(Bloomberg) – Two more Chinese developers failed to meet their dollar bond payments amid a renewed softness in home sales and a lack of aggressive stimulus.

Bloomberg’s most read articles

Central China Real Estate said it would not make interest payments on its notes and suspend payments on all offshore debt by the end of the grace period on Friday. Smaller rival Leading Holdings Group failed to pay the full $119.4 million in principal and interest on dollar-denominated bonds it issued a year ago as part of a debt exchange, according to a filing Friday night. clarified.

The companies also said they would work with external advisors to work on a comprehensive solution to offshore debt. Zhonghua is the 33rd largest construction company in China by contract sales, according to the China Real Estate Information Corporation, but Reading Holdings is not among the top 100.

The delinquency comes after several Chinese builders transferred funds for interest payments last week after or shortly after the end of the 30-day grace period. Unprecedented cash crunch in the real estate sector led to record defaults on Chinese issuers’ dollar-denominated bonds last year, with outstandings still rising in 2023.

Expectations are high that Chinese authorities will come up with more stimulus for struggling sectors such as real estate. But investors were disappointed last week when a Chinese bank cut its mortgage reference rate lower than some expected. The slow rollout of stimulus has fueled concerns about the country’s economy.

Zhang Wei Liang, strategist at DBS Bank, said: “Chinese developers continue to face investor skepticism as revenue slows again, with bank picks even after the 16-point plan. We may extend the refinancing period on a rolling basis,” he said.

Creditaites senior credit analyst Zerlina Zeng said Central China’s announcement is unlikely to come as a big surprise to the market given the trading levels of the company’s short-term dollar bonds. “Most small privately owned developers are still facing tight liquidity conditions as contract sales have been slow to recover,” she said.

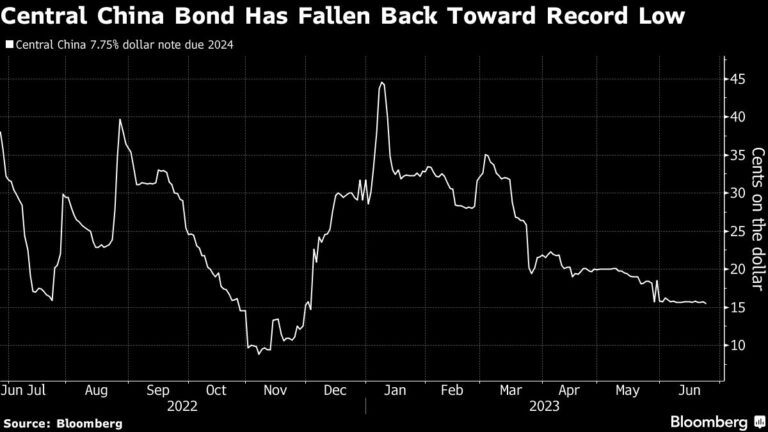

Its bonds slid as much as 4 cents on Monday, outpacing the as much as 0.5 cent decline in China’s high-yield dollar-bond market, which is dominated by construction companies, credit traders said. Chinese assets fell across the board, with stocks and the yuan declining on new signs of slowing economic momentum.

Unpaid notes from Central China and Reading Holdings have been below 30 cents on the dollar for most of this year, according to data compiled by Bloomberg. Such prices are generally viewed as highly distressed levels and indicate investor skepticism about timely payments.

Less than a year ago, Central China’s parent company sold a 29% stake in the company to a government-owned company in its home province of Henan. Market optimism, fueled by hopes that the move would provide state aid to builders, did not last long. In April, Chubu exchanged three-dollar bills that will mature in 2023.

–With help from Pearl Liu and Lorretta Chen.

(Added market performance in eighth paragraph.)

Bloomberg Businessweek’s Most Read Articles

©2023 Bloomberg LP