Track the ultimate reward The point is one of my favorites Transferable reward currency These points are accessible due to the large number of valuable airlines and hotel loyalty programs. I often Transfer tracking points to the Hyatt worldhowever, you can also transfer Chase Ultimate Reward Points to many other partners ( United MileagePlus.

Here’s how to transfer Chase Points to United Airlines and other things you should know before transferring Ultimate Reward Points:

How to transfer chase points to United

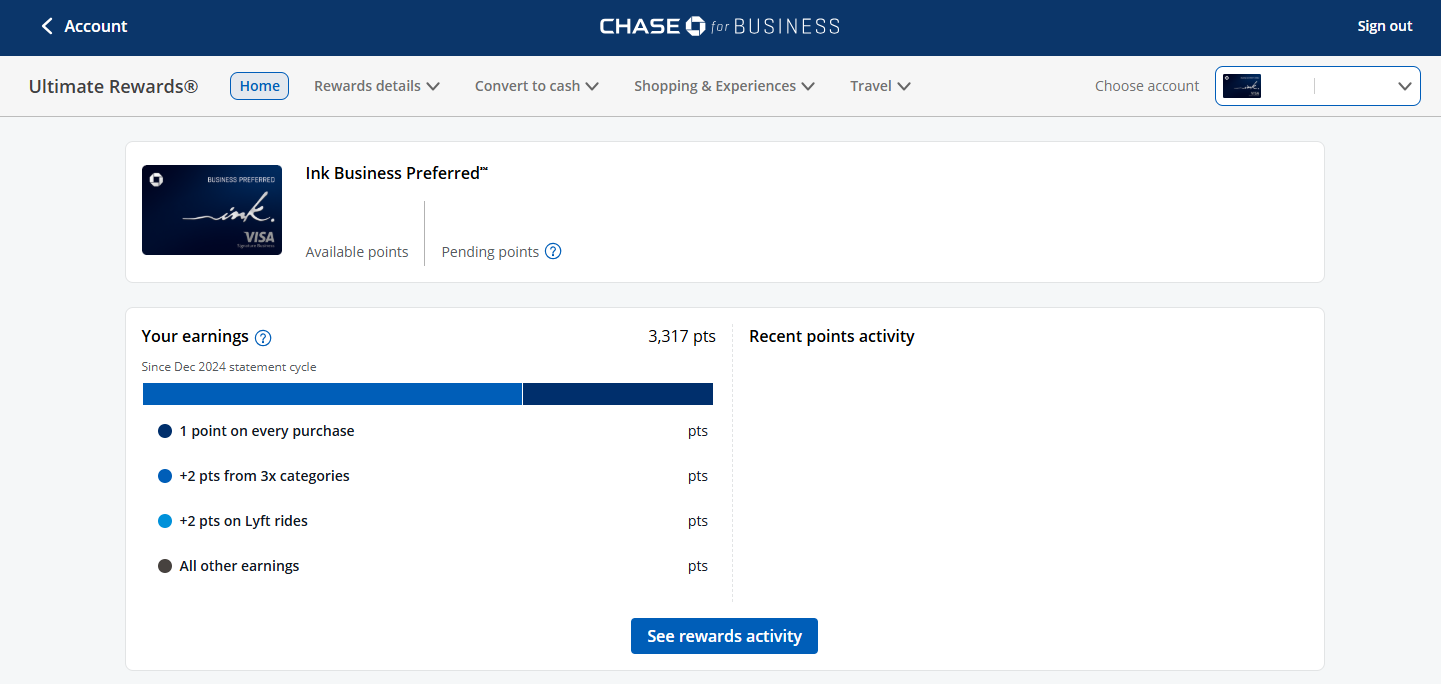

To transfer the Chase Point to United, head to Ultimate Reward Websitelog in to your account and select the ultimate reward card (for multiple cases). You must land on the dashboard page for the selected card account. For example, here is the dashboard for me Ink BusinessPreferred® Credit Card (look Fees and fees).

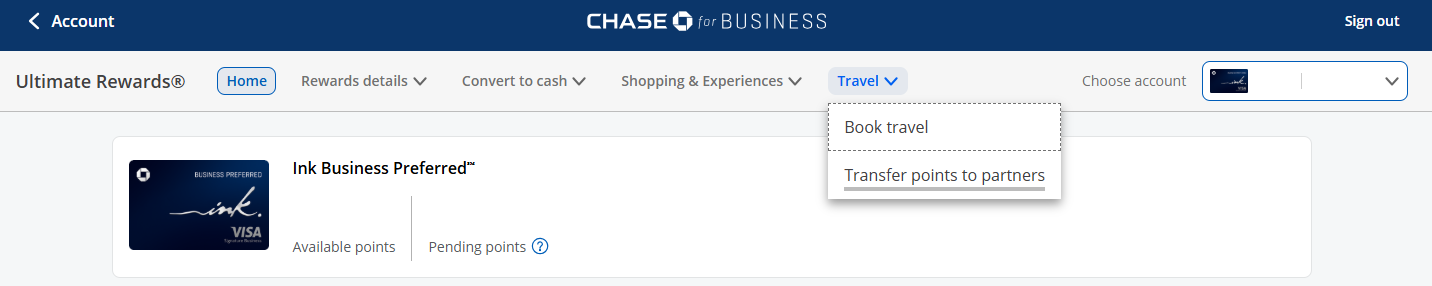

Click the Travel drop-down option at the top of the dashboard and select Transfer Points to Partner.

