A game changer is underway. Even the NAR acknowledges this “shift from a seller’s market to a buyer’s market.”

From WOLF STREET by Wolf Richter.

Mortgage rates have fallen a full percentage point since last October, to about 6.8%, but sales of existing homes have still plummeted and empty houses are popping up for sale. These are the same empty houses the industry pretends don’t exist: second and third homes that people didn’t sell when they bought new homes over the past few years to take advantage of soaring prices. So now is the time to sell them. And supply surged to a four-year high in June.

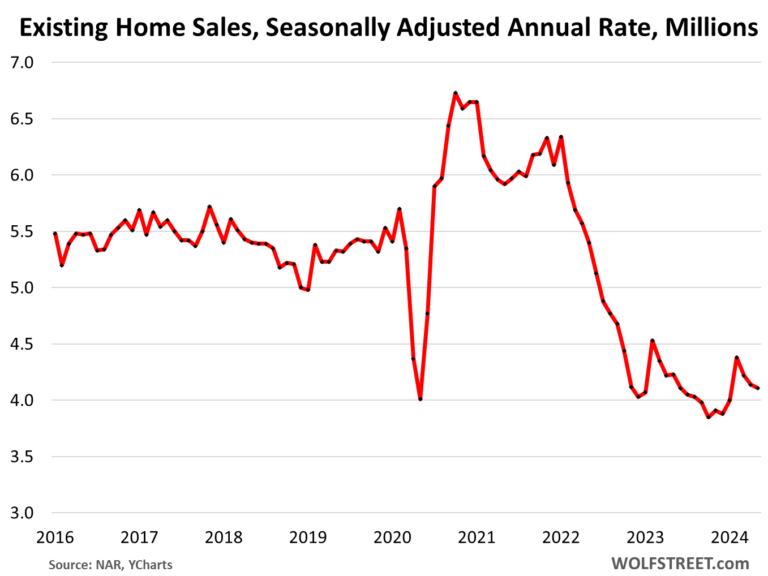

The National Association of Realtors (NAR) released a report today saying that sales of existing homes (single-family homes, townhomes, condominiums and cooperatives) in June fell 5.4% month-on-month on a seasonally adjusted basis and 5.4% year-on-year to 3.89 million units, the third-lowest sales figure since 2010, during the depths of the housing bubble collapse, and the third-lowest level after October and December 2023.

“We are seeing a gradual transition from a seller’s market to a buyer’s market. Homes are staying on the market longer and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is steadily increasing across the country,” NAR said in the report (historic data shows). Y Chart):

Sales in June were down as follows compared to June of the previous year:

- 2023: -5.4%

- 2022: -24.2%

- 2021: -34.8%

- 2019: -26.9%

- 2018: -27.8%.

While not seasonally adjusted and not an annualized rate, sales typically increase from May to June, forming a seasonal sales peak in June, after which sales decline until January.

However, this was not the case in June of this year. Actual sales in June of this year were down from May, totaling 375,000 homes, condominiums and apartment complexes.

Supply surges At the current sales pace, it will take 4.1 months in June, the highest since May 2020 and slightly below June 2019 (4.3 months), June 2018 (4.2 months) and June 2017 (4.2 months).

According to NAR data, active inventory surged 23.4% year over year to 1.32 million homes. At the same time, sales fell 5.4% year over year. This surge in inventory and the drop in sales led to a surge in supply by a third year over year to 4.1 months, up from 3.1 months in June of last year.

And while typically supply either remains roughly stable or declines through May and June, that wasn’t the case this June. This June saw a surge. A game changer is underway (Historical data via YCharts).

Active listings surge The population in June was 840,000, up 36.7% from the same month last year, and slightly lower than June 2020. Real Estate Agent.com.

But as we saw when we discussed listings in the 50 major metropolitan areas here, active listings did not grow evenly across the country. According to data from Realtor.com, the following cities saw the largest year-over-year increases in active listings:

- Tampa, Florida metropolitan area: +93%

- Orlando metropolitan area, Florida: +81.5%

- Denver, Colorado metropolitan area: 78%

- San Diego, California metropolitan area: +72%

- Jacksonville, Florida metropolitan area: +70%

- Seattle, Washington metropolitan area: +62%

- Atlanta metropolitan area, Georgia: +59%

- Phoenix metropolitan area, Arizona: +56%

- San Jose, California metropolitan area: +53%.

Price reduction The surge continues: 37.6% of active listings were reduced in price in June, the highest percentage of Junes with reduced prices except for June 2022, according to Realtor.com data dating back to 2016.

A surge in luxury home sales has pushed up median prices.

According to NAR, while overall sales were down 5.4% year over year, sales of homes over $1 million were up year over year, with the only price range where sales increased being over $1 million, while all other price ranges saw sales decline, with the largest decline occurring in the under $750,000 price range.

- Homes for sale over $1 million: +3.6% Year-on-year change

- Homes for sale between $750,000 and $1,000,000: -1.9% Year-on-year change

- Homes for sale between $500,000 and $750,000: -7.6%

- Homes for sale between $250,000 and $500,000: -12.4%

- Sales of all of the following products also declined:

The change in composition was most pronounced in expensive markets. In a housing market that is driven more by stock prices than mortgage rates, many luxury home buyers, including those currently riding the AI bubble, often pay in cash, either with proceeds from stock sales or borrowed against stocks.

For example, the luxury market in the San Francisco Bay AreaLuxury items cost more than $5 million, according to Compass’ San Francisco Bay Area Luxury Report.

“The real surge in luxury home sales in the second quarter came in the wealthiest counties with the highest concentrations of high-tech industries and in the epicenters of the so-called ‘AI boom.'”

In San Francisco and Santa Clara counties (which includes San Jose), “sales of homes priced over $5 million increased 54% and 63%, respectively, in the second quarter of 2024 compared to the previous year.”

“In the seven very expensive communities surrounding Stanford University on both sides of the San Mateo and Santa Clara county line, sales over $10 million increased 92% year over year in the second quarter.”

“The wealthiest households are typically much more affected by changes in the stock market, particularly in the Bay Area, where the Nasdaq is soaring, than they are by interest rates. Many of these buyers are paying all in cash. And of course, many of the employees of companies like Nvidia have suddenly become very wealthy.”

But sales of homes that require mortgages have plummeted. Across the U.S., mortgage applications for home purchases have fallen by about half since 2019.

Median prices increased due to changes in sales mix. The number of luxury home sales is increasing, while the number of mid-range and lower-end home sales is decreasing (here’s an explanation and illustration of how the median home price is distorted by the shift in composition).

Average price of a single-family home Property prices soared to $432,700, 2.8% above the all-time high set in June 2022, amid a surge in luxury home sales.

And there was a downward revision: May’s median price was revised down by $2,100 from the figure reported a month ago, nearly wiping out the record price posted in May and bringing it roughly on par with June 2022.

“Median home prices hit an all-time high, but further significant increases are unlikely,” NAR’s report today said. “Supply and demand trends are approaching balanced market conditions, with monthly inventory reaching its highest level in more than four years.”

Due to seasonality, median prices are expected to decline for the remainder of the year and into early 2025, as they normally do for this time of year. The highest price in 2024 was in June.

Average Price of Apartments and Co-ops Sales prices rose to a record high of $371,700 as sales shifted to luxury condos.

And then there was the revision: May apartment prices were revised downwards today to $368,900 in May from $371,300 originally reported, meaning today’s June numbers are essentially the same as the May numbers from a month ago.

Enjoy reading WOLF STREET and want to support us? You can donate, we’d be so grateful! Click on Beer and Iced Tea Mugs to find out how.

Want to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()