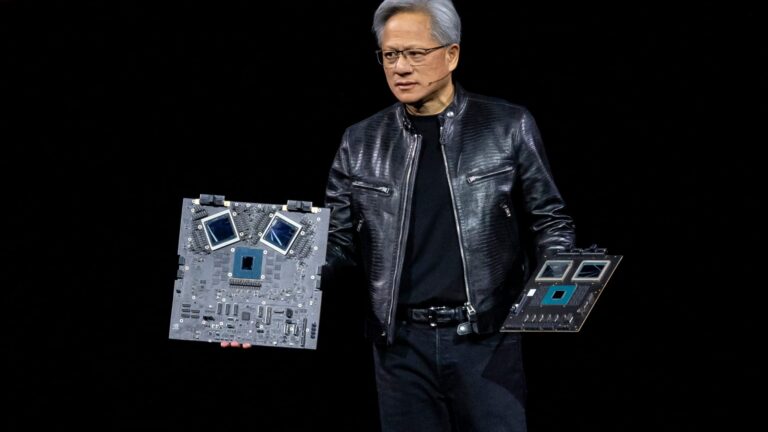

Nvidia co-founder and CEO Jensen Huang showed off the new Blackwell GPU chip at the Nvidia GPU Technology Conference in San Jose, California on March 18, 2024.

David Paul Morris/Bloomberg via Getty Images

NVIDIA Shares plunged 9.5% on Tuesday, wiping nearly $300 billion from the chipmaker’s market capitalization and dragging down semiconductor-related stocks.

Intel It fell by about 8% Marvel It fell 8.2% Broadcom It decreased by about 6%. Am A decrease of 7.8% Qualcomm The VanEck Semiconductor ETF (SMH), an index that tracks semiconductor stocks, fell 7.5%, its worst day since March 2020.

Markets were weak on Tuesday after the ISM manufacturing index came in below consensus expectations for August, raising concerns about the strength of the economy but also the likelihood of the Federal Reserve cutting interest rates.

Chip stocks have risen over the past year on optimism that the artificial intelligence boom will force companies to buy more semiconductors and memory to keep up with the growing computing requirements of AI applications.

The sector is led by Nvidia, which dominates the market for AI data center chips, and its shares are expected to rise 118% in 2024.

Other chipmakers are vying to capitalize on this growth. Intel and AMD sell AI chips, but market penetration has so far been limited. Broadcom Google It’s a TPU chip, and Qualcomm is touting its chip as being ideal for running AI on Android smartphones.

Last week, Nvidia reported $30 billion in revenue for the quarter that ended in July, beating Wall Street’s already-high expectations. Revenue from its data center business, which includes AI processors, rose 154% year over year, thanks in large part to several cloud and internet giants buying billions of dollars of Nvidia chips each quarter.

Nvidia said it expects its revenue to increase 80% this quarter.

Some investors saw Nvidia’s outlook as disappointing, briefly hurting chip makers that supply the company with memory and other components.

Intel made the announcement on Tuesday. New Laptop Processors The devices would be able to run AI programs themselves, instead of relying on servers in the cloud. Broadcom, which is working with major companies to develop custom AI chips, reported its third-quarter earnings on Thursday.