ginosphotos/iStock (via Getty Images)

Ah, retirement. A magical time drinking margaritas on the beach, traveling the world, or at least annoying the kids with endless dad jokes.But wait a minute, it looks like we have a large army of wannabes. Retirees did not receive the memo. They are more likely to be seen perusing job listings than retirement homes. why? Because a surprising number of people are preparing for retirement as much as turkeys are preparing for Thanksgiving.

A great retirement plan…it wasn’t.

Many people are looking forward to retirement. Unfortunately, far fewer retirees actually plan for it. It’s surprising how little people know how much their retirement savings cost. One way to learn about retirement planning is by reading Seeking Alpha. Many of Seeking Alpha’s articles include examples of how to prepare for retirement.But let’s face it For many people, retirement planning is more of a “hope and pray” strategy than a well-thought-out financial blueprint.

Seeking Alpha: Whispers of Retirement

If you read our articles often, you’ll notice that we focus on defensive investing. Yes, sure, we’re talking about some high-yield stocks. However, those positions are designed for trading strategies or emphasize the use of less volatile securities such as preferred stocks or baby bonds.

We believe investors should focus more on minimizing risk than guarding fences. This does not mean that investors need to hold the majority of their portfolio in cash or short-term government bonds. Indeed, investors can earn surprisingly solid yields just by holding cash today. As an American taxpayer, I am very happy to know that my tax dollars are being used to pay high interest rates to banks and China. Get the most out of my tax dollars. Sometimes I think about what I’m going to do with that money, and then I remember that my idea is stupid compared to raising interest rates.

Nothing stops inflation like accumulating interest on $34 trillion in debt and increasing the deficit. Remember all the great things we got his $34 trillion? Extra potholes in the roads? Crumbling infrastructure? Unaffordable housing? Haven’t wages kept up with the cost of housing and education? At least all that funding has paved the way for a society where no one has to go to jail and where political debate is always thoughtful and civil.

Let’s try it tomorrow

Procrastination isn’t just a problem for college students. When it comes to retirement planning, for many people it’s a lifestyle. “Start saving next year,” they say, buying a boat or the latest iPhone.

Meanwhile, my retirement account remains as empty as my refrigerator two days before payday.

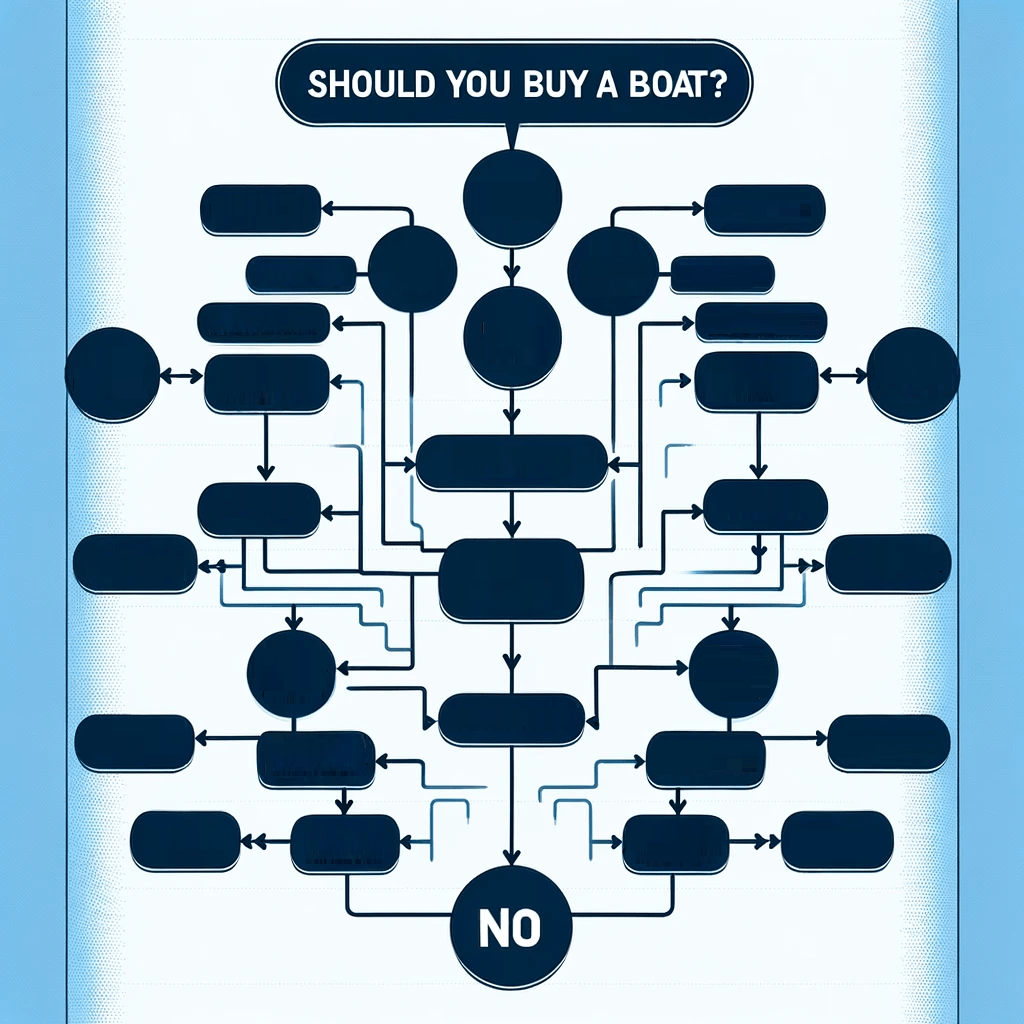

To help you decide whether or not you should buy that boat, we have created the following table.

