The Chinese government on Monday outlined a plan to boost the country’s sluggish economic growth, but experts say the plan falls short of the transformative strategy needed to resolve the country’s debt and consumer confidence crisis. It is pointed out that this has not been achieved.

China has had fun Miracle economic expansion Over the past few decades, it has consolidated its position as a global power, emerging middle class. It achieved its growth by fusing the ruling regime’s communist principles with the strategic adoption of free markets; A new form of state-led capitalism It ushered in a new era of economic prosperity.

However, the recent economic downturn has called this model into question, forcing the Chinese government to reconsider its approach.

At the annual meeting of the National People’s Congress, Chinese Premier Li Qiang set a new benchmark for economic growth next year: a 5% increase in gross domestic product (GDP). Neil Thomas, a China politics researcher at the Asian Social Policy Research Institute’s Center for China Analysis, said the goal is “relatively ambitious given China’s current economic difficulties.”

But setting this ambitious goal has not been accompanied by “ambitious reforms to change China’s growth trajectory,” Thomas added. The International Monetary Fund predicts that China’s GDP growth will remain at 4.6%, narrowly missing the 5% target in 2024, before the IMF predicts it will decline to 3.5% by 2028. .

It’s in China though has relied on domestic investment for many years To support growth, these investments are no longer sufficient to sustain economic growth at levels acceptable to national leaders.Its economy is affected by Soaring government and commercial debt, a ticking time bomb that financial experts fear could have a negative impact on the entire global economy. This in turn has fueled economic instability within the country, suppressing not only personal consumption but also employment and business investment.

Mr. Li’s plan aims to address these issues by shifting the focus of China’s economy further toward innovation, manufacturing, and technology. But experts believe it will not be enough to change the country’s economic trajectory.

“China needs to do more to signal a change in the country’s direction when it comes to economic liberalization, winners and losers, and China’s relationship with the West,” said China’s senior vice president for business and economics. said Scott Kennedy, advisor and board chair. Center for Strategic and International Studies. “There was nothing in Li Qiang’s government work report or anything China has released in the past few months to indicate that China is considering changing course.”

A simple explanation of China’s economic problems

China suffers from fundamental economic imbalances. To foster economic development, there has been an over-reliance on government spending and commercial investment rather than private consumption, which is a sign of more organic and sustainable economic growth.

After the 2008 financial crisis, local governments in China made a huge investment The company focused its efforts on domestic infrastructure and real estate development, betting that real estate prices would continue to rise.Currently, the real estate is approximately 1/4 of China’s GDP. But the country could not support that level of expansion. Per capita income remains low compared to other developed countries.Major real estate developers etc. evergrande I went bankrupt. ghost city Now they remain abandoned all over the country.

By the end of 2023, China’s accumulated debt would have increased to nearly three times its economic output, hitting a record high. Some economists liken China’s current economic situation to Japan’s “economic situation.”lost decade” The 1990s was a time of deflation and economic stagnation, which contributed to excessive debt.

While most developed countries rely on consumer spending to drive economic growth, this is not the case in China.There, about 53% of GDP in 2022.In the United States, personal consumption is approx. 68 percent of GDP.

To make matters worse, China’s stock market is showing its worst performance since 2022. 2 trillion dollar loss. China continues to trade surplusBut it is struggling to export as many goods as before as Western countries seek to reduce their dependence on Chinese manufacturing in light of geopolitical competition with the United States and Europe.

Economists argue that Expansion of domestic personal consumption It is the best way for the Chinese people to get out of the current economic recession. But it’s hard to get people to spend more money when they feel as though most of them are already spending it. experiencing a recession.

And the central government’s latest plan has not generated any excitement either nationally or internationally.

Contents of China’s new economic plan

A new economic plan announced on Monday aims to address the country’s demographic challenges, including policies to encourage people to have more children, as China’s aging population poses structural risks to its long-term economic outlook. The aim is to expand personal consumption. The plan also includes measures to remove restrictions on foreign investment in manufacturing and makes a new commitment to compete globally in technologies such as quantum computing, big data and AI.

