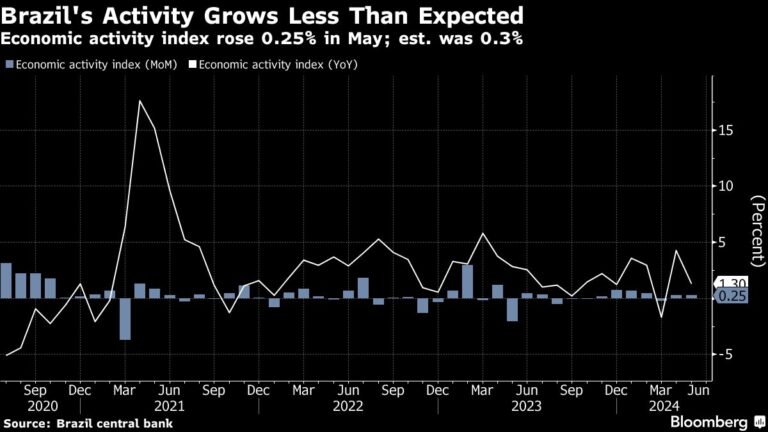

(Bloomberg) — Brazil’s economy grew slightly less than expected in May, according to a key economic indicator from the central bank, but the previous figure was revised upward, in a sign that borrowing costs could remain high for a long time.

Most read articles on Bloomberg

The bank’s index of economic activity, a proxy for gross domestic product, rose 0.25% from April, below the 0.3% median forecast of analysts surveyed by Bloomberg. Still, monthly growth in April was revised up to 0.26% from 0.01%, according to data released on Monday. Year-on-year growth was up 1.3%, the report added.

Growth forecasts for China, Latin America’s largest economy, have been trending higher in recent months as policymakers led by Roberto Campos Neto left interest rates unchanged at 10.5% in June, pausing an easing cycle that had lasted nearly a year. A separate report published on Monday said most analysts do not expect rates to be cut again this year, and project the benchmark Selic rate to hit 9.5% by the end of 2025.

The central bank is closely monitoring the pace of growth amid signs of a recovery. Retail sales surged in May and services also beat expectations in the month, but the labor market remains tight.

“The figures support our forecast for economic growth to exceed 2 percent this year,” said Lais Carvalho, an economist at BNP Paribas. The May data and April’s upward revision suggest the economic impact of record flooding in the country’s south is fading. “Improved numbers for retail sales, industrial production and services all point to a more positive outlook,” he said.

Annual inflation rose more slowly than expected in June as price pressures from severe flooding in the south eased. Most analysts now expect cost-of-living growth to exceed the 3% target for now, to 4% in 2024 and 3.9% in 2025.

Brazilian President Luiz Inacio Lula da Silva, who is seeking to stimulate the economy through public spending, has slammed the central bank’s decision to keep borrowing costs high. Lula is due to select a new governor and two new central bank directors this year, potentially paving the way for him to have greater influence on the board.

Still, Finance Minister Fernando Haddad said on Friday that President Lula’s anger at the central bank had subsided.

–With assistance from Giovanna Serafim.

(Adds economist comment in fifth paragraph)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP