The housing market was rocky last week. Yields on 10-year bonds rose significantly, pushing mortgage rates to nearly 7% in the middle of the spring selling season. New listing data decreased, but available inventory increased. Buying apps also posted negative weekly results, continuing his 2023 theme that rising interest rates will impact the data.

Here’s a quick recap of last week:

- Total number of active listings increased 3,809 Week after week, the number of new listings is still at record lows.

- Mortgage rates rose last week, starting the week at 6.55% but ending at 6.90%.

- Purchase requisitions data fell 4.8% weekly as interest rates continue to rise affecting weekly data.

weekly housing inventory

They say slow and steady win the race. Well, in terms of housing inventory in 2023, this spring has been very weak. How slow are your active listings growing? Here are my crazy stats for the week:At this time last year, the weekly available inventory was 25,542 in just one week.This year, from the bottom of the season, the total increases only slightly 18,722.

Who can say it’s terribly unhealthy? I never dreamed, I never thought this would happen so close to June.

- Weekly inventory fluctuation (May 5-12): In stock 420,381 To 424,190

- Same week of the previous year (May 6-13): In stock 312,857 To 338,399

- 2022 stock bottom price 240,194

- So far, the peak in 2023 is 472,680

- For context, see this week’s active list. 2015 it was 1,108,932

according to Altos Research, the year-on-year decline is very pronounced, as new listings data fell last week and hovered at record lows throughout the year. However, this time last year saw an increase in new listings compared to 2021 levels. In the second half of 2022, new listings began to trend negative as mortgage rates soared toward 7.37% and some people gave up listing their homes because interest rates were too high.

Here’s this week’s new listing data for the last few years:

- 2023: 59,651

- 2022: 84,298

- 2021: 76,051

And this is new listing data for the same week of a more normal year to provide a historical perspective.

- 2017: 89,411

- 2016: 90,048

- 2015: 90,323

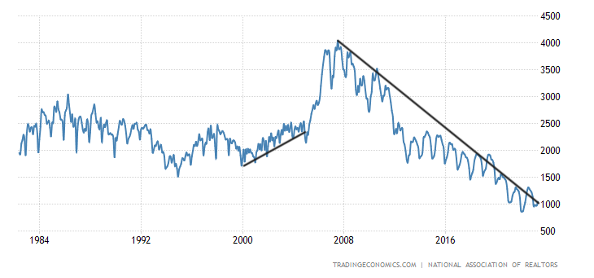

of NAR data It goes back several decades and shows how difficult it was to bring the total active listed stocks back into the historical range. 2000000 To 2.5 million.According to the latest existing home sales report I wrote here, year-on-year growth is 1.03 million To 1.04 million.

NAR: Total Inventory:

