A former pensions minister has warned that around one million young Brits are “gaming with their retirement” by taking out mortgages because they are past state pension age.

Sir Steve Webb, Partner LCP (Lane Clark & Peacock) A former Liberal Democrat lawmaker who served in the Coalition government has warned of a “shocking” number of transactions that exceed the age threshold for retirement benefits.

Freedom of Information (FOI) data provided by the Bank of England shows that 42% of new mortgages in the fourth quarter of 2023 had an over-age condition.

During the same period, 38% of new business had terms ending in excess of 66 years, and in the fourth quarter of 2021, 32% of new business exceeded this threshold. Lord Webb said one million new mortgages had been issued on the end date past the state. Based on these figures, we calculate your pension age for the past three years.

“The challenge of getting onto the housing ladder is forcing many young homebuyers to gamble with their retirement prospects by taking out very long-term mortgages,” he said.

“We already know that millions of people do not save enough for retirement, and if they use some of their limited retirement savings to pay off their mortgage balance in retirement, If they have to spend, they are at greater risk of becoming poor in old age.

Have a money story you’d like to share? Email us money@gbnews.uk.

Former pensions minister warns young people about ‘shocking’ mortgage deals

getty

In the fourth quarter of 2023, homebuyers aged 30 to 39 years accounted for 30,943 new mortgages extending beyond state pension age, while people aged 40 to 40 accounted for 32,305 new mortgages. Occupied.

Of these, 3,676 home loans involved young borrowers under the age of 30, 18,854 were between the ages of 50 and 59, 4,955 were between the ages of 60 and 69, and 661 were between the ages of 70 and older.

Sir Steve said many Brits will eventually be unable to repay their mortgages when they retire and may end up buying up their pension savings to pay off their mortgages, leaving them with less money for retirement. He pointed out that there is.

Retirement experts say that even if a mortgage contract takes them past pension age, it means Brits are getting closer to retirement and can enjoy a period where they can build up their pension savings without taking out a mortgage. He says he won’t be able to do it.

Last autumn, the Bank of England’s Financial Policy Committee (FPC) revealed that the proportion of new mortgage lending with terms of 35 years or more had risen by 8 percentage points since the first quarter of 2021.

As of the second quarter of 2023, these mortgages accounted for 12% of new contracts with FCP, and it notes that homeowner debt burdens may increase over time.

According to financial information site money factsThe average two-year fixed mortgage rate on Friday was 5.94%, up from 5.93% on Thursday.

Property firm Savills recently announced that it expects property values across the UK to rise by an average of 21.6% by the end of 2028.

Carina Hutchins british finance “The proportion of long-term mortgages has increased in recent years as buyers look for ways to achieve affordability,” the head of mortgage policy said.

“When assessing new mortgage applications, lenders will act in accordance with the Responsible Lending Rules set out by the Financial Conduct Authority and will carefully consider whether a borrower can repay their mortgage in the future.

Latest developments:

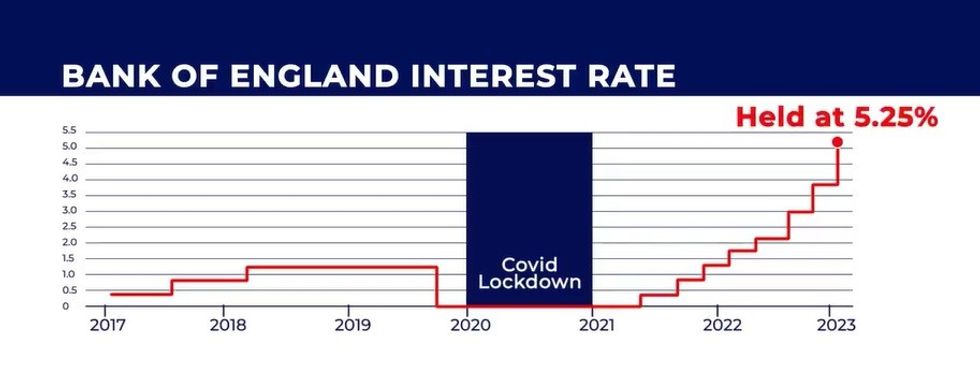

The Bank of England has kept its benchmark interest rate unchanged at 5.25% in recent months. GB News

The Bank of England has kept its benchmark interest rate unchanged at 5.25% in recent months. GB News

“This includes whether the requested period exceeds the expected retirement age of the borrower. In this case, lenders will typically require proof of pension, typically within 10 years. Those approaching may need to convince lenders that they can afford the mortgage based on their retirement income.

“A longer mortgage term will result in lower initial monthly payments, but if the mortgage lasts for the full term, the borrower will pay more interest and have less disposable income to put towards their pension. We encourage our customers to speak to an independent mortgage advisor to discuss the best options for their particular circumstances.”

Potential homebuyers are facing historically high mortgage rates after the Bank of England decided to raise the benchmark interest rate to 5.25% to combat inflation.

At the same time, experts are urging policymakers to rethink Britain’s pension system, as working generations face a tougher retirement than their parents and grandparents.