In September 2022, we saw it Marriott Bonvoy Brillion® American Express® Card Increase annual fee to $650 (see Fees and fees) And exchange your easy-to-use annual Marriott Bonboy credits for monthly meal credits.

The annual benefit amount remained the same, but up to $300 in statement credits per calendar year – I think the change was generally negative.

There’s everything you need to know about using the monthly dining statement credits up to $25 available at Marriott Bonvoy Brilliant Amex.

Which purchases usually cause a Marriott Bonvoy Brilliant Dining Credit?

Purchases coded as restaurants, cafes, etc. must trigger monthly meal statement credits for your account. Credits can be used at restaurants in both the US and worldwide.

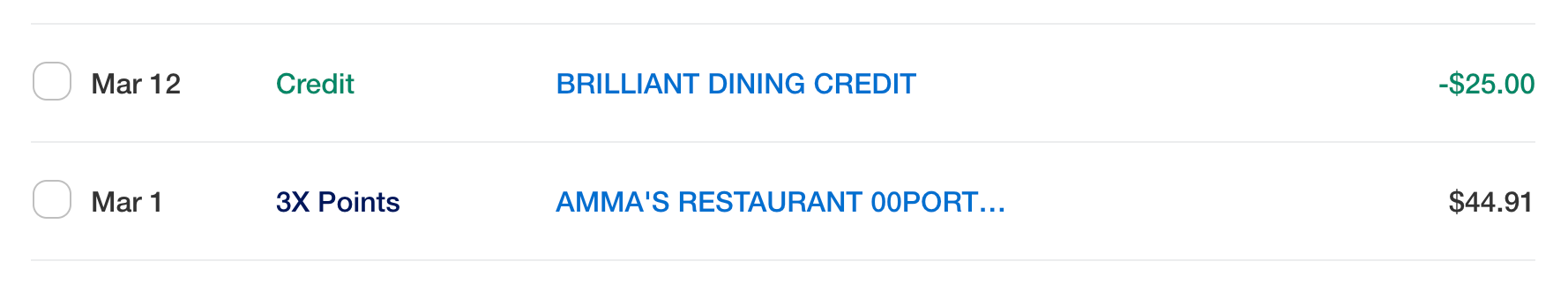

As with other American Express statement credits, These tend to post quickly. We tried it and in March 2025 our credits were posted in 11 days.

As you can see, it triggered a purchase that caused a credit in a meal statement that qualifies for 3 points per dollar at a restaurant at Worlwide.

It is also worth noting that a maximum of $300 statement credits apply, which are only applied once per account.

If you approve users on your account and make a qualifying purchase, those fees will count towards a $300 meal statement credit. However, authorized users of the Main Card Holder account do not receive their own meal credits.

Related: Is Marriott Bonvoi Brilliant Amex worth the annual fee of $650?

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news from TPG experts, detailed guides and exclusive deals

How much do I need to spend on the Marriott Bonvoi Brilliant Dining Credit?

The good news is that you can use up to $300 dining credits as soon as you open Marriott Bonvoi Brilliant American Express. These statement credits are available for the lifetime of your account.

The bad news is that credits need to be used monthly. Bonvoy Brillion Card’s dining statement credits are only available as statement credits up to $25 per month, rather than dealing with a lovely dinner that costs $200 for a birthday.

Maximize your full statement credit of $25 each month and receive a statement credit of up to $300 per calendar year.

Statement credits do not roll over either. This means that if you forget to use the $25 available statement credit this month, your credit is gone. You can’t make up for it by using your $50 meal credit next month. These credits are essentially “used or lost” each month.

The terms and conditions of the card state that it may take 8-12 weeks for the credit to appear in your statement, but that is much faster in our experience.

Related: 8 places to maximize your 85,000 points Marriott Awards night certificate

What is not covered by Marriott Bonvoi Brilliant Dining Credit?

Unfortunately, the conditions indicate:

Dining Credit perks are invalid for purchases of gift cards or products, or for purchases made at non-restaurant merchants such as nightclubs, convenience stores, grocery stores, supermarkets, and other retailers.

Additionally, the Terms of Use warn you that you will not receive a statement credit if your purchase is not coded as a restaurant purchase. This can happen at restaurants located in different venues, such as inside stadiums or casinos.

From these terms you will not receive monthly credits Bonvoi Brilliant If you are purchasing in a location that you do not code as a restaurant for your credit card statement. The same applies when you buy products rather than food.

Related: Marriott Bonboy Brilliant vs. Ritz-Carlton Card: Should you get one or both?

How to Maximize These Credits

Perhaps it’s something I think going to a restaurant and spending exactly $25 is the best way to use this statement credit each month. You can definitely do it.

You can also reposition your wallet or set reminders on your phone to use it. Bonvoi Brilliant You will have your first meal at the restaurant or monthly delivery orders. Another idea of using statement credits is to set this card as the default payment method for your food delivery app you use regularly.

Normally, it is not recommended to use credits on the last day of the month as restaurants may be able to process transactions the next day. In fact, AMEX states:

For example, if you make a qualifying purchase on the last day of the month and the merchant does not process the transaction until the next day, the transaction date reflects the next day’s date, and the statement’s credits apply to the next month.

And if you forget to use your statement credits until the last day of the month, what is it? Loading a Chick-fil-A app or Starbucks card is an effective way to use the remaining balance that is left over for the month.

If you’re already using $20 at a restaurant, you can add $5 to your Starbucks card on the last day of the month. The balance will not be carried over until next month, so you can use the full amount of monthly meal statement credits.

Conclusion

The Marriott Bonvoy Brilliant American Express Card offers dining statement credits of up to $300 per calendar year in your account. Credits can be used as statement credits up to $25 on statement credits for purchases at eligible restaurants, making them extremely easy to use.

Read more Complete review of Marriott Bonvoi Brilliant Cards.

Apply here: Marriott Bonvoy Brilliant American Express Card

Click here for prices and fees for the Marriott Bonvoi Brilliant Card here.