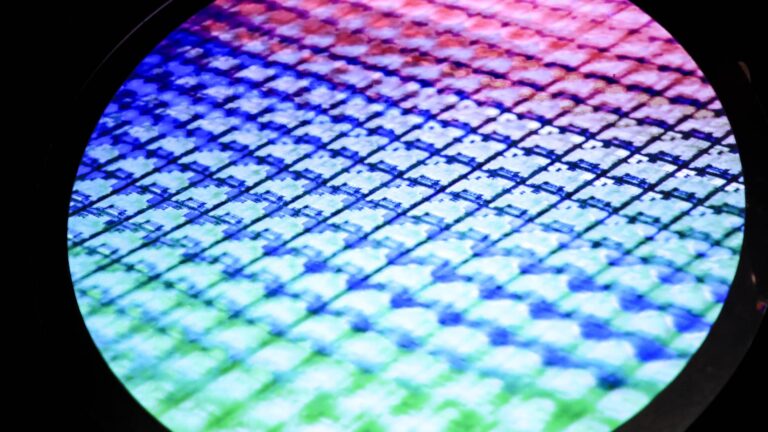

Image of a semiconductor wafer at the Taiwan Semiconductor Manufacturing Innovation Museum in Hsinchu, Taiwan, on January 11, 2022.

Chen Yihua | Bloomberg | Getty Images

Taiwan Semiconductor Manufacturing Company on Thursday reported a 54% jump in third-quarter net profit, the highest annual rate in the last three months of the year, as the global chipmaker continues to benefit from demand boosted by AI applications. Forecast sales growth.

The company’s net profit for the July-September period was NT$325.3 billion ($10.1 billion), beating the LSEG estimate of NT$300.2 billion cited by Reuters.

U.S.-listed stocks were up 6.4% in premarket trading as of 4:35 a.m. ET.

TSMC is the world’s largest manufacturer of advanced chips, serving customers including: apple and Nvidia.

Net revenue for the third quarter rose 36% year over year to $23.5 billion, and TSMC’s gross profit margin rose to 57.8% from July to September (54.3% in the same period last year).

“Based on our current business outlook, we expect our fourth quarter revenue to be between $26.1 billion and $26.9 billion, an increase of 13% sequentially and 35% year over year at the midpoint. ” said the TSMC chief financial officer. According to a transcript of the call compiled by FactSet, board member Wendell Hwang said this in a conference call after the company’s results were released.

TSMC said in a statement, referring to the semiconductor node, that for the third quarter, “our business was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies.”

During Thursday’s earnings call, TSMC Chairman and CEO CC Wei said the demand for AI is “real” and that the company is experiencing “the deepest and broadest growth in our industry” as a result. He emphasized that there is.

“We’ve been constantly talking to our customers, including hyperscaler customers who are developing their own chips, and almost every AI innovator is working with TSMC,” he said.

The company’s Taipei-listed shares have soared nearly 80% since the beginning of the year, outpacing the Taipei-listed stock’s 28.57% rise. wider market over the same period.

TSMC now expects capital spending to increase to just over $30 billion this year, it said on an earnings call. The company’s capital expenditure costs increased slightly to $6.4 billion in the third quarter, compared to $6.36 billion in the prior three months.

The Taiwanese chipmaker, whose advanced chips are essential to a wide range of products from smartphones to AI applications, has made significant overseas investments and expanded its manufacturing presence around the world. $65 billion for three chip factories in Arizona It also opened its first factory in Japan earlier this year to meet demand in the United States.

TSMC’s profit beats Netherlands-based TSMC in the same week ASMLThe company, which supplies machinery to Taiwanese companies, announced lower-than-expected net sales forecasts, sending its stock price plummeting.

Although some market participants question the long-term resilience of the AI boom and the benefits of increased investment in the technology sector, Young, CEO and chairman of Foxconn, a major Apple supplier, Liu told CNBC last week that the AI craze is “still having some impact.” As advanced language models evolve with each new iteration, “it takes time.”

Correction: This article has been updated to accurately reflect that TSMC’s third-quarter net profit reached NT$325.3 billion.