As 2024 approaches, retailers are trying to predict what customers want and how preferences will change in the coming months, especially in key categories such as alcohol.

In December NACS Webinarjames Fortescuea senior category manager for beer, wine and spirits at BP. Nielsen IQ Alcoholic Beverages discusses the top flavor trends in alcoholic beverages for 2024.

One of the main topics of discussion is the rise of bold flavors in all types of alcohol. And nowhere is this movement more evident than in the growth of ready-to-drink flavored malt beverages, which feature stronger flavors of fruit, hops, and spiciness. These include things like canned cocktails and malt-based drinks like hard lemonade and seltzer. In the 52 weeks ending Dec. 2, hard tea sales rose 37% year-on-year, hard sodas 45% and wine-based cocktails 32%.

C-stores have proven to be particularly strong outlets for RTD. According to NielsenIQ data, nearly half of his RTD beverage sales in the U.S. are sold in convenience stores, and the channel recorded nearly 14% growth this year compared to last year. This is more than double the increase seen in other types of retail stores.

Bud Light Chelada Tajine combines lime flavor and spiciness.

Provided by Tajine USA

“There is no question that the convenience channel is the go-to channel when it comes to RTD,” said John Berg, vice president of the company. beval Demonstrates leadership Nielsen IQin a webinar.

He pointed out some of the reasons This will likely come down to a format that allows c-stores to easily get in and out when customers want a hard seltzer or lemonade.

However, the RTD space is also crowded and expanding, forcing convenience retailers to make difficult decisions about what to stock. Here are the top three trends highlighted during the webinar.

Innovation is the key

He said the field is so crowded that brands are growing and innovating in different directions. Cary Thériaultclient manager beval thought leadership for Nielsen IQ.

“What we’re seeing is brands just choosing one path to take and sticking with it,” she says.

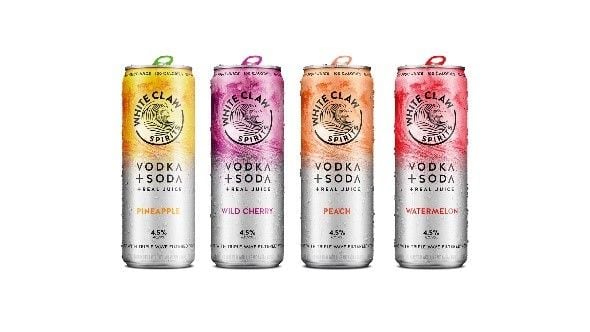

He said some companies are pushing further with bold fruit flavors, noting Gay Water’s vodka sodas with lime, watermelon, peach and grapefruit. Dad Water, a fruit-infused tequila water, comes in flavors such as lime, blood orange, and pineapple jalapeño.

She also noted that products like Suntory’s -196 seltzer brand, a Japanese supplier with a presence in the U.S., are showing more foreign influence. The brand uses liquid nitrogen to freeze its fruit, hence its name. The fruit is then ground up, soaked in vodka, and used as the base for a zero-carb drink.

Looking to the future, Nielsen IQ Experts see several trends in alcohol flavoring.

First, we expect growth in beverages that offer mango-like sweet and spicy flavors. habanerochili lime or dad water pineapple jalapeño.

Second, he noted an increased focus on Hispanic flavors, such as smoky flavors. mezcaltamarind, tropical fruit.

Finally, they predicted an increase in indulgent flavors such as chocolate, caramel, and toasted coconut.

RTDs are evolving but face regulation

Many of the alcohol industry’s popular and innovative brands are malt-based. For a while, hard seltzer was the star, but as its popularity waned, other flavored malt beverages such as hard lemonade and twisted tea took over.

However, there is a growing movement to incorporate more spirits into RTD options for specific booze-based flavors.

“The stores that can sell it are obviously very successful at it,” he said. Fortescue. “It moves the basket. It drives the trade.”

While this is great for customers looking for these options, it can cause problems for convenience retailers, as each type of alcohol has different sales rules.

I just keep leaning towards fruit flavors.

Courtesy of Truly

NielsenIQ reports that it is legal to sell beer in almost all convenience stores in the United States. However, only about two-thirds of these stores are permitted to sell wine, and only 22% are permitted to sell spirits-based products. R.T.D.. This means that c-stores can be left behind if customer preferences skew too far in that direction.

“We are considering it on a store-by-store basis,” he said. Fortescue. “If you have a license, [it] Since we can sell spirits, we are paying special attention to that store and making sure we have space for that. [spirit-based RTDs], warm and cold. ”

Support for more flavorful beer types

Beer is one of the top categories that draws customers to c-stores. In 2021, it was the third largest seller in the industry after tobacco and packaged beverages.

“We’re seeing so many flavors coming through, and we’re also seeing other styles that have been that way in the past.” hoppyBut now we’re adding different flavors within those hop segments.” Thériault.

You may be tempted to just stock major brands, but C-stores should focus on niche flavor segments that are becoming increasingly popular across the alcohol industry.

For example, heavy hoppy IPA flavors are big sellers, according to Nielsen IQ data. Across all external channels, IPA sold more than $2 billion in his 52 weeks ending Dec. 2. This is an increase of more than 5% year over year.among them time framesales in the Craft Hazy Imperial/Double/Triple IPA category more than doubled.

Similarly, the presenters noted that sales of hop water (basically a seltzer with hop flavors rather than fruity or floral flavors) increased 143% to $22.6 million.

They also pointed out that Cheladas All outlets saw an increase of approximately 40%. Cheladas A cocktail made with lager beer and lime juiceIn restaurants and bars, it is served with salt on the rim like a margarita, but there is also an RTD version.