Property of thereitforum.com

golden age myths

It’s important to note that retirement does not automatically become a period of endless leisure and joy. It’s what you think of it. And if you don’t think of it at all, you’re going to experience something amazing. Imagine that you used to dream of playing golf every day, but now comparing grocery prices has become your main hobby. thrilling.

For some, it could be even worse, as it means stocking up at the grocery store.

In search of alpha lifeline

Seeking Alpha is more than just a website. It is a lifeline for people in financial need. It’s like having a large team of financial advisors who don’t charge by the hour.

As with any team, some contributors are less valuable than others.

Anyone who didn’t see it coming probably didn’t know whose book they were reading.

I don’t mean to insult anyone. I never meant to be rude. What I’m trying to say is that the Beach Boys also had Mike Love.

Desired investment strategy

Apparently, hope is not a strategy, except for retirement planning. No successful investor has ever said, “If I wish hard enough, my savings account will magically grow.” But this seems to be a common approach. What will happen next time?

Spoiler alert: Cat food tastes bad.

DIY Retirement Planning Disaster

Let’s be honest: For some, the idea of DIY retirement planning is like performing surgery on yourself. “How hard is it?” they think, completely ignoring tax-efficient savings strategies and investment diversification. It’s like building a house without a foundation and wondering why it collapses at the first sign of a storm.

inventory picking

Ah, stock picking, that noble pursuit is akin to choosing the perfect avocado from a pile of potential disappointments. It is really an art form only for those with the patience of a saint and the insight of a sage. For the few talented people who can navigate the rough waters of the stock market with the grace of an experienced captain, stock picking is more than just a skill. It’s just a superpower. And in the context of retirement planning, it’s like having a secret weapon in your arsenal, a magic wand that, used wisely, can turn your modest savings into a veritable treasure chest.

However, I want to be clear that not everyone is cut out for the high-stakes world of stock picking. For each Midas touch, a reverse Midas touch occurs, converting potential gold into shares in Medical Properties Trust (MPW). But for those with a rare combination of analytical ability, emotional discipline, and good old luck, stock picking can certainly be a game changer.

When it comes to retirement planning, the value of stock picking cannot be overstated, especially for those with the skills to do it well. Well, maybe it is. That may certainly be the case. Let’s ignore it for now (and later).

Of course, the stock picker’s path is full of potential pitfalls. A fickle and fanciful market can be a fickle mistress.

Broadly speaking, stock picking is more than just picking winners and avoiding losers. It’s about understanding the market, recognizing opportunities and making informed decisions. It’s a skill that, when honed and applied wisely, can transform the daunting prospect of retirement planning into an exciting journey toward a future filled with promise and possibility. And for those who tread this path with care and expertise, Seeking Alpha stands as a solid guide, providing insight, analysis, and travel companions who share the goal of navigating the rough waters of the market with skill and grace. Our community lights the way.

How to retire if you are not good at investing

dollar cost average.

No, seriously. Maximize your $401,000 into cheap index funds with dollar-cost averaging. Don’t do anything fancy.

boom. There it is. I’ve aligned the headings on both sides. I taught people who are bad at investing how to retire.

Once you set up your dollar-cost averaging strategy, throw away your passwords. The only thing that can really ruin a dollar-cost averaging strategy with cheap index funds is someone logging in and dumping all their holdings when the market crashes.

If you’re really not good at investing, play to your strengths instead. By investing dollar-cost averaging in low-fee broad-market index funds, you can beat most investors and it takes almost no time to develop a strategy.

We also offer some suggestions for investors who want this strategy.

-

Schwab U.S. Large Cap ETF (SCHX)

-

Vanguard S&P 500 ETF (VOO)

-

iShares Core S&P 500 ETF (IVV)

-

Vanguard Total Stock Market ETF (VTI)

-

Invesco QQQ Trust ETF (QQQ).

If you choose the last one, you basically just buy the popular ticker on Seeking Alpha. I mean, it’s a big company. That’s how I think about them. Not just as a popular ticker, but as a big company.

-

Microsoft (MSFT)

-

Apple (AAPL)

-

Amazon (AMZN)

-

Nvidia (NVDA)

-

Meta Platform (META) (Facebook if you are 10+).

-

Tesla (TSLA)

-

Alphabet/Google (GOOG) (GOOGL)

Basically, it’s big business and Tesla in everyone’s homes.

-

However, there is also Broadcom (AVGO).

It is now worth more than $500 billion, having risen nearly 1900% over the past decade.

Lovely.

Of course, these stocks soundly beat out almost all investors. why? That’s because it’s selection bias. We have picked up a number of companies that are already the largest.

Picking big doesn’t necessarily mean winning.

ExxonMobil (XOM) stock has increased 8.9% over the past 10 years. Yes, its yield is 3.62%, but several other companies exceed it.

Remember when WeWork (OTC:WEWKQ) was huge before becoming nearly worthless?

Well, its market cap is still bigger than me. Thank you for pointing this out.

Somehow, while tens of millions of people switched to working from home, the idea of renting or subletting office space turned out to be a failed idea. Shocker.

conclusion

Please read my article.

If you are good at investing, you will come up with good ideas.

Even people who are not good at investing can enjoy a wealth of bad words.

Plus, if you’re not good at investing, you could just dollar-cost average your money into index funds with low fees.

If that makes you feel bad, just remember that you’re beating most people who are actually trying.