There are some things you can’t do online, like buying gas or eating out at a restaurant. What about the rest?

I created a graph by taking my total sales and subtracting the things I don’t normally buy online.

The same goes for gas and eating out at restaurants.

You can buy groceries online and have them delivered, but most of us don’t order a lot of food online. A package of Omaha steak and Christmas cheese doesn’t add up to a lot of money. Subtract groceries from the total.

The same applies to cars. Most people don’t buy cars online. But I’m sure this will change eventually.

Details of non-store retail sales as a percentage of pre-retail sales

progress

- In 1992, about 9% of sales were online

- Over the next eight years, online sales increased to about 12%.

- Online sales were at 15% for another eight years before the coronavirus recession began, then fell during the recession.

- In the decade from 2010 to 2020, online sales jumped from 15 percent to 26 percent.

- Over the past four years, online sales have jumped more than eight percentage points, from about 26 percent to 34 percent, ignoring the initial COVID-19 surge.

While COVID-19 hasn’t changed the trend toward online shopping, it has certainly accelerated the trend.

Retail sales rose 0.6%, beating economists’ expectations

Economists had expected retail sales to rise 0.4% in December. Instead, consumers started overspending. But two-thirds of that was due to inflation. Real (inflation-adjusted) sales increased by 0.2%.

Real retail sales peaked in April 2022 (yellow highlight).

See below for further discussion and charts. Retail sales rose 0.6%, beating economists’ expectations

And how do consumers pay for this? I think you know the answer.

Driven by debt

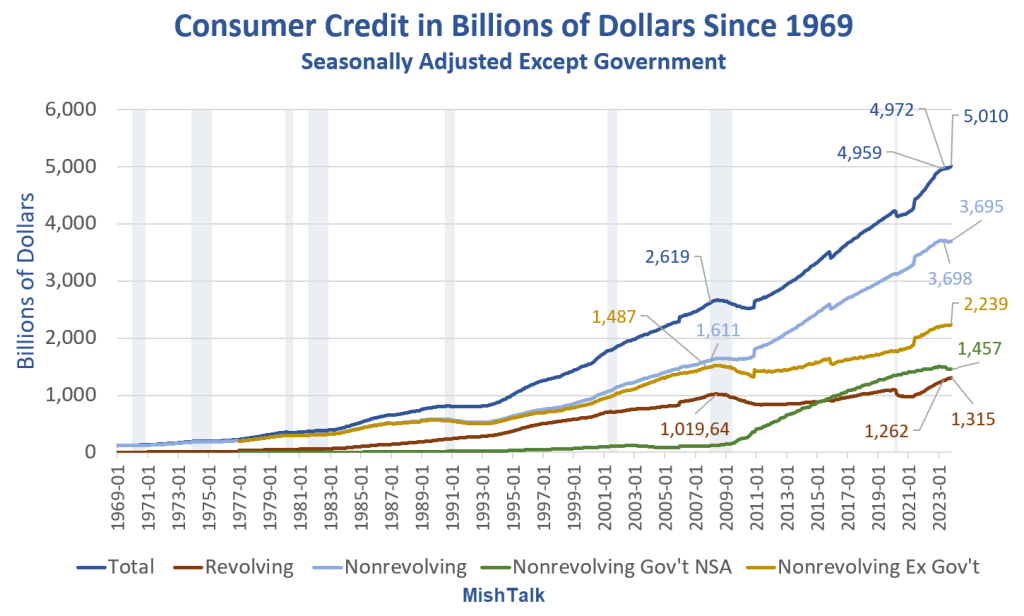

Consumer credit, revolving credit payments, and total interest rates on credit cards all hit record highs in November.

Consumer credit reaches record high of $5 trillion

To explain the apparent strength in retail sales, note the following: Consumer credit reaches an all-time high of $5 trillion, and credit card interest rates hit an all-time high

Revolving debt payments (mainly credit card debt) are at an all-time high. Click on the link above for a discussion including the calculation of inflation-adjusted real debt.