However, although Mr Lee promised to “push ahead with transforming the growth model”, his speech lacked specifics on the planned changes and their duration.and the prime minister Absent from annual press conference For the first time in 30 years.

Such violations of protocol are “a big signal that they don’t want dialogue with society and the rest of the world and just want everyone to pay attention and follow,” Kennedy said. .

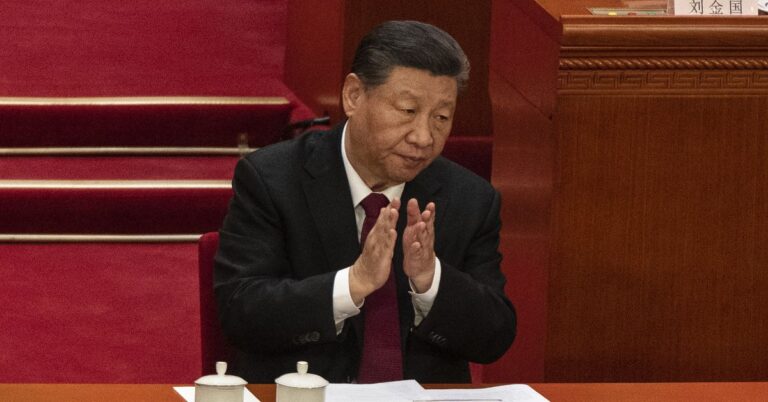

This flimsy strategy reflects Chinese President Xi Jinping’s reluctance to make fundamental structural reforms to the national economy, even in the midst of a growing crisis. Nevertheless, many economists believe it is necessary for China to adopt a sustainable economic growth model, Thomas said.

These reforms include a fundamental review of local government finances, which carry the bulk of the national debt, as well as expanding lending to private companies and eliminating restrictions on internal migration and land use that hinder personal consumption. there is a possibility. Kennedy said the overhaul would also include raising taxes on state-owned enterprises, which currently keep most of their profits, and introducing a property tax to support local governments.

Strengthening social safety nets could improve consumer confidence and, in turn, spending. Victor Shi, director of the 21st Century China Center at the University of California, San Diego, noted that Li announced in his speech that subsidies for universal health insurance would be increased by $4 per person. But that still isn’t enough to keep up with inflation.

“Many economists believe that social welfare payments should be higher in China, increasing by several thousand dollars per person. But of course, given the leadership’s priorities, that is unlikely to happen. ” said Mr. See.

Leaders could introduce further stimulus this year if the economy fails to meet growth targets, but Shi said that for the Chinese Communist Party leadership, meeting the targets is a symbol of China’s ability to compete with the United States. said. “I think it’s important for top leadership to achieve a growth rate of about 5%, because without that growth rate, it will take much longer for China to catch up with the United States in terms of GDP,” he said. said.

The Chinese leadership’s focus on competition with the United States is an extension of geopolitical tensions. The United States and China have already been in a stalemate for years. trade warAnd China’s efforts to strengthen its manufacturing and innovation sectors pose a direct challenge to the West and could lead to further economic brinkmanship.

“Beijing’s focus on supercharging manufacturing to boost growth will create excess capacity and exacerbate trade tensions between China and the West,” Thomas said. “This could have implications for the United States and European countries, potentially imposing further restrictions on Chinese exports and technology.”

U.S. leaders are already anticipating an escalation of this economic conflict. Former President Donald Trump vowed: Increase tariffs on imports from China Meanwhile, President Joe Biden signed legislation to boost domestic computer chip production and cut off related subsidies from China. He is also considering new restrictions on Chinese electric vehicles and other imports in a second term.

Any U.S. retaliation would complicate China’s efforts to get back on track at a crucial time for its economy.