The companies, which act as middlemen to negotiate and manage access to prescription drugs in the U.S., wield “enormous power” with largely “highly opaque” business practices that could “inflate drug prices and squeeze Main Street pharmacies” for profit, the report said. The Federal Trade Commission released a damning interim report on Tuesday..

As national attention focuses on America’s uniquely astronomical drug costs, the FTC is taking aim at companies that operate largely deep within the nation’s complex health care system, hidden from public understanding and scrutiny: pharmacy benefit managers (PBMs).

PBMs were originally hired by a variety of payers (employers, health insurance companies, government health plans, etc.) to manage prescription drug benefits through a variety of plans. But over the years, PBMs have evolved to also negotiate kickbacks from drug companies, set rebates for dispensing pharmacies, and create drug formularies (lists of drugs covered by health plans). These functions alone give PBMs significant power, but recent consolidation and consolidation have led to problematic concentrations of that power, according to the FTC report.

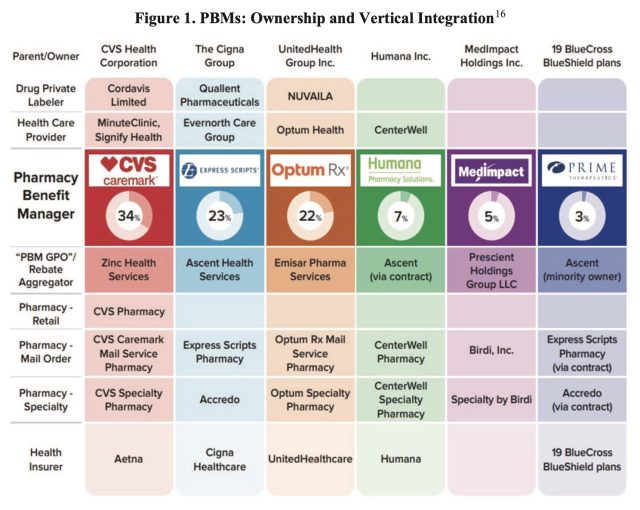

Currently, the top three PBMs in the country, CVS Caremark, Express Scripts, and Optum Rx, processed about 80% of the approximately 6.6 billion prescriptions dispensed in 2023. However, these large PBMs are not independent companies, but are integrated into large corporate conglomerates that include the nation’s largest health insurance providers and pharmacies (specialty pharmacies, mail order pharmacies, and, in the case of Caremark, the largest retail pharmacy chain in the country). Recently, these large conglomerates have also expanded into the private drug labeling business, partnering with pharmaceutical companies to distribute drugs themselves under different trademarks.

Earnings

Previous FTC investigations have found evidence that PBMs steer people to affiliated pharmacies, hurting smaller independent pharmacies and allowing affiliated pharmacies to earn payments that “significantly exceed” the average drug cost. For example, for two generic cancer drugs (one for prostate cancer and one for leukemia), pharmacies affiliated with the top three PBMs earned a combined revenue of nearly $1.8 billion from 2020 to 2022—revenues that are $1.6 billion above the national average cost of the drug. In other words, pharmacies not affiliated with a top PBM would have earned less than $200 million to dispense the same drug.

Additionally, the FTC found evidence that large PBMs and big pharmaceutical companies had agreements to exclude cheaper drugs made by rival manufacturers from the PBMs’ drug lists in exchange for certain pricing and kickbacks.

“The FTC’s interim report reveals how dominant pharmacy benefit managers can raise drug prices and overcharge patients for cancer drugs.” FTC Chairman Lina Khan said in a statement:“The report also details how PBMs squeeze independent pharmacies that many Americans, especially those living in rural communities, rely on for basic health care. The FTC will continue to use all of its tools and authority to scrutinize major players across the health care market and ensure Americans have access to affordable health care.”

The committee released the report by a 4-1 vote. The two Republican committee members issued a statement expressing concern that the interim report was based on limited data and evidence. The FTC’s report noted that some PBMs have yet to fully comply with orders issued by the committee two years ago. But the FTC said that if the PBMs do not comply or continue to delay, the committee will sue them.

in Response to the New York TimesJustin Sessions, a spokesman for PBM Express Scripts, disputed the FTC report, saying its “biased conclusions do nothing to address the pharmaceutical industry’s efforts to solve high prescription drug prices.”