area where these two cards overlap is access to an array of The Benefits of the Hotel. Both personal and business Amex Platinum, you receive free gold status at Hilton and Marriott You can access it Amex Fine Hotels + Resorts. Registration is required for the perks of your choice. Terminology applies.

Hilton Gold Status comes with perks such as a free breakfast, room upgrades if available, and an 80% point bonus for paid stays. Marriott Bonvoy Gold Status has advantages such as slow priority checkout, upgrades if available, and a 25% point bonus.

Amex Fine Hotels + Resorts is a program that offers elite-like benefits in properties around the world. These perks include guaranteed late check-out, two daily breakfasts, room upgrades if available, and unique real estate amenities (worth more than $100).

Some properties of this program offer free third, fourth or fifth free time. This is a valuable benefit if you don’t use your hotel points for your stay.

You only need one platinum card to enjoy these benefits, but both ensure that you are exploiting profits while maximizing your revenue, whether your trip is business or joy.

Maximize your personal and business spending

Perhaps one of the biggest benefits of having both the personal and business versions of Amex Platinum is that you can effectively earn 7.7% on all the airfares you put into your individual Platinum Card (Airfares booked directly with the airline or American Express Travel earn up to $500,000 for these purchases per calendar year, followed by 5 points per dollar for one point). This rate of return applies to prepaid hotels booked through Amex Travel.

This means that when you have a business platinum card, you Pay with points Book a flight with Amex Travel and get 35% of your points back (up to 1 million points per calendar year). This essentially gives you a value of 1.54 cents per point.

Earn 5 points per dollar on eligible travel purchases and redeem those points at a value of 1.54 cents and get a 7.7% return.

That said, maximizing the array of valuable transfer partners on American Express may give you even more value. After all, TPG points with AMEX Membership Reward Points as of March 2025 at 2 cents evaluation.

That’s the other thing to consider Amex Business Platinum Earn 1.5 points per dollar for US construction materials and hardware purchases, US electronics, cloud system providers, software purchases, and US shipping providers. On top of that, Business Platinum earns 1.5 points per dollar on purchases over $5,000. Purchases earning 1.5 points per dollar are limited to the first $2 million per calendar year (1 point per point after that).

For example, let’s say you’re buying $11,500 and you’re not entitled to a bonus on another card. In total, earn 17,250 membership reward points on your Business Platinum Card. It’s about $345 based on the TPG rating.

If you use a different qualifying AMEX card with no category bonus on your purchase, you will earn 11,500 membership reward points. It’s about $230 worth.

Virtually, using business platinum will allow you to get an extra value of over $100.

Related: How to Maximize Revenue with Amex Business Platinum

https://www.youtube.com/watch?v=aazsrmkzgwm

Conclusion

With both your personal Amex Platinum card and your business Platinum card, you can get maximum value in both reward revenue and redemption, along with some great card member perks.

This combo is perfect for business-owned travelers who want to take advantage of high budgets and large savings, generous credits and luxurious travel opportunities.

Although the annual cost is high, the right card members don’t have any problems getting great value from this pairing. Each is a great card in its own right, but even if you put both in your wallet, you will still earn more membership reward points and help you grow those points even more when using them on your trip.

For more information, see our full review of Amex Platinum and Amex Business Platinum.

Apply here: Amex Platinum

Apply here: Amex Business Platinum

Click here for Amex Platinum Card pricing and fees here.

Click here for Amex Business Platinum Card pricing and pricing here.