As Insurance fee With insurance rates seemingly rising frequently, it’s no wonder consumers are looking for ways to lower their premiums. Most auto insurance companies offer some sort of discount for safe driving that the insurer will track.

So we were interested in exploring the question Mary raised about the pros and cons of allowing insurance companies to track your driving in exchange for lower premiums.

“State Farm provided me with a ‘tracker’ so they could give me a safe driving discount. Am I providing too much information? I started filling out [out] The app showed me the info but then it stopped. It gives me driving tips and suggestions based on the tracker. What do you think about this type of tracker?” — Mary, St. Louis, Missouri

Most auto insurance companies offer some form of vehicle tracking service in exchange for encouraging safe driving, but the question most drivers have is whether the benefits outweigh potential privacy concerns.

To get security alerts, expert tips, sign up for Kurt’s newsletter – Cyberguy Report here

Woman driving a car (Kurt “Cyberguy” Knutson)

What is a car insurance privacy device?

Progressive first introduced its Drive & Save program, called Snapshot, in 1998, and many other insurers have followed suit. Instead of connecting telematics devices to collect driving data, insurers are using OnStar or apps on drivers’ mobile devices.

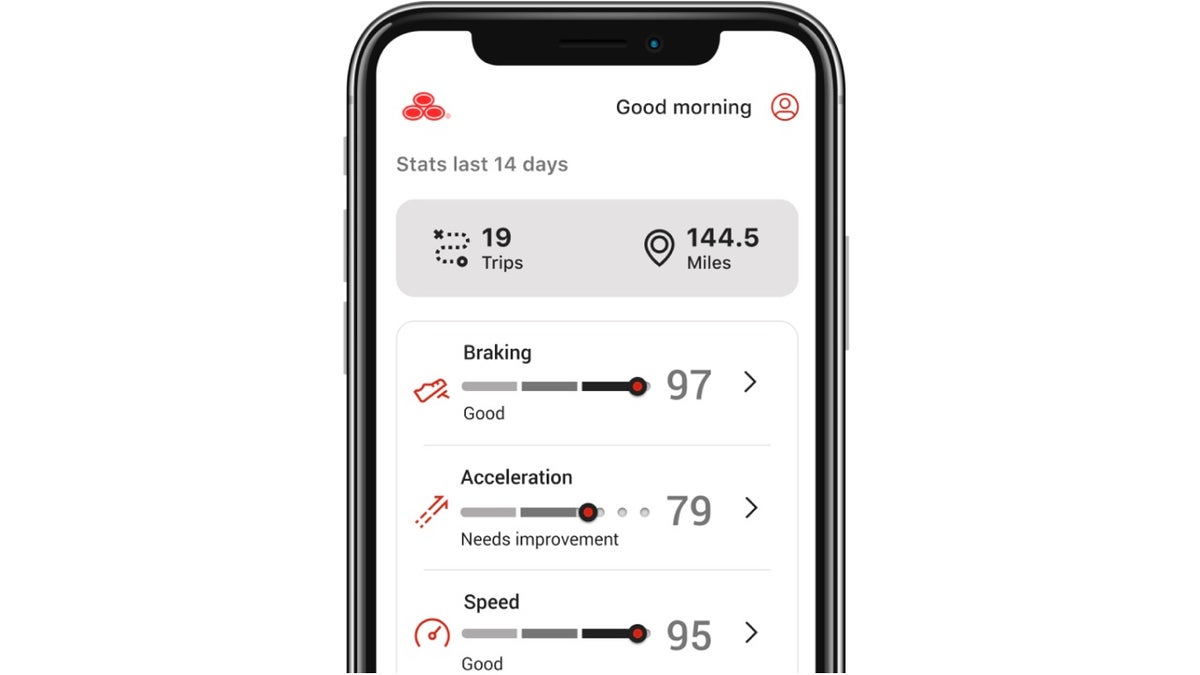

Specifically, with State Farm, you have the option of a mobile app or Bluetooth beacons that work with Drive Safe & Save Connected Cars. State Farm is phasing out OnStar for new subscribers.

It’s important to note that there is not one single metric that all insurance companies collect or use to determine safe driving, so if you’re considering what information is collected and how your driving will be assessed, it’s important to know the details of your particular insurance company.

State Farm Drive Safe & Save App (State Farm)

What your car knows about you and what it might be telling the world

What information is collected?

