In times like these, double down on your skills, knowledge and yourself. On August 8-10 he’ll be at Inman Connect Las Vegas to lean into your shift and learn from the best. Get your tickets now at the lowest price.

After selling its correspondent finance business and laying off hundreds of employees last year, Homepoint is exiting mortgage origination altogether by selling its wholesale loan business to rival The Loan Store Inc. are planning to

Mark Lefanowitz

but, announcement Parent company Home Point Capital Inc. also acquired a stake in The Loan Store in a deal Friday, saying Homepoint executive Phil Shoemaker will become The Loan Store’s new chief executive officer. The Loan Store’s current CEO, Mark Lefanowicz, will serve as chairman of the company’s board of directors.

Phil Shoemaker

“We are proud of what we have achieved with Homepoint and are grateful for the experience,” said Shoemaker, Homepoint’s president of origination, in a statement. “We look forward to the next chapter of The Loan Store, where we will continue to make a positive impact within the wholesale lending community.”

Terms of the sale were not announced. However, if the transaction closes as expected by the end of the second quarter, The Loan Store’s goal is to become one of the nation’s leading providers of “aggressively priced” conventional, jumbo, VA and non-QM loans. Its goal of becoming a wholesale mortgage lender will go further, the company said. .

Homepoint was still the third-largest wholesale lender by origination volume last year, despite a 68% plunge in wholesale originations to $22.39 billion, according to Inside Mortgage Finance.

Brandon Stein

Brandon Stein, president of The Loan Store, said in a statement: “Combining that with Phil Shoemaker’s visionary leadership and acclaimed sales and operations team, The Loan Store is well-positioned to sustainably grow our business.”

Homepoint said it will continue to manage mortgage servicing rights on a portfolio of more than 300,000 loans with an outstanding principal balance of $89.28 billion as of December 31.

Homepoint shares have traded between 99 cents and $4.65 last year. It had occurred 20% close at $2.07 in Thursday’s light trade. The market was closed after the Good Friday trade announcement.

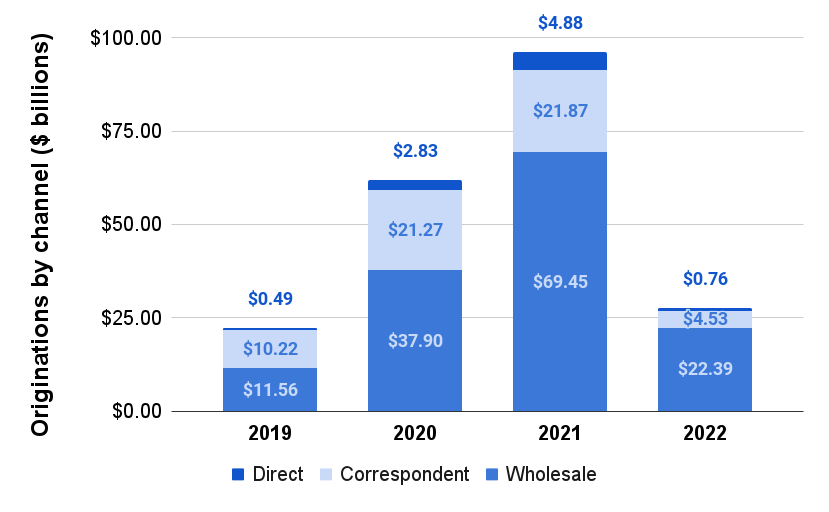

Home Point Mortgage Arrangements 2019-2022

HomePoint Mortgage Composition by Channel 2019-2022 (Wholesale, Correspondent, Direct) | Source: HomePoint Capital Annual report

Founded in 2015 and headquartered in Ann Arbor, Michigan, Homepoint until recently originated mortgages through three channels: wholesale, correspondent and direct.

As of December 31, more than 9,259 mortgage brokerage partners have originated HomePoint-funded loans through wholesale channels. When interest rates plummeted during the pandemic, Homepoint was able to increase its wholesale loan originations by 228% in 2020 and another 83% in 2021. , to a peak of $ 69.45 billion.

But when mortgage rates soared last year, Homepoint’s wholesale loan originations faltered, forcing the company to scale back. With other lenders also taking a toll on business, Homepoint gained 6.6% market share in its wholesale channel last year, up from 1.6% in 2017, according to Inside Mortgage Finance.

Although Homepoint’s primary method of structuring loans is through its wholesale channel, until last year it had been closed and funded by a network of correspondent lenders (mainly small and medium-sized independent mortgage banks, builder affiliates and financial institutions). I also purchased a prepaid mortgage.

In 2019, Homepoint’s correspondent channel accounted for nearly half (46%) of the company’s loan volume.

But Homepoint exited the correspondent business last year, selling its correspondent lending channel (and subsidiary Homepoint Asset Management LLC) to rival Planet Home Lending LLC.the deal is announced It closed in April last year and will close on June 1, 2022.

Planet Home Lending made a cash payment of $2.5 million to Homepoint’s correspondent lending business, with an additional $900,000 in 2022 earn-out income, according to an update from Home Point Capital. Annual Report to InvestorsPlanet Home Lending will continue to make earnout payments to Homepoints based on origination volume through June 1, 2024.

A third avenue for Homepoint to originate mortgages was a direct channel to refinance borrowers who had already made payments on homepoint-served mortgages. Direct originations saw him plummet to $758 million last year after peaking at $4.88 billion in 2021.

Homepoint Service Portfolio 2019-2022

At the end of 2022, Homepoint had servicing rights to collect payments on 317,000 mortgages, with outstanding balances down 33% from 2021 to a total of $89.28 billion .

Short on cash at the end of the year, Homepoint sold its Ginnie Mae servicing rights for about $6 billion in the fourth quarter for a total of $87.8 million.

However, Loan Servicing continues to “generate significant profits and cash flows over time,” the firm said Friday, announcing its exit from wholesale lending.

In reporting 2022 net loss of $163.7 million On March 9, Homepoint said its lending services were net positive, generating $277.5 million in revenue, adding $121.8 million to the company’s net income after deducting fixed costs.

Last year, Home Point was agreement Serves as a subservicer with ServiceMac LLC, a subsidiary of First American Financial Corporation. ServiceMac has been collecting payments from borrowers on Homepoint’s behalf since his second quarter of 2022, but Homepoint retains the underlying mortgage his servicing rights.

By hiring ServiceMac as a sub-servicer and retaining servicing rights, Homepoint “maintains a lower, more variable cost structure and provides greater flexibility in strategically selling certain non-core MSRs.” You can,” the company said.

Get Inman’s Extra Credit newsletter delivered directly to your inbox. A weekly roundup of the world’s biggest mortgage and financial news, delivered every Wednesday. Click here to subscribe.

Email Matt Carter