Radha lost her husband Mahipal and faced a further blow when her life insurance claim was rejected. Even if you have life insurance, consider that it may not be enough for your family in your absence. Discover shocking developments that reveal hidden truths and learn how to avoid life insurance claim denials with complete honesty and planning.

Reasons why life insurance claims are denied and how to avoid them

Life insurance acts as a financial safety net for families, but as Radha’s true story reveals, even the best life insurance plans can fall apart. When her husband Mahipal’s insurance claim was rejected after his unfortunate death, she came to know the shocking truth. Here we explain what happened, why your application is rejected, and what you can do to avoid such nightmares in the future.

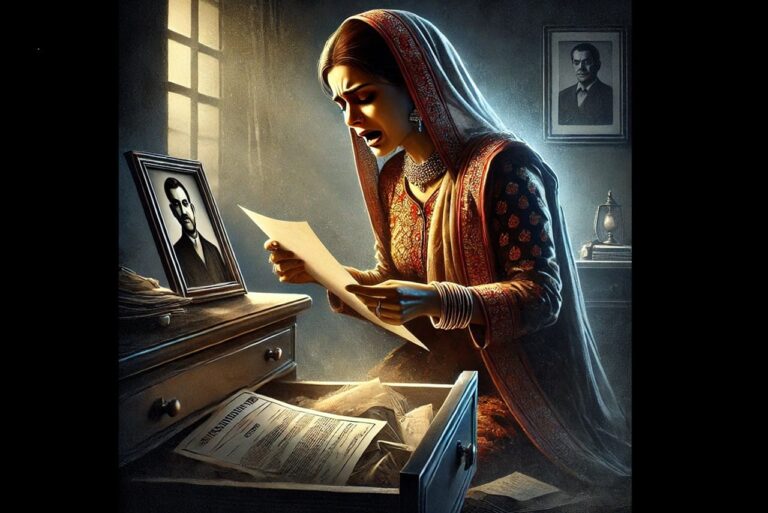

The tragic story of Mrs. Radha – claim denied

Radha’s grief was compounded when her husband Mahipal’s life insurance claim was rejected just months after it expired.

Just five months before his death, Mahipal had taken out a life insurance policy with a sum assured of 600,000 rupees, which would double in case of an untimely death. Radha found this insurance while sorting out her belongings and filed a claim, but her life insurance claim was rejected.

The insurance company says:

- Mahipal had a visible growth on his head, indicating a pre-existing health problem that he did not disclose.

- He had applied for multiple policies with other insurance companies, but they were all rejected for the same reason.

- He did not disclose these rejections or his medical history in his proposal.

The Ombudsman reviewed the case and determined that the insurance company’s refusal was justified. This decision was a harsh lesson in the importance of full disclosure.

Main reasons why life insurance claims are rejected

- Non-disclosure of information

- Not disclosing a medical condition, past policy denials, or ongoing treatment violates the trust that insurance companies require when issuing insurance policies.

- Early complaints trigger investigations

- Claims made within a short period of time after insurance is purchased will be flagged for further investigation. Disagreements can lead to rejection.

- falsehood or falsification

- False information provided on the proposal form, whether intentionally or unintentionally, may invalidate your policy.

How to avoid insurance claim denials

#1 – Be transparent with insurance companies

Always declare:

- All pre-existing health conditions and ongoing treatments.

- Details of previously rejected policies.

- Other existing insurance contracts.

#2 – Transparency ensures that policies are valid and trustworthy.

#3 – Keep your spouse informed

Partners need to know:

- Purchased insurance.

- How to receive it in your absence.

- Who to turn to for assistance in times of conflict?

#4 – Work with professional advisors

A trusted advisor can:

- We will help you choose the right policy.

- Ensure application accuracy.

- We will provide you with support in the event of a claim or dispute.

#5 – Maintain a comprehensive documentation file

Organize all your insurance policy documents, medical records, and communications with insurance companies in one place. This simplifies the claims process for your loved one.

Important lessons learned from the story of Mahipal

- Honesty is non-negotiable: As the Mahipal case illustrates, misrepresentations can lead to claim denials.

- Transparency protects families: Insurers share data across their networks, so hiding details on one policy can affect other policies.

- Involve your loved ones: By keeping your family informed, they can feel confident in filing a claim even when you’re not around.

Conclusion: Life insurance is a powerful tool to protect your family, but only if managed honestly and systematically. Mahipal’s tragic story highlights the risks of concealing information when purchasing insurance. Learn from this story — be honest, keep your family informed, and work with professionals to avoid complications.

Protect your family’s future the right way. Your family’s security depends on your hard work today.