How does Experian Boost work?

To get started: Sign up for a free account on Experian® Use of SSN and Personal Information. Experian protects your data with 256-bit SSL encryption. You may be asked to link your payment method and sign up for a paid account, but you are not required to do so.

To be eligible to use Experian Boost, you must have a credit history of at least six months and at least one account reported to a credit bureau. Once your Experian account is set up, from your dashboard[クレジット]go to the page and[Experian Boost]Select a tool.

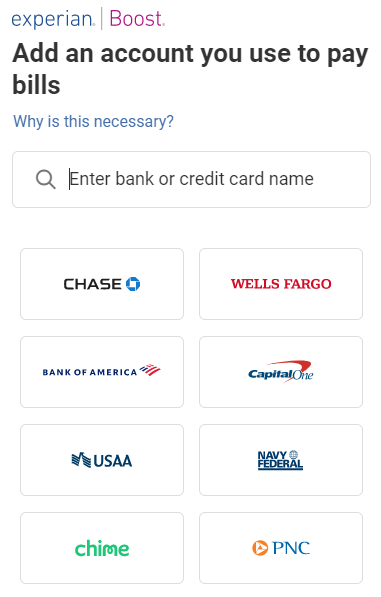

Then link the bank account or credit card you use to pay most bills. This requires you to sign in to authenticate your account and authorize Experian to access your information.

If you can’t link your bank, Experian Boost probably doesn’t support it and you should try another option. Accounts can be added and removed at any time.

Once you have connected your bank, you can start boosting. It will take a few minutes for Experian to scan your eligible invoice.

Once boosted, manually select invoices to add to your Experian credit report for found invoices.We recommend that you select the scheduled automatically paidEach invoice must have at least 3 payments made over a period of 6 months, 1 of which is from the last 3 months.

You can report on all invoices of the following types:

- Phone plans (including Verizon, AT&T, T Mobile)

- internet, cable, satellite

- Streaming (including Hulu, HBO, Netflix, Disney+)

- electricity and solar

- Gas/Electricity/Water

- garbage

The tool can also give credit for housing rent payments when done through a supported online payment platform. .

If you see an invoice you don’t want to add,[削除]Click. Then verify that all other invoices are accurate.

Your score may or may not improve immediately after boosting. If your credit score doesn’t improve quickly, that doesn’t mean it won’t improve. Experian will check your account monthly for bill payments and update your account.but the result is no We guarantee. Note that Experian uses a FICO score of 8.

Experian Boost Disclaimer – Results may vary. You may not see any improvement in score or acceptance odds. Not all lenders use the Experian credit file and not all lenders use scores that are affected by Experian Boost.

Experian Boost Pricing

The boost feature itself is free to use. There are also many other free resources that come with your Experian account, such as monitoring and tracking your credit score.

You can pay to upgrade to a premium account to unlock even more tools and access your mortgage, car loan, credit card FICO scores, and more, but this is not required to use Boost. is not.

Experian Boost Feature

Key features and benefits of Experian Boost include:

FICO® Score 8 Monitoring

Experian uses a FICO score of 8 for boost.Majority of moneylenders are interested FICO credit score A FICO score of 8 is very commonly used to assess creditworthiness whenever you apply for credit.

However, lenders can decide which credit score to use and may choose not to look at Experian’s credit report at all. Remember Experian is just one of the three major credit bureaus. Two others, TransUnion and Equifax, also calculate credit scores, but may give slightly different results based on the FICO score model they use and the data points they collect.

Many lenders, such as mortgage lenders, get your credit Reported by all three credit bureaus. However, it’s possible that the lender doesn’t look at your Experian credit score at all when evaluating your credit file.

Customizable reports

Experian Boost gives you the opportunity to take advantage of timely payment of invoices that normally don’t go on time. Non-credit bills such as utility bills and rent aren’t counted as credits and aren’t normally reported, but this tool allows you to build your history faster by adding some of those payments.

