Subprime does not mean “low income”. It means “bad credit” and some people have high incomes. And subprime mortgages are coming back to roost.

Written by Wolf Richter of Wolf Street.

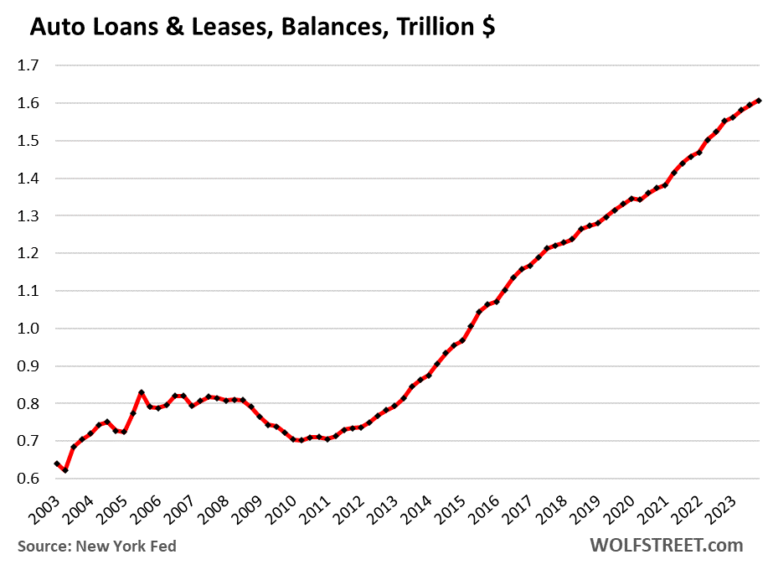

Auto loan and lease balances totaled $1.61 trillion in the fourth quarter, up 0.8% from the third quarter and 3.5% from a year earlier, according to data from the New York Fed’s Household Debt and Credit Report.

While new car sales rose 12% year-on-year in 2023, used car sales were roughly flat, and this was a modest year-over-year increase in loans and leases given the sharp rise in disposable income. . 7%.

Rising prices led to a sharp increase in loan balances from 2020 to 2022.. As retail prices for used cars soared 55% and retail prices for new cars by 20% during the pandemic, loan amounts soared even as sales fell due to car shortages in 2020 and 2021.

From mid-2022 to 2023, new car prices began to level off and rose slightly, while used car prices suffered a historic collapse that wiped out a third of the pandemic-induced rally.

The combined CPI for new and used cars jumped 31% from January 2020 to September 2022, before falling by about 2%.

New cars account for the majority of financing, with 80% of new car buyers financing or leasing new cars, but only 39% of used car buyers financing or leasing new cars. The rest is paid in cash (data by Experian based on registration).

New cars account for the majority of the CPI, which is a combination of new and used cars. This is because new cars cost more and weigh more in the CPI basket than used cars (4.2% new car weight, 2.5% used car weight).

Auto debt burden has decreased. Growth in disposable income has kept pace well with growth in auto loan balances. Auto loan and lease balances fell to 7.8% of total disposable income, lower than in years before the pandemic.

Disposable income is income from all sources, excluding capital gains, less taxes and social insurance contributions. This is the income that consumers have left over for expenses.

There are two reasons for this reduction in burden. As interest rates have skyrocketed, there has been a slight increase in the number of buyers paying cash for new and used cars. And disposable income increased by 7% compared to the previous year.

There’s a reason subprime is called “subprime” – it’s not the income.

Sales and financing to customers with subprime credit ratings is a specialized high-risk, high-reward activity that is primarily limited to older, used vehicles. It attracts specialist lenders and dealers, often backed by PE firms. The system will fail because it depends on the ability to securitize subprime auto loans into asset-backed securities (ABS) and sell investment-grade tranches of those ABS to pension funds and other yield-seeking institutional investors. It functions up to.

Bad loans are created during good economic times. In the Corona era of free money, professional subprime dealers/lenders relaxed their credit standards and became very aggressive and very greedy. At the same time, used car prices soared. And there were a lot of risks. In 2023, several subprime specialty dealer chains owned by PE companies filed for bankruptcy. Investors are wary of buying bonds that securitize subprime auto loans, and these ABS are what keep the whole system working. And even major publicly traded subprime dealer and financier Carmart disclosed massive problems in December, sending its stock price plummeting.

And lenders are belatedly tightening their lending standards. According to Experian, about 61% of used car buyers pay cash, regardless of credit rating. For people borrowing money to buy a car, subprime accounted for 14% of total loan and lease originations, down from 20% in 2018, according to Experian’s third quarter report. Financial conditions are tight for borrowers with subprime credit ratings.

However, subprime does not mean “low income,” but rather “poor credit” (a history of not paying debts, which caused the FICO score to fall into the subprime category). And subprime is only a small part of the used car business and auto loan business.

Subprime loans that are at least 60 days past due According to auto loans backed by ABS tracked by Fitch Ratings, they hit a record high in September, but have since fallen back slightly, reaching 5.9% of total loan balances in December (red line in the chart below). It became.

Prime loans are rock-solid with relatively stable delinquency rates, hovering around 0.3% (blue).

overall delinquency rate; The 30-day or more delinquency rate for auto loans and leases that went into delinquency by the end of the quarter rose to 7.7% in the fourth quarter, slightly higher than in years before the pandemic, according to New York Fed metrics. Most ranged from 7.0% to 7.4%.

The 90+ day delinquency rate for auto loans and leases that were 90 days or more past due by the end of the fourth quarter rose to 4.2%.

The lowest income ZIP codes will see the greatest increase in delinquencies..

In a blog post, the New York Fed breaks down delinquencies by zip code into four income categories, from the lowest income zip code to the highest income zip code, and reveals that delinquency rates decline as income levels rise. I made it. Additionally, I found the following:

Lowest Income Postal Code Categories, the delinquency rate rose more sharply, 12.8% vs. 11.7%, significantly higher than in 2018 (light blue in the graph below). These low-income borrowers are behind the rise in auto loan delinquencies above pre-pandemic levels. These low-income borrowers are also the ones suffering the most from inflation, including the soaring car prices they now have to pay for.

in three high-income zip code categories., delinquency rates are either slightly below or slightly above 2018 levels. After having less money at our disposal during the pandemic, we have basically just returned to normalcy.

Even the highest-income ZIP code categories (dark blue in the chart below) have car loan delinquency rates of 4.6%, or are delinquent at all. This indicates that there is a decrease in ” And even people with high incomes develop bad credit if they have a lot of debt or a serious medical problem that they don’t have insurance for. (Graph from New York Fed)

Enjoy reading and supporting Wolf Street? You can donate. I appreciate it very much. Click on the beer and iced tea mugs to see how.

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()