In a fast-paced business environment, the demand for flexibility in financial transactions is paramount, with non-recurring ad-hoc payments accounting for nearly two-thirds of small and medium-sized businesses (SMBs) monthly revenue, according to recent PYMNTS Intelligence. Masu. the study. This reality highlights the importance of processing these payments efficiently to ensure stable cash flow. The survey revealed that two-thirds of small businesses are willing to continue doing business with companies that offer free instant payments, and that offering free instant payments is a valuable It is emphasized that it helps maintain customer relationships.

These are some of the findings from PYMNTS Intelligence and How Instant Ad Hoc Payments Drive SMB Success. ingo money Research cooperation. This study examines small businesses’ reliance on contingency payments, challenges when processing accounts receivable, and how instant payment methods can help small businesses manage cash flow and prepare for success.

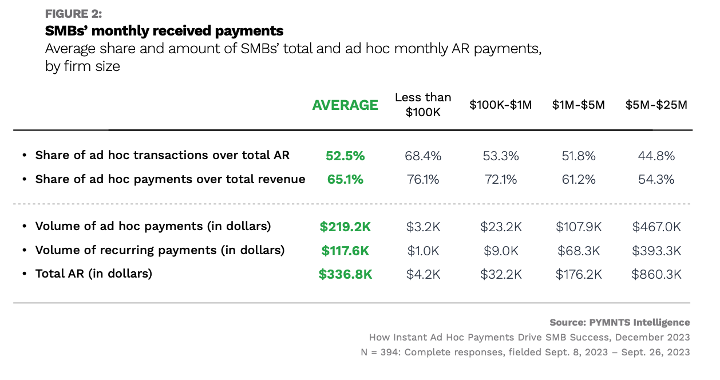

According to the study, extraordinary payments already account for 53% of small businesses’ accounts receivable, and the percentage is significantly higher at 68% for businesses with less than $100,000 in revenue.

The report identified improved cash flow management as the most important motivator for these businesses to receive immediate payments, and identified delays in receiving payments as the biggest challenge. “Payment delays may be the reason recipients are less satisfied with their payers,” the report states.

Time discrepancies are a particularly important challenge for recipients. For one of her four recipients, timing was the most difficult issue when dealing with ad hoc payments.

Traditional payment methods that involve delays can create uncertainty and prevent accurate assessment of a company’s financial health. Choosing an instant payment method streamlines the complexity associated with ad hoc payments, benefiting businesses across a variety of industries. By enabling on-demand remittances with real-time payments, small businesses will have access to their 24/7 liquidity, significantly improving their daily cash flow.

However, the widespread adoption of real-time payments among small and medium-sized businesses will depend on banks’ ability to introduce faster payment solutions. Another report from PYMNTS Intelligence warns, “If banks don’t have real-time payment systems in place, small businesses will be unable to take advantage of their benefits.” In this sense, fintechs can also play an important role in educating SMEs about the benefits of real-time payments and helping them make the transition. As banks and fintechs work together to expand the adoption of real-time payments, businesses can benefit from faster and more efficient financial transactions.