Denis Vermenko

The stock market is sometimes likened to a gigantic casino, where the stocks of even the best companies can move more than 20% in either direction within a year.But unlike casinos where the odds are reset after each game, the value is Stock market investors can win in the long run by simply buying quality stocks when prices are down, as long as the long-term theory doesn’t break down.

where Trust Financial (New York Stock Exchange: TFC) has fallen 32% in price over the past 12 months. While the market doesn’t seem to like TFC’s Q2 results, this article discusses why this negative reaction presents a solid opportunity for long-term value investors.

Why TFC?

Truist Financial is a financial services company headquartered in Northern Charlotte. Carolina, home of Bank of AmericaBACs), also known as the banking center of the South. Serving his 15 million customers in 17 states and high-growth markets including Washington, DC. Today, TFC’s total assets are his $555 billion, ranking among the top 10 commercial banks in the United States.

Starting with the negatives, TFC’s share price fell to high single digits after its second-quarter earnings release. This is because the market did not take very well the 6% decline in net interest income and the 12% decline in EPS from the first quarter due to higher expenses and higher funding costs (i.e. higher interest rates on deposit accounts).

This was reflected in a lower net interest margin of 2.91% from 3.17% in the previous quarter. NII increased 7% year-over-year, offset by higher loan loss reserves and higher expenses, and EPS declined 16% year-over-year.

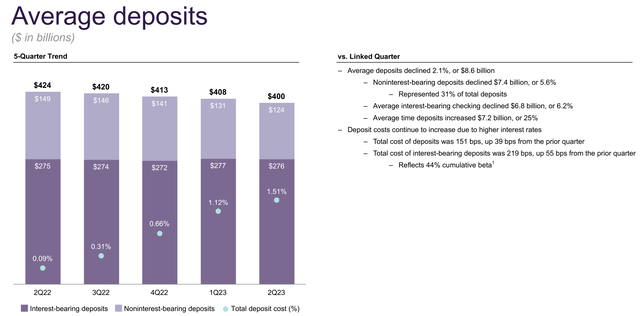

Notably, average deposits declined $24 million year-over-year, from $424 billion to $400 billion. However, as shown below, the collateral effects of Silicon Valley bank and signature bank failures appear to be contained as the downtrend began even before those events occurred.

Presentation for investors

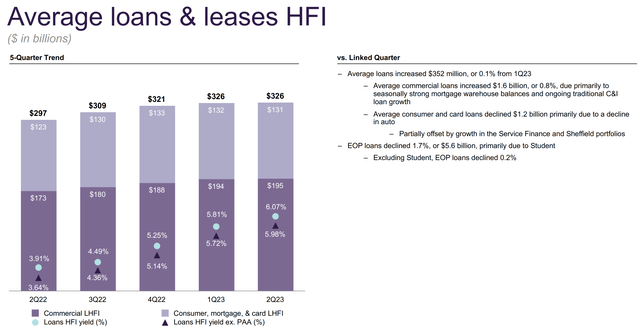

On the positive side, TFC’s total revenue remains strong, up 5% quarter-on-quarter and down 2.9% (in line with guidance), with TFC generating a still-high ROTCE of 19%. TFC’s loan balance also remained strong, growing 10% year-over-year to his $326 billion without a quarter-over-quarter decline. This was achieved by strong year-over-year performance in both the consumer and commercial sectors, as shown below.

Presentation for investors

Meanwhile, TFC has witnessed strong digital engagement from its customers, with mobile app users growing 6% to 4.6 million over the past four quarters, with digital and Zelle transactions growing 9% and 31%, respectively, over the same period. TFC also has an AI-driven platform that assists small business customers with cash flow overviews, profit and loss analysis, and proactive balance monitoring.

Risks to TFC include the possibility of a recession that could strain consumer finance and lead to an increase in loan loss reserves. In addition, margins could continue to be squeezed if funding costs continue to rise without an increase in lending. This could be offset by cost-cutting efforts that management noted on its recent earnings call.

As a company, we have a huge opportunity to operate more efficiently and are working to reduce costs. At its April earnings call, the company discussed a strategic restructuring of its fixed income sales and trading business, discontinuing certain market-making activities and services offered by middle market fixed income platforms that had unattractive ROEs.

We also identified a range of cost-saving initiatives already underway, including realigning the LightStream platform for broader consumer businesses and ongoing capacity adjustments for market-sensitive businesses such as mortgages.

We are actively working to identify and accelerate additional actions we can take over the next 12-18 months to create efficiency opportunities and cost savings that reflect changing circumstances.

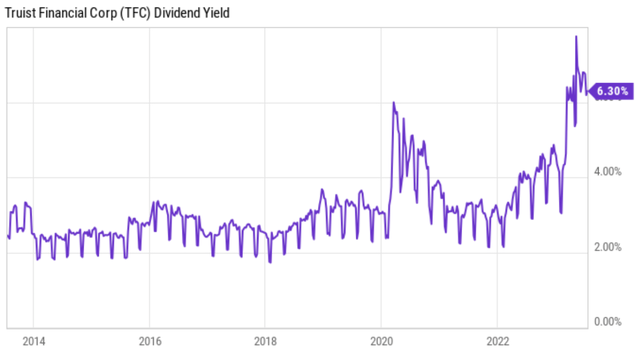

Importantly, TFC maintains a strong A- credit rating with a stable outlook from S&P. This is supported by a CET1 ratio of 9.6%, well above the minimum requirement of 4.5% set by the Federal Reserve. TFC also delivers an attractive dividend yield of 6.3% with a payout ratio of 23%, eight consecutive years of growth and a five-year CAGR of 8.8%. As you can see below, the 6.3% yield is even higher than the 2020 pandemic-time high.

Y-chart

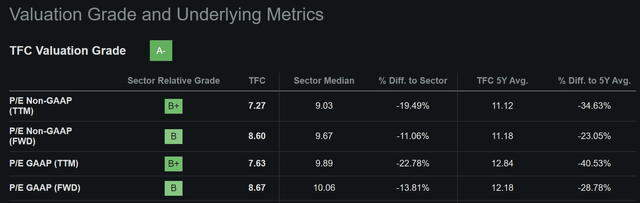

With a current price of $33.05 and a forward P/E of 8.6, I believe the potential risk is more than priced into the stock. This takes into account TFC’s usual PER of 14.3 and analysts’ expectations that TFC will resume his EPS growth in his teenage net income from 2025. TFC’s valuation is also attractive relative to its peers, with an A- valuation grade and a P/E ratio well below the sector median, as shown below.

looking for alpha

Points for investors

Trust Financial has experienced significant share price declines over the past 12 months, with the share price falling since its second quarter earnings release. While there are headwinds in the short term, patient value investors may be rewarded in the long run as we believe issues will improve as management works to cut costs and increase digital engagement. Meanwhile, TFC maintains a well-covered and historically attractive dividend yield, with long-term capital gains potential due to a return to average valuation. As such, value and income investors may want to look at TFC at current discount levels.