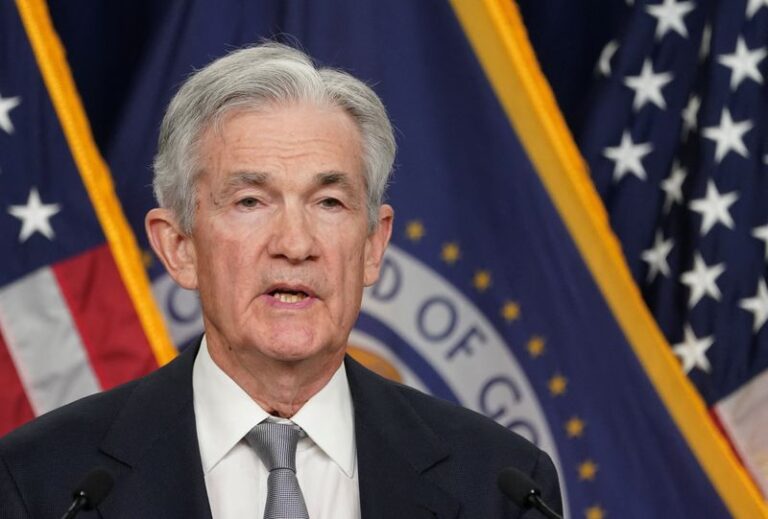

Investing.com — Jefferies said inflation data due next week could give Federal Reserve Chairman Jerome Powell an opportunity to prepare for a September interest rate cut after a string of recent economic data, including Friday’s labor market reading, set off the Fed’s “good news” counter.

“If the CPI data released next week is again weak (as we expect), the Fed could move to signal a rate cut as early as its September meeting,” Jefferies said in a Friday note ahead of Thursday’s release of the June consumer price index.

Economists expect the CPI to rise 0.2% in June from 0% the previous month, while the more closely watched measure, core CPI, which excludes food and energy prices, is expected to remain steady at 0.2%. The CPI decline would mark a second month of slowing inflation, reinforcing confidence that the upward surprise seen in the first quarter was simply a departure from last year’s deflationary trend.

Expectations for a September rate cut rose sharply after Friday’s jobs report revised down job gains for April and May, overshadowing a better-than-expected increase in payrolls in June and pointing to signs of a slowdown in the labor market. In addition to the employment revision, the unemployment rate unexpectedly rose to 4.1% in June and average hourly earnings slowed, lending further credence to expectations of a slowdown in the labor market.

The nonfarm payroll numbers confirmed what Fed Chairman Jerome Powell said earlier this week that the U.S. labor market is “moving significantly toward a much better balance than it was a few years ago.” Both the unemployment rate and wage levels are approaching “sustainable” levels, he added.

Traders now see a 70% chance of a rate cut in September, down from 60% last week.

Economic data since April has been pushing the Fed’s “good news” counter higher ahead of Chairman Powell’s congressional testimony and the Fed’s July board meeting, two events that could give the Fed chairman an opportunity to set the stage for a rate cut in September.

Fed officials have recently signaled they need more credibility before cutting rates, but “that could change at the next meeting on July 31 or when Chairman Powell testifies before Congress next week,” Jefferies added.

Powell begins two days of testimony before Congress on Tuesday.