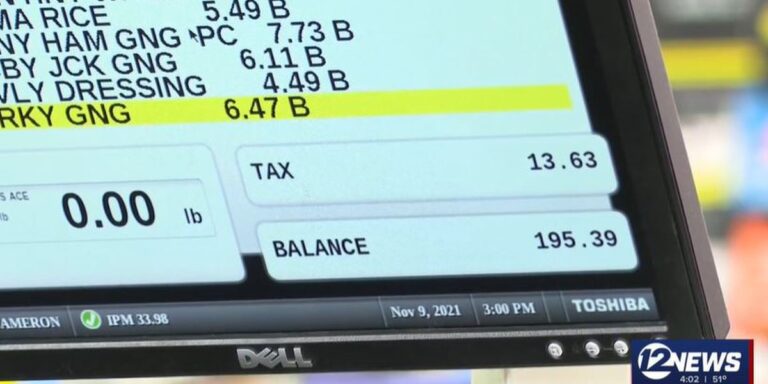

Wichita, Kansas (KWCH) – As the calendar shifts to January 1, 2023, the state sales tax on food was set to drop to 4% from 6.5% some time ago. But that’s not what some shoppers see on their receipts.

The local sales tax in Sedgwick County is set at 1%. Add this to the state tax of 4% and you get 5%.

Most items can be found at the new 4% rate. However, other products on the shelves, including alcohol, are still subject to the 6.5% tax rate.

Still confused?

For example, if you buy meat from a deli, there is a 4% tax. But if that meat is sandwiched between slices of bread with lettuce, cheese and tomato, it’s 6.5%. tax remains at 6.5%. We’re talking rotisserie chicken, store-packaged sliced apples, and charcuterie boards here.

Whether or not utensils such as knives, forks, spoons, napkins, plates, and straws come with it determine whether you pay the old or new price. Takeout pizza, for example, is not considered prepared food and is therefore taxed at 4%. But with cookware, you guessed it, 6.5%. The same goes for bakery items such as wedding cakes. If you don’t have the tools, you will be charged 4.5% tax.

With tableware? Yes, 6.5%.

There are other exemptions, which the Kansas Department of Revenue lists in the 12 News app.

To make things even more confusing, the new state tax rate of 4% will be halved in 2024 and repealed in 2025.

Copyright 2023 KWCH. all rights reserved. To make corrections or report typos, please email news@kwch.com.