Let’s be honest: money is complicated. You might think it’s “just math,” but the reality of personal finance is that there is never one “right” answer. In fact, even when evaluating the numbers in your financial projections, there are many different ways to value money. You can value your future financial situation in future dollars or in present dollars, but the difference can be hundreds of thousands or even millions of dollars. And neither is wrong.

Huh? Let’s explore.

Financial forecasting is an abstract concept

Financial forecasting is a way of foretelling the future. Like all divination, predictions are subject to error and are open to interpretation.

These calculations involve complex mathematical principles and predictions that go beyond direct, tangible experience. These calculations require an understanding of variables such as inflation, interest rates, and the time value of money that are not directly observable in everyday life.

For example, calculating the future value of an investment requires predicting how your money will grow over time, taking into account compound interest and fluctuations in economic conditions. This requires abstract thinking and understanding hypothetical scenarios, which many people may find difficult to understand intuitively without a background in finance or economics.

The abstract nature of these calculations can make financial planning difficult, as they require assuming and quantifying future financial results based on current and projected data.

Comparing future and present values helps you understand your future

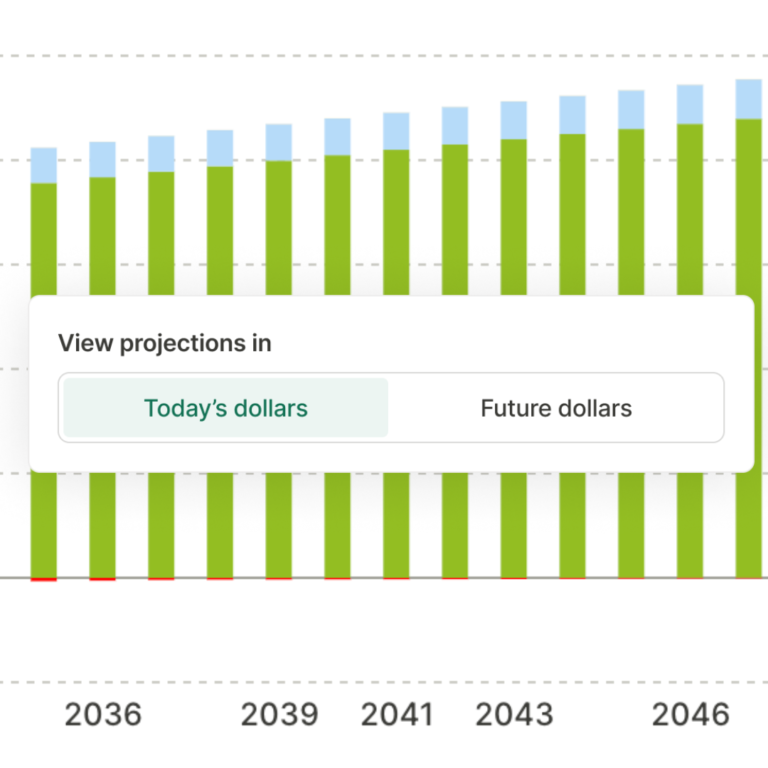

Financial projections can be viewed in a variety of ways. Two common ways to look at a projection are to look at today’s dollar figures or future dollar figures.

Projecting a dollar today doesn’t take inflation into account in its future value. Projecting a dollar in the future does include inflation. Let’s look at this in a bit more detail.

What are “Future Dollars”?

A future dollar, also known as a nominal dollar or nominal value, represents the projected value of money taking inflation into account. A future dollar is usually worth more than a current dollar.

In other words, a future dollar represents the purchasing power of money at a specific point in the future. Due to inflation, the value of money tends to fall over time, which means that a dollar in the future will generally buy less than a dollar today. For example, if inflation is 2% per year, something that costs $100 today might be worth about $121 in 10 years.

Calculations in future dollars can be more “precise.” However, future dollar figures can be harder to understand than today’s dollar figures.

What is “Today’s Dollar”?

A today’s dollar, also known as a current dollar or real dollar, represents the purchasing power of money in the current economic situation, without adjusting for inflation. In other words, a projection of today’s dollar does not inflate money with inflation assumptions. Your account will grow if you have investment income, but its value will not reflect the effects of inflation.

Reviewing your projections in today’s dollars brings future values closer to home. It is a measure of your current understanding of the value of money.

How today’s dollars and future dollars impact financial projections

When assessing your future financial security, looking at your plan’s projections in current or future dollars can make a difference of hundreds of thousands of dollars.

A dollar in the future is likely to be more accurate, but a dollar today may mean more to you.

Example of current and future dollars

Spending

If you expect to need $100,000 per year in retirement, future dollar projections might show that inflation means you need $120,000 per year in 20 years.

Using today’s dollars, without adjusting for future inflation, the same projections might show you need $100,000 per year.

It’s easy to understand, but today’s dollars don’t fully represent how much you’ll actually need in the future.

savings

Let’s say you have $1 million today, the average rate of return is 8%, and inflation over the next 20 years averages 3%.

- In today’s dollars, your money would be worth $2,653,297 after 20 years.

- In future dollars, this amounts to $4,660,957.

Dollars of Today and Tomorrow in the New Retirement Planner

The NewRetirement Planner has two types of numbers.

- What you typed

- What is calculated and displayed as a forecast

Here we explain how the concept of dollars today and dollars tomorrow applies to both inputs and projections in the NewRetirement Planner.

output: All calculations and forecasts can now be viewed in current or future dollars. Switching between the two types of forecasts can help you get a better understanding of your financial forecasts.

input: Most of the input into the NewRetirement Planner is done in “today’s dollars” (what money is worth today), with a few exceptions.

The only thing you need to enter for future dollars is:

- Future primary residence to which you plan to relocate

- Future property purchases

- Lump sum annuity

- Future pensions

- Unexpected Benefits

- One-time cost

- Spending

- transfer

How to compare future dollar value predictions to current dollar value predictions

The New Retirement Planner puts the power of your financial wellness in your own hands – you can see all of the extensive insights, charts and other forecasts in today’s dollars or future dollars.

The toggle to switch between the two types of forecasts is located in the top navigation bar on every page in Planner.

- Look in the top right corner of the top navigation bar

- Click on the “Assumptions” tab

- Scroll down to the toggle labeled “Show Projections.”

- Click the option you want to view.

- You can switch between today’s dollars and future dollars on any page

Log in to the NewRetirement Planner now and compare future and current values.