High-quality companies with sustainable earnings growth can lift your portfolio over time and become a wealth-building engine. Most people who retire with high net worths are likely to have earned impressive returns from stock investments.

The key is that investors shouldn’t bet too much on any one horse. Diversified Portfolio Investing is important to manage risk, but there are some stocks that buying and holding for the next decade could make a big difference in growing your savings.

Here are two such stocks: Consider investing $10,000 in each of these stocks, and you could retire as a millionaire.

Amazon will continue to benefit from e-commerce and cloud computing.

What a business Amazon (Nasdaq: AMZN) The company began selling books online in the mid-1990s and is now the leading e-commerce retailer with approximately 38% market share in the U.S. Perhaps even more impressive is that Amazon followed this massive success with the launch of Amazon Web Services, which is now the world’s largest cloud infrastructure platform with 31% global market share.

The company has been a very successful long-term investment. A $10,000 investment in Amazon stock at the company’s launch would be worth more than $18 million today. Of course, Amazon is now worth nearly $2 trillion, so there is no room for it to grow in size and value again in the global economy. But the company still has enough upside to justify a $10,000 investment today. Amazon’s core businesses, e-commerce and cloud computing, have plenty of room to grow. E-commerce still represents only 16% of U.S. retail. Meanwhile, the surge in artificial intelligence investments around the world should have big implications for Amazon and other cloud platforms.

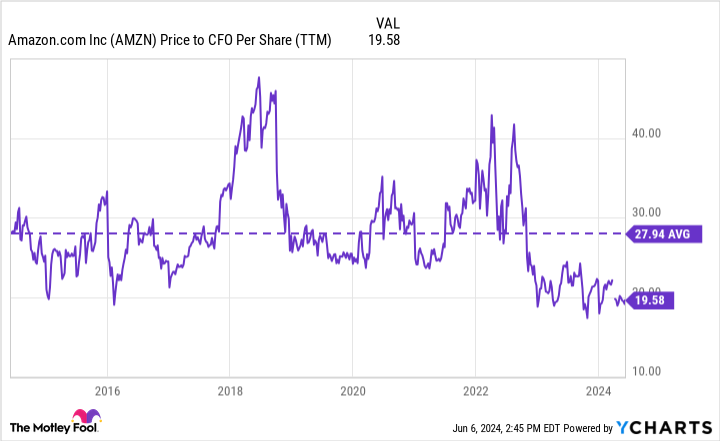

Consider that a giant like Amazon needs to trade at a fair valuation to have the potential to generate even greater profits. If you value Amazon based on operating cash flow — the cash it generates from normal business activities before investing in future growth — the stock is at its cheapest level in a decade (as the chart above shows). This winner will keep winning, so don’t hesitate to include it in your long-term investment plan.

Netflix has proven itself in the ever-growing streaming industry

It is not easy to pioneer a new field or create a new industry. Companies that try to do so are often plagued by many skeptics. Netflix (Nasdaq: NFLX) It has undoubtedly faced challenges over the years, but the streaming pioneer is now the global streaming champion, with over 270 million paid subscribers at the end of the first quarter. With subscriber numbers up 16% year over year in the quarter, it shows there is still plenty of room to grow as people around the world steadily shift from cable to streaming.

And when you’re as big as Netflix, there are plenty of tricks you can use to squeeze profit growth out of your business. Beyond simply increasing subscriber numbers, Netflix could raise prices or crack down on password sharing (which is Great successThe company has been steadily moving into live sports content and is also testing video games now that the technology has advanced enough to allow games to be streamed via the cloud.

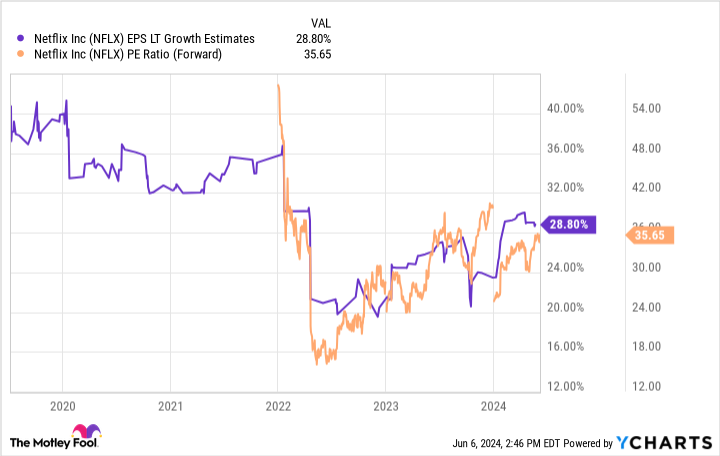

Netflix’s stock has significantly outperformed the overall market over the past decade, but the company is poised to continue to enjoy robust earnings growth. The stock currently trades at 35 times earnings, but analysts see Netflix’s earnings growing at more than 28% annually over the next three to five years. That should make the stock attractive to investors.

Should I invest $1,000 in Amazon right now?

Before you buy Amazon stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Amazon isn’t one of them. These 10 stocks have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $740,688.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Justin Pope The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Netflix. The Motley Fool Disclosure Policy.

Want $1 million when you retire? Investing $10,000 each in these two long-term stocks could help you get there. Originally published on The Motley Fool