(Bloomberg) — Global stocks and bonds remained under pressure, shedding much of an early gain sparked by France’s far-right leader Marine Le Pen’s promise to respect the political system if she wins upcoming parliamentary elections.

Most read articles on Bloomberg

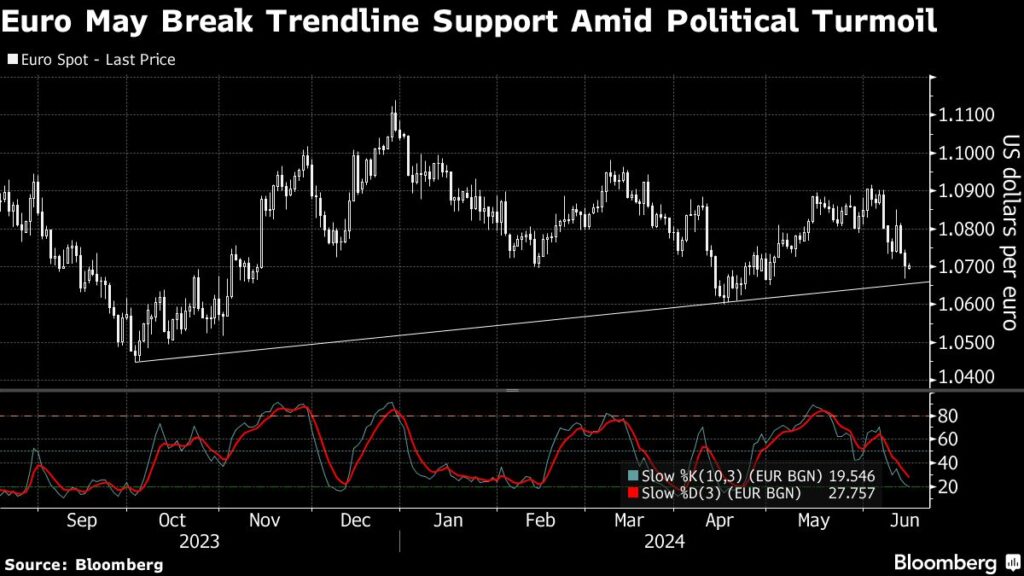

S&P 500 contracts fell along with the pan-European Stoxx 600 index. France’s CAC 40 benchmark fell, erasing all of its opening gains of 1 percent. Eurozone bond yields rose, pushing France’s yield premium over Germany near its highest in several years. The euro firmed somewhat against the dollar after falling nearly 1 percent last week.

Global markets are struggling to recover from a selling pressure that began last week when French President Emmanuel Macron called early elections, a move that could benefit far-right groups such as Le Pen’s National Rally. European assets initially rallied after Le Pen appeared to appease investors by saying she wouldn’t try to oust Macron if she won the election, but the gains quickly evaporated.

“It’s fair to say that foreign investors are nervous about the heightened political risk posed by the situation in France,” said Frederic Carrier, head of investment strategy at RBC Wealth Management. “The market is still having a very hard time pricing this in.”

Still, she noted that populist politicians have a history of moving closer to the center once in power, and Le Pen’s comments had stoked hopes in France for that outcome.

“Any indication that they’re willing to be a little less extreme and take a more moderate approach could galvanize the market a little bit,” Carrier said.

ECB officials see no need to worry about French market turmoil

But investors are likely to remain wary of Europe, with the first round of elections taking place on June 30. Citigroup analysts warned that a possible far-right majority in France is one risk factor for European stocks, and said they favored U.S. markets.

Tushka Maharaj, multi-asset strategist at JPMorgan Asset Management, said she had started to take a positive view on European stocks before the election announcement, but “political uncertainty makes it difficult to take a position quickly.”

Market worries about monetary policy could rise again this week. The Bank of England meets on Thursday and could signal that the July 4 general election and lingering inflationary pressures will force policy makers to wait until at least August to ease policy. The Australian and Norwegian banks, which also meet this week, also appear in no rush to cut rates.

Federal Reserve officials, including Dallas Fed President Lori Logan, Chicago Fed President Austen Goolsby and Fed Board Member Adriana Kugler, are scheduled to speak.

For bond traders, data matters more than Fed rhetoric

On the same day, Asian stocks fell, tracking Wall Street’s weak closing on Friday. The People’s Bank of China kept the one-year MLF interest rate unchanged. Shares of Chinese property developers fell after home prices plummeted in May despite recent efforts by authorities to support the property market.

Major events this week:

-

US Imperial Manufacturing, Monday

-

ECB Chief Economist Philip Lane to speak on Monday

-

Philadelphia Fed President Patrick Harker speaks Monday

-

Australian interest rate decision, Tuesday

-

Chile interest rate decision on Tuesday

-

Eurozone CPI, Tuesday

-

Singapore trade, Tuesday

-

U.S. retail sales, business inventories, industrial production and cross-border investment on Tuesday

-

Richmond Fed President Thomas Barkin, Dallas Fed President Rory Logan, Fed President Adriana Kugler, St. Louis Fed President Alberto Mussallem and Chicago Fed President Austen Goolsbee on Tuesday.

-

Japan Trade, Wednesday

-

The Bank of Japan released the minutes of its April policy meeting on Wednesday.

-

UK Consumer Price Index, Wednesday

-

Bank of Canada to release summary of deliberations on Wednesday

-

Brazil interest rate decision Wednesday

-

New Zealand GDP on Thursday

-

China loan prime rate Thursday

-

Indonesia interest rate decision Thursday

-

Eurozone consumer confidence on Thursday

-

Norway interest rate decision Thursday

-

Swiss interest rate decision on Thursday

-

Eurozone finance ministers meet on Thursday

-

Bank of England interest rate decision on Thursday

-

U.S. housing starts, initial jobless claims Thursday

-

Japan Consumer Price Index, Friday

-

Hong Kong CPI, Friday

-

India S&P Global Manufacturing PMI, Friday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

-

UK S&P Global/CIPS Manufacturing PMI, Friday

-

U.S. Existing Home Sales, Conference Board Leading Index, Friday

-

Canadian retail sales Friday

-

Richmond Fed President Thomas Barkin to speak Friday

Some of the key market developments:

stock

-

The Stoxx Europe 600 index was down 0.2% as of 11:37 a.m. London time.

-

S&P 500 futures fell 0.1%

-

Nasdaq 100 futures rose 0.1%

-

Dow Jones Industrial Average futures fell 0.2%.

-

MSCI Asia Pacific Index fell 0.8%

-

The MSCI Emerging Markets Index fell 0.2%.

currency

-

The Bloomberg Dollar Spot Index rose 0.1%.

-

The euro was little changed at $1.0704

-

The Japanese yen weakened 0.2% to 157.64 yen to the dollar.

-

The offshore yuan was little changed at 7.2700 to the dollar.

-

The British pound fell 0.2% to $1.2662.

Cryptocurrency

-

Bitcoin fell 1.1% to $65,710.01.

-

Ether fell 2.6% to $3,505.46.

Bonds

-

The yield on the 10-year Treasury note rose 2 basis points to 4.24%.

-

German 10-year government bond yields rose 3 basis points to 2.39%.

-

UK 10-year government bond yields rose 2 basis points to 4.07%.

merchandise

-

Brent crude fell 0.1% to $82.51 a barrel.

-

Spot gold fell 0.5% to $2,321.40 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Michael G. Wilson, Masaki Kondo, Matthew Burgess, and Winnie Hsu.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP