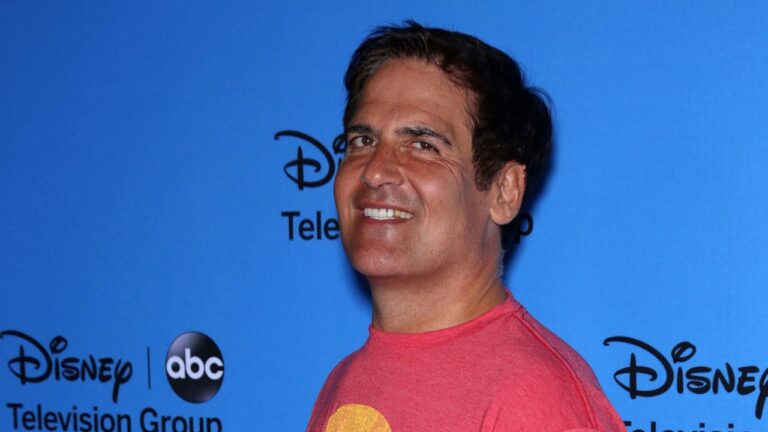

You may know Mark Cuban as the former owner of the NBA basketball team Dallas Mavericks, but he is also a brilliant businessman worth over $6.2 billion as of 2024.

A few years ago, Cuban released a short video outlining his nine rules for getting rich. I agree with many of them too, but two of his rules are completely wrong. And some others require a little context.

What are the rules for Cubans to get rich? Which one is wrong?

Rule #1: Live like a student

This is a particularly strict rule after literally several years of being a student.

Once you graduate from high school or college, it makes sense to start enjoying the fruits of your labor. You now have a full-time job and earn money, so you want to spend some of it doing things that make you happy.

There’s nothing wrong with that, but it can quickly get out of hand. Living like a student isn’t fun, but it can help you build wealth and achieve financial freedom quickly. In general, I like this rule, but it takes discipline to properly apply it to your life.

Balance is the key.

Rule #2: Don’t use credit cards

Mr. Cuban insists that if you never use your credit card, you won’t pay any credit card fees. While that is true, I wholeheartedly disagree with this rule.

However, there is a catch here. At the end of the month, you should diligently pay off your credit cards without exception. If you have a habit of maintaining balance, Cuban is right.

Do not use credit cards.

However, credit cards offer a wealth of benefits to responsible buyers. For example, credit cards have built-in fraud protection. If someone steals your cash, you’re out of luck. But if someone steals your credit card and you use it to buy something, you can usually get your money back.

Additionally, many credit cards offer reward points or cash back, which is literally free money (again, assuming you don’t pay any credit card interest by carrying a balance). Also, depending on the card, you won’t need the “extended warranty” that major electronics stores require you to purchase because it will guarantee the electronics purchased with that card.

Using credit cards responsibly can also help build your credit.

Rule #3: Save 6 months of income.

6 months emergency fund It is important. An emergency fund is money set aside for unexpected emergency expenses, such as a leaky roof, a car accident, or unexpected medical expenses.

Most personal finance experts recommend keeping your money in a safe place (like a savings account or money market account) for 3 to 6 months, but I always recommend 6 months. Recommended. The more money you have saved for emergencies, the more you can protect yourself from taking on debt or selling stocks to raise unexpected funds.

Rule #4: Put your savings in Spx mutual funds.

Cuban recommends putting your emergency savings in the SPX mutual fund. The SPX fund is a diversified and relatively safe S&P fund.

But I don’t agree with this rule.

As with any other type of investment, there is still a risk that your funds will decline. It’s best to keep your emergency savings in something completely safe, such as an FDIC-insured savings account. However, for those with a higher tolerance for risk, the SPX mutual fund may be a good option.

Rule #5: Invest up to 10% of your savings in high-risk investments.

To me, 10% is too high for high-risk investments like Bitcoin (and other cryptocurrencies), initial public offerings (IPOs), and REITs (Real Estate Investment Trusts). However, the amount you invest in high-risk investments largely depends on your risk tolerance. If you are more tolerant of risk, you might invest more.

My philosophy allows me to invest about 5% of my savings in something risky.

Rule #6: Buy supplies in bulk on sale.

When items you use regularly (bath soap, coffee, toothpaste, etc.) go on sale, buy as much as you can. why? Because I bought it when it was on sale and I end up using it and it saves me money in the end.

Additionally, try to buy staple foods in bulk at places like Costco. Staple foods are those used in a variety of meals, such as rice, pasta, potatoes, wheat, eggs, cheese, and dried legumes.

Rule #7: Negotiate using cash

Talking about cash. Cuban recommends using cash to negotiate lower prices. This applies to almost everything, including goods and services. I once purchased a truck for nearly 20% off his asking price using a negotiated cash offer.

When using cash, individuals or merchants do not have to pay credit card processing fees. They also receive their money immediately. The deal is also “off the books” and could tempt some service providers.

Rule #8: Read books

Reading is important to stimulate the mind.Cubans used nonfiction investment book As an example, I recommend reading novels.

In fact, I get more out of fiction than non-fiction because it stimulates my mind in such creative ways. In fiction, the reader follows the story. We make predictions in our heads about what will happen based on what we know about the author and the characters. It’s a great brain teaser.

And fiction teaches us about the human condition. How people interact with other people, and this knowledge helps them succeed in virtually every aspect of life.

Rule #9: “Great work.”

“If you’re kind to those around you, you’ll always get better results,” Cuban said. And he couldn’t be more right. Also, some people want to hang out with friendly people.

The saying “nice people finish last” is nonsense. Kind people finish first.