While the data points that each auto insurance company collects vary, some common types of data collected include (but are not limited to):

- Acceleration rate

- Drive Speed

- Braking Speed

- cornering

- Telephone distraction

- Total distance traveled

How to remove your personal information from the internet

How do usage-based insurance programs work?

Usage-Based Insurance (UBI) programs, also known as telematics or “pay-as-you-drive” insurance, are becoming increasingly popular among large insurance companies as a way to offer customized premiums based on an individual’s driving behavior. These programs typically work as follows:

Registration: Drivers typically join the program in exchange for an initial discount.

Data collection: Your insurance company will provide you with a plug-in device for your car’s OBD-II port or a smartphone app to track your driving.

Monitoring period: Your driving will be monitored for a period of time (usually three to six months).

Data Analysis: Insurance companies analyze the collected data to assess your driving habits.

Premium Adjustment: Your premiums may be adjusted based on the analysis. If you are a safe driver, your premiums will often go down.

Different insurance companies offer different programs with their own unique features.

State Farm’s “Drive Safe & Save”: Some vehicles use Bluetooth beacons or mobile apps with built-in telematics.

Progressive snapshot: It is one of the pioneers of UBI, offering both a plug-in device and a mobile app option.

Allstate Drivewise: It uses a mobile app to track driving behavior and provide rewards.

Geico’s DriveEasy: A mobile app-based program that monitors driving habits.

Liberty Mutual RightTrack: You can choose between a plug-in device or a mobile app.

It’s important to keep in mind that while these programs can result in significant savings for safe drivers, they can also lead to higher premiums for drivers who are considered a higher risk. Additionally, availability and specific features vary by state due to differing insurance regulations.

Before enrolling in a UBI program, carefully review the terms and conditions, paying particular attention to what data will be collected, how it will be used, and how it may affect your premiums in the short and long term.

How to outwit car thieves with smart air tag tactics

What are your concerns?

Privacy isn’t just a question of what information is collected. Many insurance companies have privacy policies that allow them to share your data with third parties. State Farm says it doesn’t sell Drive Safe & Save data, but it does share some information with third parties.

Data sharing related to Drive Safe & Save Accident Assistance is done with driver consent and is intended to improve the customer experience. For example, if you are a driver of a broken-down vehicle, State Farm may share your vehicle’s location with towing companies and police, as appropriate. Additionally, if you are involved in a motor vehicle accident, insurance companies may use your tracking data to assist with claims.

Your idea of safe driving may differ from your insurance company’s. Some drivers have seen their premiums increase after using driving tracking programs. Insurance companies aren’t the only ones with access to your driving information. With State Farm, designated policyholders can view all recorded driving across all devices for the past 30 days.

Click here to read more US news

Illustration of insurance policy and how to review it (Kurt “Cyberguy” Knutson)

Your car may be selling you out to insurance companies

What are the benefits?

While the specific discount amount will vary depending on the insurer and the driver, State Farm, for example, claims that those who sign up for its “Drive Safe & Save” program can initially save 10% by signing up for the program, and can get up to a 30% discount.

Keep in mind that the percentage you save is capped in states like New York where the discount is limited to 30%. The program is not available in states like California, Massachusetts, and Rhode Island. If you don’t drive much and are a safe driver, this is a way to reduce your payments to your car insurance company. It records data about your driving safety, making it a great learning tool to accurately evaluate your driving habits.

Click here to get FOX Business on the go

Illustration of a driver on the road (Kurt “Cyberguy” Knutson)

Important points about the cart

Mary was spot on in stopping to think about the benefits and potential issues of letting your insurance company track your driving. It’s important to weigh these privacy concerns against the potential benefits, such as possible discounts. If you feel uneasy or concerned about the data your insurance company collects and how it uses it, then this program offered by your insurance company may not be right for you. If you are already using a tracker and are concerned, you should contact your insurance company for guidance on how to delete the feature or app and any associated data.

Click here to get the FOX News app

Remember, it’s always important to read and understand the terms and conditions before using an app, especially for apps that collect personal data. It’s your data, and you have the right to know how it’s used.

Do you participate in an insurance tracking program? Do you feel the benefits outweigh your privacy concerns? Let us know below. Cyberguy.com/Contact Us

If you want to receive more of my tech tips and security alerts, subscribe to the free CyberGuy Report newsletter at the link below. Cyberguy.com/Newsletter

Have a question for Kurt or tell us the story you’d like to see featured?

Follow Kurt on his social channels

Answers to the CyberGuy’s most frequently asked questions:

Copyright 2024 CyberGuy.com. All Rights Reserved.