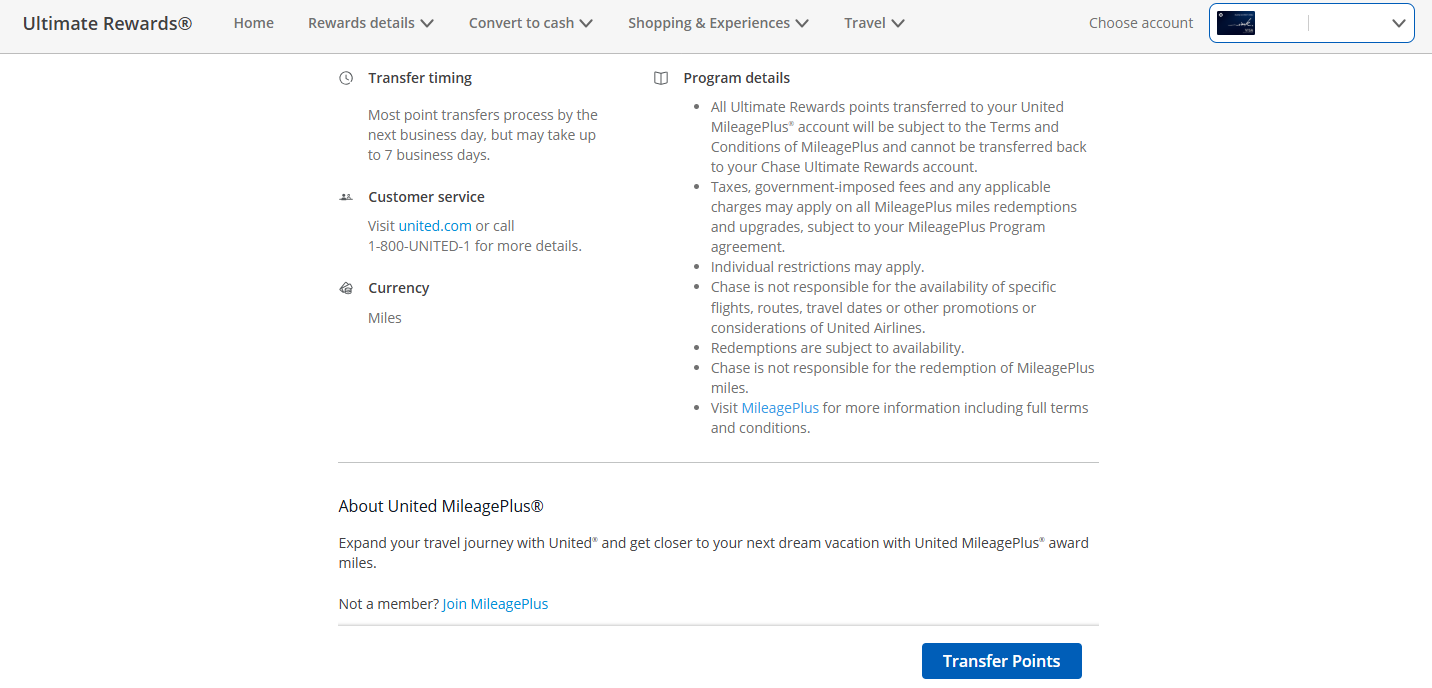

You will be taken to the page that shows everything Tracking forwarding partner. Scroll down and click on the United row. Doing so takes you to the information page about transferring Chase Points to United.

To continue,[ポイントを転送]Click to reach the page where you can enter or view United MileagePlus information. I have already registered my United MileagePlus account with my husband (a certified user of my Ink Preferred account) and my ultimate rewards account, so I can transfer Chase Points to one of my United accounts.

On the next page, enter the amount of chase points to be transferred to United. You must transfer at least 1,000 points, and can only be transferred in increments of 1,000 points.

[[次へ]Click to reach the summary page, and then[送信]Click to confirm the forwarding request.

Related: How to redeem Chase Ultimate Reward Points for Maximum Value

Daily Newsletter

Reward your inbox with TPG Daily Newsletter

Join over 700,000 readers for breaking news from TPG experts, detailed guides and exclusive deals

How long does Chase Point take?

When you transfer Chase Points to United, miles will usually be displayed in your MileagePlus account Instantly.

