Personal finance expert Dave Ramsey expressed concern about the growing popularity of variable-rate mortgages (ARMs). In a recent episode of “The Ramsey Show,” Ramsey didn’t hesitate to describe ARM as a “ticket to foreclosure” rather than a road to home ownership.

in the episode, co-host George Kamel addressed a “passive-aggressive” question posted on Experian about whether variable-rate mortgages help people buy a home. Ramsey made it clear that he believes there is a potentially sinister motive behind the question. He questioned the vested interests of organizations like Experian driving ARM, implying that their goal is to get people into debt and keep them there. When people take out mortgages, their credit scores are checked and monitored, and one of the leading credit bureaus, He Experian, benefits from this activity.

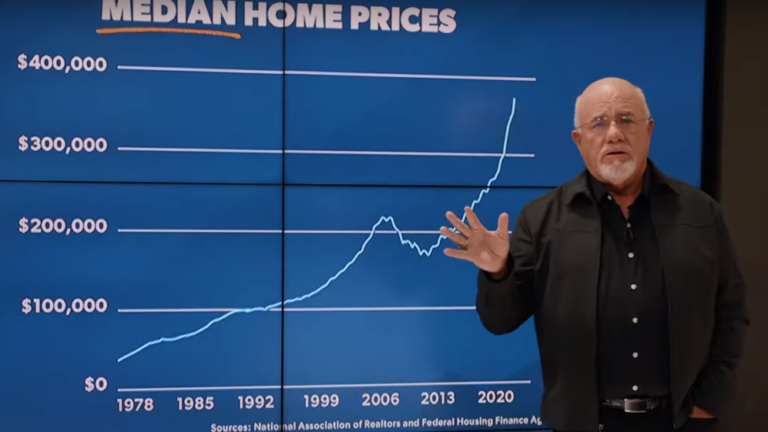

Ramsey scoffs at the idea of buying ARM when interest rates are rising. He asks rhetorical questions. “In a rising interest rate environment, if you buy a mortgage that adjusts, how far do you expect it to adjust?

Do not miss it:

according to investigation, 40% of Americans said they would take a variable rate mortgage. Despite its obvious appeal to some desperate buyers, Ramsey has strong concerns about ARM, and his concerns are not without reason.

He explains that ARM has a built-in “bait and switch” mechanism. When a borrower initiates an ARM, they are already assigned a higher interest rate than they can secure with a fixed rate mortgage at that time. During the update he said that broader interest rates would need to be cut to stabilize ARM rates, but this is a rare case.

The ARM could quickly revise upwards when benchmark rates rise, but move much more slowly once the Federal Reserve announces rate cuts. This dynamic will almost certainly result in an increase in adjustable mortgage rates on first renewal, which could put a strain on your finances.

Ramsey emphasized in his assessment that ARM ranks among the most serious financial traps ever devised. As in recent history, if the Federal Reserve continues to raise rates, the ARM could soon become unavailable. When homeowners default on their payments, they risk defaulting on their mortgage and eventually being foreclosed on.

Much of Ramsey’s skepticism about ARM stems from his experience in the real estate industry, especially in the 1980s. Interest rates rose sharply during this period, reaching a whopping 17%. This situation caused a banking crisis. Many financial institutions found themselves paying high interest rates to their depositors while receiving low payments from borrowers locked into fixed-rate mortgages.

In this tumultuous time, it is often said that savings and loan crisis, As a result, several financiers went bankrupt. To mitigate such risks, banks introduced variable rate mortgages, effectively transferring risk from lenders to borrowers.

Ramsey argues the change has little to do with helping prospective homebuyers, it’s all about banks protecting their interests. He argues that banks have a long history of prioritizing financial health over borrower welfare.

Read on next:

Image Source: Screenshot from Will the housing market collapse? | Ramsey Real Estate Reality Check on youtube.

Don’t miss real-time stock alerts – join us benzinga pro For free! Try tools that help you invest smarter, faster and better.

This article ‘Ticket To Foreclosure’ Dave Ramsey Warns About This Mortgage Trap He Calls ‘Stupid Than Stone On Surface’ originally appeared benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.