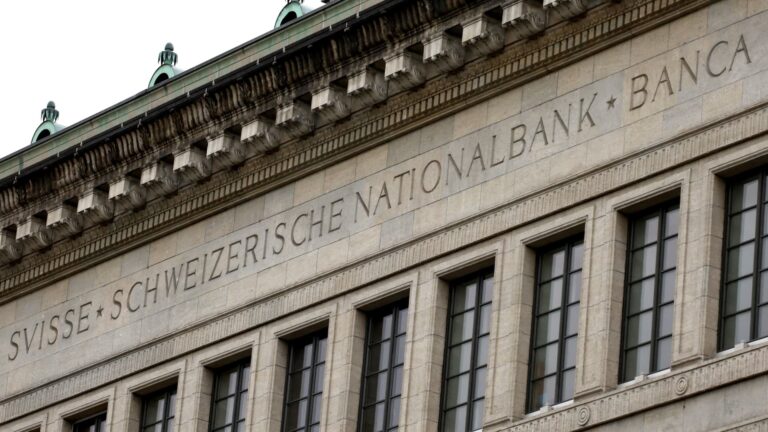

A view of the headquarters of the Swiss National Bank (SNB), before a press conference in Zurich, Switzerland, March 21, 2024.

Denis Balibouse | Reuters

The Swiss National Bank on Thursday trimmed its key interest rate by 25 basis points to 1.25%, continuing cuts at a time when sentiment over monetary policy easing remains mixed among major economies.

Two thirds of economists polled by Reuters had anticipated the SNB would decide in favor of a 25-basis-point-cut to 1.25%.

The country’s inflation flatlined at 1.4% in May after a bump up in April and is expected to average the same level across full-year 2024, according to the SNB’s latest projections. The Swiss central bank expects the national GDP, adjusted for sporting events, to hit 1.2% this year. It anticipates support from exports but ongoing pressure from “low capacity utilization in industrial production and high financing costs,” which are likely to subdue investments.

In a June 14 note, analysts at Nomura had characterized a likely cut as a “finely balanced decision” and signaled that “underlying inflation momentum has remained weak which is likely to increase the SNB’s confidence that inflation will converge to the mid-point of its inflation target.”

Switzerland already has the second-lowest interest rate of the Group of Ten democracies by a wide margin, following Japan. It became the first major economy to cut interest rates back in late March and was earlier this month followed by the European Central Bank.

But the U.S. Federal Reserve has yet to blink, and market participants will be following later in the Thursday session to see if the Bank of England takes the leap to trim, after U.K. inflation eased to the 2% target for the first time in nearly three years.

This breaking news story is being updated.