However, it may take some time for Chase Points to transfer to United. In most cases, miles will be displayed in your account by the next business day, but it may take up to 7 business days.

When you confirm the forwarding request, you will receive an email saying that the point forwarding is in progress, and once the point forwarding is complete, Chase will display another email. So, if you don’t see miles instantly in your United account, look at the email and know when the transfer is complete.

Chase to United Transfer Ratio

Chase to -UnitedThe transfer ratio is 1:1. Chase points must be transferred in increments of 1,000 points. This means you can convert 1,000 Chase Points to 1,000 United Miles. You may find it sometimes Transfer bonus This increases the Chase to United Transfer ratio, but these are rare.

Based on TPG April 2025 evaluationChase Points are worth 2.05 cents each, and United Mile is worth 1.35 cents each. Since then, transferring a chase point will lose its theoretical value Transferable points are inherently more valuable. However, as explained in the next section, this does not mean that Chase Points should not be transferred to United.

Related: Best Chase Credit Cards to Add to your Wallet

Should I transfer my chase points to United?

Reading this guide may make you wonder if Chase Points should be transferred to United. This question is complicated so you cannot tell you without understanding your situation.

However, United MileagePlus is not the most valuable tracking and forwarding partner based on our ratings. For example, the April 2025 rating is 1.35 cents each, but we value other chase forwarding partners. The Hyatt World, British Airways Club, Air Canada Aero Plan and Virgin Atlantic Flying ClubHyatt is 1.7 cents each, and British Airways, Air Canada and Virgin Atlantic are 1.4 cents each.

We recommend booking Chase’s ultimate reward points for transfers to these high value partners – especially if you’re not earning a large stash of Chase Points, you can get much higher value from United Miles with some redemptions. Check out the guide United Mile Repayment Read about the guide to get started Maximize United MileagePlus redemption For more tips to get the most value from the United Mile.

Even if you’re only getting 1.35 cents per point when transferring Chase Points to United, this is higher than the 1.25 cents per point you can earn when redeeming points for your trip. ChaseTravel℠ Portal in Chase SapphirePreferred® Card (look Fees and fees)or Ink Business Priority Credit Card. So, if you have many tracking points or don’t want to book awards with higher value transfer partners, it may be right for you to transfer your chase points to United.

However, if you have Chase Sapphire Reserve® (look Fees and fees), you will earn 1.5 cents per point when you pass through the Chase Travel Portal. For this reason, Chase Sapphire Reserve Cardholders must ensure that they can earn at least 1.5 cents per cent in the United Awards before moving Chase Points to United.

Related: Flights, credit cards, etc.: How to earn miles with the United MileagePlus program

How to earn tracking points

If you want to transfer Chase Points to United, you may also be interested in how you can earn more tracking points. Here are some of the most popular Chase Ultimate Rewards cards available today, the rate of return, welcome offers and annual fees:

| card | Welcome offer | Revenue Rate | Annual fees |

|---|---|---|---|

| Chase Sapphire Priority Card | You earn 100,000 points after spending $5,000 on purchases in the first three months of opening an account. |

|

$95 |

| Chase Sapphire Reserve | After spending $5,000 on purchases in the first three months of opening an account, you earn 60,000 points. |

|

$550 |

| ChaseFreedomFlex® (look Fees and fees)) | You will earn $200 cashback after spending $500 on purchases in the first three months of opening an account. |

|

There is no annual fee |

| Chase FreedomUnlimited® (look Fees and fees)) | You will earn $250 cashback after spending $500 on purchases in the first three months of opening an account. |

|

There is no annual fee |

| Ink Business Priority Credit Card | You will earn 90,000 points after spending $8,000 on purchases in the first three months of opening an account. |

|

$95 |

| InkBusiness® Credit Card (look Fees and fees)) | After spending $3,000 on purchases in the first three months after opening an account, you earn $350 in cashback, plus $6,000 on purchases in the first six months after opening an account, then another $400. |

|

There is no annual fee |

| Ink BusinessUnlimited® Credit Card (look Fees and fees)) | After spending $6,000 on purchases in the first three months of opening an account, you will earn $750 in cashback. |

|

There is no annual fee |

Some of these cards earn cashback rewards rather than points, but you can combine rewards from all the ultimate reward cards into a single account. If the account you use to collect all your rewards is a Sapphire Reserve, Sapphire Priority, or Ink Business Priority account, there is a hidden point where you can transfer to your Chase Transfer Partner.

Related: How to combine your Chase ultimate rewards into a single account (and why)

Conclusion

Now you know how to transfer Chase Points to United.

Forwarding a chase point can be difficult for the first time. However, as this article shows, it is not difficult to transfer Chase Points to a loyalty program like United MileagePlus. Once you find a flight with the award you want to book with United MileagePlus, follow the steps above to transfer the number of points you need to book your award flight.

You may need to transfer points in increments of 1,000, so you may need to transfer slightly more points than you need to book a flight.