This marks the second consecutive month of sharp month-on-month increases as companies raise prices ahead of the new fiscal year.

From WOLF STREET by Wolf Richter.

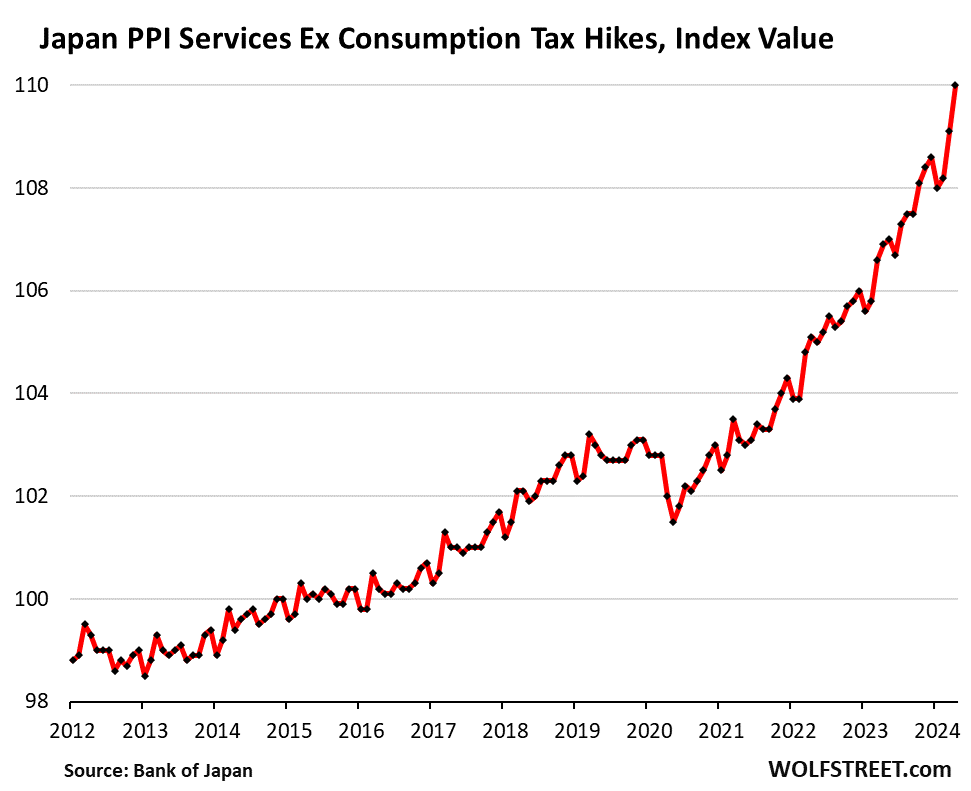

The producer price index for services purchased by Japanese companies rose 0.82% from the previous month in April, after a similar increase in March compared with April, according to data from the Bank of Japan. On an annualized basis, both increases amounted to just over 10%.

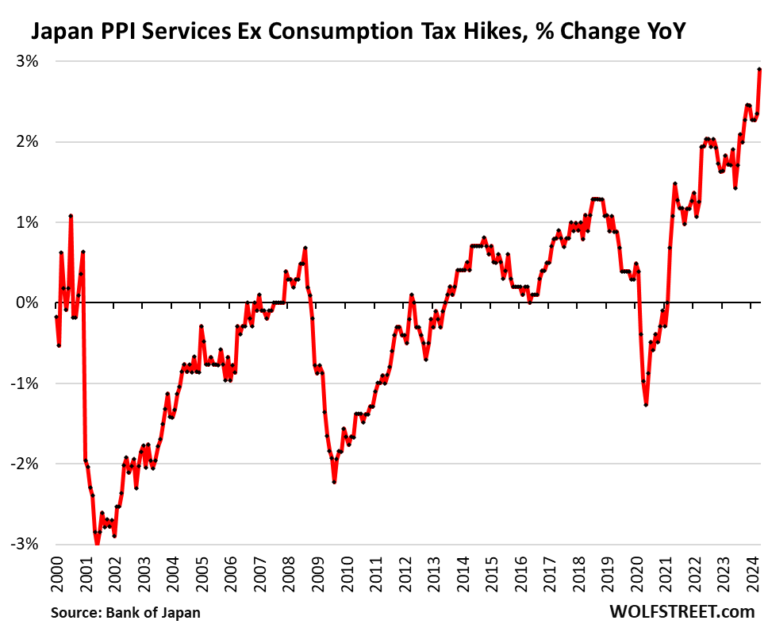

In data that excludes past consumption tax hikes, April’s surge took the year-on-year increase to 2.9%, the worst increase since 1991.

Japan’s fiscal year begins in April, and while many companies adjust prices at this time, most of the monthly price hikes in March and April were due to companies raising prices for services they provide to other companies. Now, companies are passing on wage increases to them.

The services that saw the biggest year-over-year price increases were:

- Civil engineering and construction services: +7.5%

- Other technical services: + 5.9%

- Training and development services: +6.7%

- Machine repair and maintenance: +5.5%

- Waste and industrial waste disposal: +5.1%

- Software Development: +4.5%

- Product inspection, non-destructive testing, and inspection certification services: +5.4%

- Leasing of computers and related equipment, communication equipment, automobiles, etc.: +5.3%

- Hotel: +22.3%

- Ocean freight: +16.7%

- Domestic air passenger traffic: +10.1%

The recent acceleration can be fully understood in the graph below, which shows the index value of the service industry producer price index without the consumption tax hike. This shows that all kinds of chaos is being unleashed. Meanwhile, the Bank of Japan is still keeping its policy rate at 0% after one tiny rate hike in March and signs of slowing bond purchases.

Companies that bear the costs of rising service prices pass the burden on to their customers. Wages are a big driver of service inflation. The Bank of Japan points to service inflation as a sign that inflation is spreading across the economy, and that is indeed the case.

The Bank of Japan has ample inflation-related reasons to raise its policy rate with a big hike, rather than a paltry one like the one it implemented in March, from minus 0.1% to 0%. Its policy of refusing to raise interest rates in the face of rising inflation has caused the yen to plummet, currently trading at around 157 yen to the dollar, but it is the currency that will ultimately deal with such monetary sins.

Enjoy reading WOLF STREET and want to support us? You can donate, we’d be so grateful! Click on Beer and Iced Tea Mugs to find out how.

Want to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()