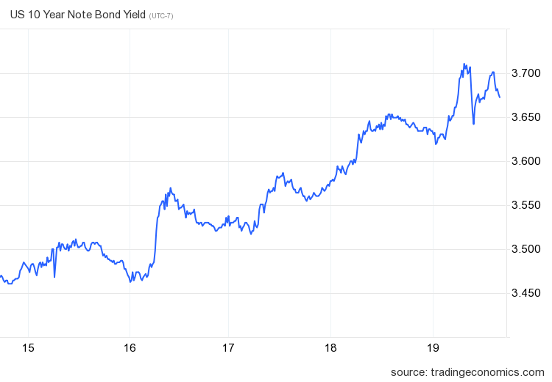

10-Year Yield and Mortgage Interest RatesS

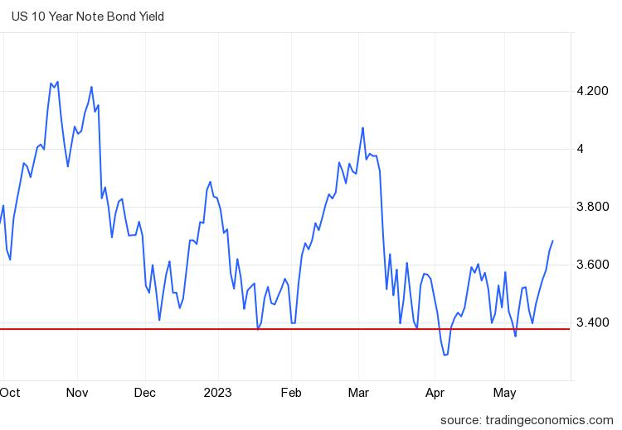

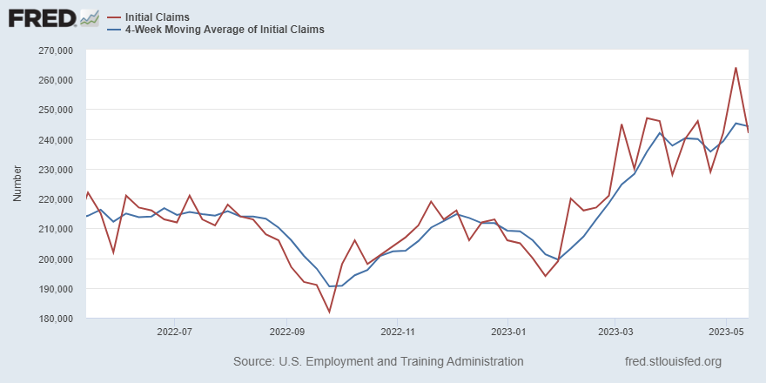

Mortgage rates rose in an unusual week for 10-year bond yields.There are many drama topics debt ceiling problemHowever, unemployment claims were a good report, reversing from last week’s sharp decline.

When I talk about mortgage rates, it’s really about what the 10-year yield feels like that year. Our forecast for 2023 said that if the economy held up, the range of 10-year bond yields should be: 3.21% and 4.25%be equivalent to 5.75% To 7.25% mortgage interest rate.

Now, if the economy weakens, meaning the labor market sees a notable increase in unemployment claims, the 10-year bond yield should fall. 3.21%go all the way 2.72%. This will make mortgage rates even lower 6%If spreads return to normal, they could go even lower Five% Mortgage interest rates again.

On that note, however, unemployment claims had a strong week. they fell This is a positive rather than a negative sign for the labor market.

From the St. Louis Fed: “First-time claims for unemployment insurance benefits fell by 22,000 to 242,000 in the week ending May 13, with a four-week moving average of 244,250.”

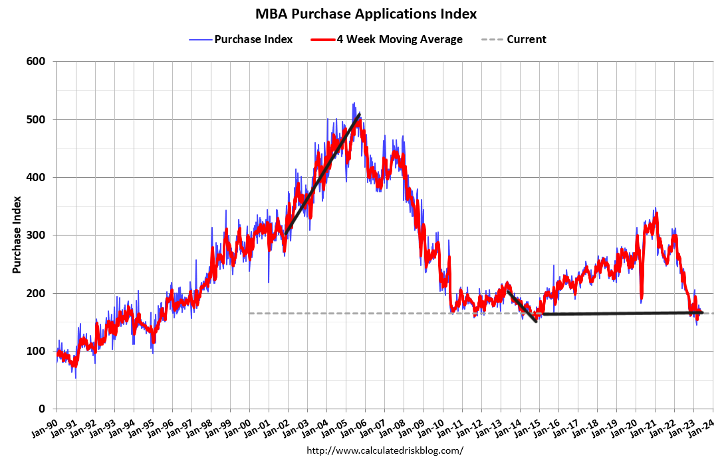

Purchase application data

The housing market changed significantly when mortgage rates peaked at the end of the year and began to decline. During that time, demand was stable, with more positive printouts than negative printouts on purchase requisitions. As you can see below, the buying app waterfall dive stopped as interest rates fell.

That being said, however, rising interest rates had a negative impact on the weekly data, with purchase apps declining last week. 4.8%. Negative claims data are likely this week as mortgage rates climb to nearly 7%.

When mortgage rates rise 5.99%-7.10% Earlier this year, we had three weeks of negative data. Then the data line improved as interest rates dropped. Traditionally, the total amount he peaks in May, and seasonality begins for the rest of the season. My focus is on the second half of 2023. If mortgage rates drop significantly, we could see another surge in demand at the end of the year like we’ve seen over the past three years.

next week

we’re getting closer and closer to some things short term solution There’s also the debt ceiling issue, but this week could be even more tumultuous.The debt ceiling problem is a wild card market activity This week, with or without a resolution, will either be focused on completion or postponed until September. Markets will focus more on that than economic data this week.

But there are some key economic reports this week, including new home sales, pending home sales, and Friday’s consumer spending inflation data that the Fed wants to get closer to 2%. The world prefers to pay more attention to CPI inflation data, but 2% of core PCE is the Fed’s target level.

Markets know that inflation growth peaked last year, but they are trying to determine when the economic expansion and the next job-loss recession will begin. This is why I make a point of following unemployment claims every week. The default debacle could lead to a chaotic week for bond yields, which could turn upside down any minute, so keep an eye on the 10-year yield.

For this reason, caution should be exercised in making statements about long-term changes in data during this week of political factors. Once this drama story is over, we can focus on real economic data.