A comprehensive look at SAIC Motor’s dividend performance and sustainability

Science Applications International Corporation (New York Stock Exchange: Shanghai) recently announced dividend $0.37 per share, payable on October 27, 2023, with an ex-dividend date of October 12, 2023. The company’s dividend history, yield, and growth rate are also in focus as investors look forward to future payouts. Let’s examine Science Applications International Corps’s dividend history and assess its sustainability using data from GuruFocus.

What does Science Applications International Corp do?

Science Applications International Corp provides technology, engineering, and enterprise IT services primarily to the U.S. government. Specifically, the company provides engineering, systems integration and information technology for large-scale government projects, offering a wide range of services with an emphasis on high-end technology services. The company’s end-to-end enterprise IT products span the entire spectrum of a customer’s IT infrastructure.

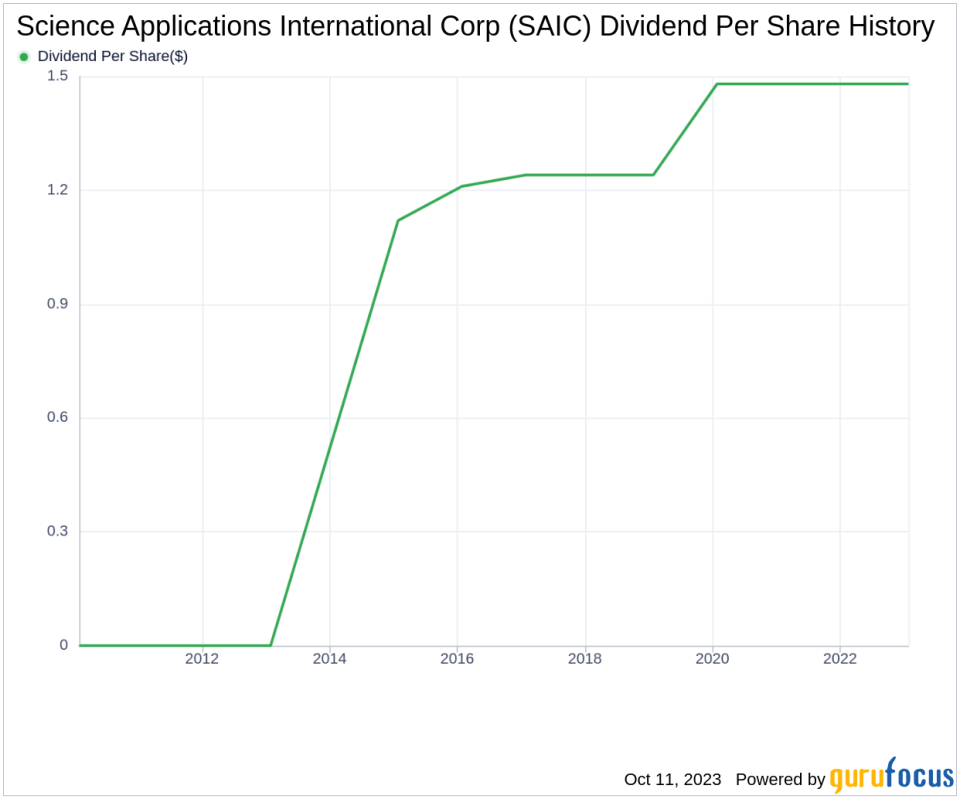

A glimpse at Science Applications International Corp’s dividend history

Science Applications International Corp has remained consistent. dividend payment Dividends are currently distributed on a quarterly basis.Below is a graph showing the year Dividend per share To track historical trends.

Analyzing Science Applications International Corp’s dividend yield and growth rate

As of today, Science Applications International Corp. has a 12-month Trailing dividend yield 1.34% and 12 months Future dividend yield 1.34%. This suggests that the same dividend payments are expected over the next 12 months. When extended to a five-year period, this rate increased to 4.10% per year.

Based on Science Applications International Corp’s dividend yield and 5-year growth rate. 5 year cost yield As of today, Science Applications International Corp’s shares are approximately 1.64%.

Questions about sustainability: Dividend payout ratio and profitability

To assess dividend sustainability, you need to evaluate a company’s payout ratio.of Dividend payout ratio Provides insight into the portion of profits that companies distribute as dividends. A low ratio indicates that the company is retaining a significant portion of its earnings, thereby ensuring that it has funds for future growth or unexpected economic downturns. As of July 31, 2023, Science Applications International Corp’s dividend payout ratio is 0.16.

Science Applications International Corporation Profitability rank, you can understand a company’s profitability compared to its peers. GuruFocus ranks Science Applications International Corp’s profitability at his 8 out of 10 as of July 31, 2023, suggesting a good profitability outlook.The company reported a positive test Net income The company has been profitable every year for the past 10 years, further cementing its strong profitability.

Growth indicators: future outlook

To ensure dividend sustainability, companies must have solid growth metrics.Science Applications International Corporation growth rank A score of 8 out of 10 suggests that the company’s growth trajectory is favorable compared to its competitors.

Revenue is the lifeblood of any company, and at Science Applications International Corp. Earnings per sharewhen combined with 3 year sales growth rate, demonstrating a strong revenue model. Science Applications International Corp’s revenue grows on average at around 8.50% per year, which outpaces around 50.79% of its global competitors.

Company’s 3 year EPS growth rate has demonstrated the ability to grow earnings, which is a key factor in maintaining a dividend over the long term. Over the past three years, Science Applications International Corp’s revenue has grown by an average of approximately 12.00% per year. This percentage is higher than around 53.03% of its global competitors.

Finally, the company’s 5-year EBITDA growth rate This is better than about 42.2% of its global competitors.

next step

Science Applications International Corp’s solid dividend, impressive growth rate, low payout ratio, and high profitability suggest a sustainable dividend policy. The company therefore offers an attractive proposition for value investors looking for stable dividend income. However, investors should continue to monitor the company’s growth metrics and profitability to ensure dividend sustainability.

GuruFocus Premium Users: High dividend yield screener.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article was first published on guru focus.