Inflation slowed more than expected in January, but showed worrying resilience after accounting for volatile food and fuel costs. This is a reminder that controlling price increases remains a difficult process.

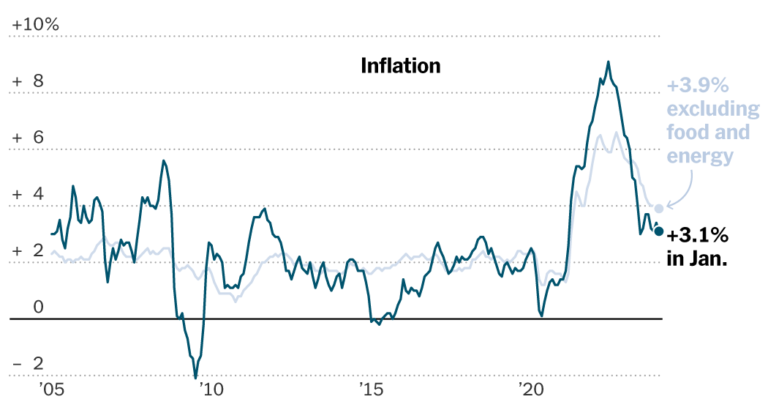

Overall consumer price index The increase was 3.1% compared to the same month last year, down from 3.4% in December but higher than economists’ expectations of 2.9%. This figure is down from the most recent peak of 9.1% in summer 2022.

However, excluding food and fuel, whose prices fluctuate from month to month, “core” prices have remained largely stable over the year, rising 3.9% year-on-year. On a monthly basis, this was the largest increase in the past eight months.

Fed officials have welcomed the recent slowdown in inflation and are likely to take the report as confirmation that they need to remain vigilant. Policymakers have carefully avoided declaring victory over inflation, insisting they need more evidence that inflation is falling sustainably.

Investor has been significantly removed The data has raised the possibility that a rate cut is imminent, with the Fed betting not to cut rates at its next meeting in March and significantly lowering the chances it will cut rates at its next meeting in May. They believe new inflation statistics will alarm officials.

Federal Reserve policymakers raised interest rates to about 5.3% from near zero in early 2022, with the aim of cooling consumer and business demand and dissuading companies from raising prices too quickly. Inflation has fallen markedly in recent months, prompting countries to pause interest rate hikes and consider when and how much to lower borrowing costs.

But they want to avoid cutting rates before inflation has completely subsided. They fear that doing so could make rapid price increases a more permanent feature of the American economy.

“They were right to be patient, because these are the kinds of numbers that raise questions about whether we’re really looking forward to a slowdown in inflation,” said Omile Sharif, founder of Inflation Insights. Stated. “This is definitely an eerie number.”

The slowdown in inflation in recent months is also a welcome development for President Biden. Despite a strong job market and rapidly rising wages, rising costs of living are eating into household budgets and weighing on voter confidence. As price increases begin to ease, people are starting to report a positive economic outlook.

The question for both the administration and the Fed is whether the cooling in inflation of the past six months can be sustained, and the latest inflation report could make officials more wary.

“Does that send a real signal that we are actually on a sustainable path to 2% inflation?” Fed Chairman Jerome H. Powell said in a Jan. 31 press conference. He said this: “That’s the problem.”

The Fed aims for average inflation of 2% using another related measure, the Personal Consumption Expenditure Index. His January reading on that gauge was set for release February 29th.

Inflation is falling for several reasons, but a major driver of the recent improvement has been the recovery in global supply chains. The pandemic-induced disruption of transportation routes and factories led to shortages of semiconductors, automobiles, and furniture, and prices began to soar in 2021.

These problems have gradually been resolved, and commodity prices have recently stabilized and even fallen for some products. For example, used car prices fell significantly in January.

Recently, price increases for major services have also begun to slow down. Economists are now watching closely to see what happens, especially with regard to housing. Official inflation figures show rent growth is starting to slow, but many analysts expect the trend to deepen as new, cheaper rents gradually trickle into official data.

But in that regard, the January report provided cause for alarm. You receive a monthly measure (called owner-equivalent rent) that estimates how much it costs to rent a home that someone owns.

Brelina Ursi, chief U.S. economist at T. Rowe Price, said the acceleration “considers the odds against other surveys of rent data that we monitor.”

Still, the numbers mean the Fed needs to remain cautious and officials are unlikely to cut rates until May or June.

“We really need to make sure that inflationary pressures don’t accelerate again before we cut rates,” Ursi said.