And you can choose what is important and what is not. Choose a bank account or credit card that you feel comfortable linking, and add invoices that you know work best for you, such as those with more payouts or those you’re most likely to pay on time.

positive payment history

If your bank account has late payments, Experian Boost will not report them. Experian Boost only elicits useful information, not harmful to your FICO® score. You can also skip unfavorable data and delete payment history you don’t want to track.

This means you don’t risk hurting your score with Experian Boost. We may not see change for the better, but we also do not see change for the worst. That said, you should try to pay your bills on time whenever possible, as more payments have a greater impact on your credit in the long run.

read more: How to pay bills when you have no money

Who is Experian Boost for?

Below are a few users who have benefited from Experian Boost.

people with limited credit history

Experian Boost is designed for “thin file” customers or customers with little credit history. Adding timely payments to your report can show that you’re responsible for your money, making it easier to borrow in the future.

Remember that you need at least 6 months of credit history to be eligible to sign up.

Who needs a small credit boost

Paying your utility bills might only increase your score by a few points. However, sometimes those few points are all you need to get into a more favorable bracket for lenders.

people working to improve their credit

The lower your credit score, the more likely you are to see improvement using Experian. Change may not matter, but a positive move is a step in the right direction.

Who is Experian Boost not for?

This tool may not be suitable for:

People who are behind on payments or have low utility bills

If for some reason you’re underpaying your utility bills, or are prone to late payments, Experian Boost may not help you. The more bills you pay on time, the better.

untrustworthy person

If you’re completely new to credits, don’t use Experian to improve your score until you can see 6+ months of credits. build trust from scratch.

person applying for a mortgage

Most mortgage lenders use a version of the FICO® Score that is not affected by Experian Boost. So Boost isn’t the best choice, especially if you want more credit to get a mortgage.

read more: How to Get Your First Mortgage Approved

Experian Boost and Credit Repair

If you’re reading this and want to know the difference between Experian Boost and Credit Repair, let me clarify.

Credit repair has several implications.First, it may mean doing the work yourself fix the creditsWe’ll talk more about this in the next section, but basically any action you take to improve your score, whether it’s paying off some of your debt, controlling your spending, or avoiding over-borrowing, will help improve your credit score. It is considered recovery and helps restore credit. Good feeling. When your credit is in bad shape and you make an effort to change it, that’s credit repair.

Another version of credit repair is a service you pay for. Companies that offer credit repair claim they can improve your credit. They do this by removing inaccuracies from your credit history and contesting errors and mistakes that can lower your score. We will work for you to “clean up” the , but we can’t guarantee improvements or do anything you couldn’t do yourself.

If someone tries to tell you that you need to pay to fix your credit, walk away (or hang up, etc.). no We recommend paying for credit repair services.

Experian Boost may fall under its own credit repair strategy, but even if you pay to upgrade your Experian account, this tool is not the same as a paid credit repair service.

Are there other easy ways to build or rebuild trust?

There are many things you can do right now to start building or repairing your credit. Here are some.

Get a Secure Credit Card – secure credit card It has a higher acceptance rate than traditional unsecured credit cards. It requires a refundable cash security deposit as collateral, but otherwise works like a regular credit card. You will pay the invoice for each itemized period. Payment activity is reported to the Bureau and affects your credit (for better or worse).

Apply for a credit builder loan – credit builder loan Designed to improve your credit with regular positive payments. Take out a loan and pay it back monthly with interest. This is a good option for new borrowers and delinquents.

Become a regular user with someone else’s card – a parent, spouse, or close friend add you as a user One of their credit cards allows you to spend on their account. However, requesting to be an authorized user on someone’s card is not a big deal.

summary

If you need credit to pay your bills on time, experian boost Worth checking out. This tool won’t improve your score immediately or at all, but it won’t hurt your score or cost you anything.

If you don’t feel comfortable linking your bank account or credit card, consider other options.