The Thai Futu family in Phuket, Thailand.

didi taifutu

Lagos, Portugal — In Lagos, a small coastal town in the heart of the Algarve region of southern Portugal, Didi Taihutu spends most of his days on the roof of his villa. This holiday home is an unpretentious home with rustic charm perched on a hill sloping from the Atlantic Ocean. The Mediterranean sun reflects off the house’s bright white stucco walls, illuminates the orange terracotta roof, and illuminates Taihutu, who sits on a plastic chair under a round table from the same manufacturer.Patriarch of the Netherlands Bitcoin The family drinks black coffee, watches cryptocurrency price charts on their MacBook Pros, and decides which trade to start the day with.

“We only need a few thousand dollars a month to live, so our performance is not that important to us,” says Taihutu, referring to cobalt-colored seas, cliff-backed beaches and bougainvillea. told CNBC from a sprawling deck.

Taifutu’s family home in Lagos, Portugal.

Mackenzie Cigaros

Taihutu’s understated demeanor and low-key surroundings belie the 45-year-old’s success. In 2017, Taihutu, along with his wife and three children, liquidated all his assets, trading his 2,500-square-foot home and most of his ground possessions for bitcoin and life on the streets. This was back when the price of Bitcoin was around $900. Bitcoin is currently trading above $30,000, down from its all-time high of nearly $70,000 in November 2021.

Such extreme price volatility has helped grow the Dutch family’s crypto egg.

For seven years, investors have regularly traded Bitcoin for US dollar-pegged stablecoins to take advantage of the price volatility of the world’s largest cryptocurrency. Taihuttu trades Bitcoin for stablecoins such as Tether, USDC and DAI when he believes Bitcoin is at the peak of its bull market. When Bitcoin appears to be hitting a bear market cycle low, he begins to buy back Bitcoin. Thai Futu says the gamble has paid off so far thanks to a market indicator he created himself called Didi BAM BAM.

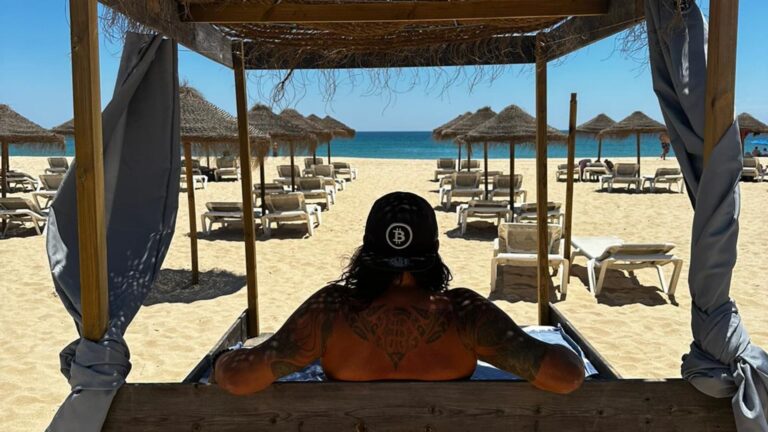

Didi Taifutu from Lagos, Portugal.

Mackenzie Cigaros

Taihuttu’s indicator considers a combination of inputs such as directional trading data and lunar cycles. It has guided all of his investment decisions since Tai Fu Thu founded it before the COVID-19 pandemic.

“From mid-November to early December 2022, we saw the first signs that the bear market was completely over,” Taiftu said. “Confirmed with the arrival of the Long Flag on the model in January 2023.”

“People should already be buying bitcoin,” he added.

The father of three says his Bitcoin investment is up about 50% from the bottom of the recent bear market.

Taihuttus has refused to share its current cryptocurrency investment total with CNBC. However, Thai Hutu revealed that it had completely bought back bitcoin before it crossed the price threshold of $19,000, which is “not that bad.”

It also helps that this nomadic family is domiciled in Portugal, Europe’s ultimate cryptocurrency tax haven.

“We don’t pay capital gains tax or anything else on cryptocurrencies in Portugal,” Taihutu said. “As long as you don’t earn cryptocurrency by providing services in Portugal, you should be fine.”

“It’s such a beautiful bitcoin heaven,” he said.

Didi Taifutu from Lagos, Portugal.

didi taifutu

How the BAM BAM indicator works

When Taihuttu started day-trading tokens, he first turned to traditional predictive indicators such as stock-to-flow models and Mayer multiples. The Mayer Multiple, calculated by dividing the current price of Bitcoin by the He 200-day moving average, is an indicator that helps identify bubble moments. When the value of an asset exceeds its intrinsic value in the market.

But spending time reading all of these somehow relevant indicators didn’t seem like a particularly productive use of his time, so Taihutu created his own blend of the best indicators on the market. I decided to.

“It’s not enough to know which metrics go into the formula,” Taihuttu explained. “What you can’t see is the calculations and code that are performed based on the stock conditions. Those calculations are displayed on the chart.”

Beginning in 2019, Taihuttu began developing and perfecting a custom-built predictive trading tool that evaluates multiple technical indicators and astrology with a touch of spitting out real-time insights on potential price movements.

”It is a combination of Bollinger Bands, Lower and Upper Bands, NMA, Red/Green Ribbon, Norm Stock, RSI, Price Oscillator, Plot, MACD, Cross, Chande Momentum Oscillator, RSI-EMA, Full Moon and New Moon,” Taihuttu said. explained Mr. He lists 12 of the most popular market signals that crypto traders look to when making investment decisions.

“Short signals, long signals, and confirmation signals appear on the chart when it might be the perfect time to buy or sell,” Taifutu continued.

The Taihutu family from Lagos, Portugal.

Mackenzie Cigaros

A brief breakdown of the technology underlying the model is as follows:

- bollinger bands Focus on price changes over time. The model consists of a simple moving average line and two standard deviation lines. upper and lower bands. Price movements outside these outer bands can indicate whether an asset is oversold or vice versa.

- N-day moving average A type of moving average that averages the closing price of an asset over a variable period or ‘N’ days.

- red/green ribbon The indicator represents bullish market conditions (green) and bearish market conditions (red).

- of Normalized Stochastic (NormStoch) Look at the price momentum.that A variation of the Stochastic Oscillator, it is an indicator that compares the closing price of an asset with its price movements over a specified time period.

- Like Bollinger Bands, relative strength index Assess whether an asset is oversold or overbought. The index ranges from 0 to 100 and measures the speed and magnitude of an asset’s recent price movements.

- Moving Average Convergence Divergence (MACD) Compare two moving averages of cryptocurrency prices with 26 periods subtracted. Exponential Moving Average (EMA) From the 12 period EMA.

- of Percentage Price Oscillator (PPO) Take the MACD reading and divide it by the 26 period EMA. Expressed as a percentage, he can compare his PPO measurements for different assets with large price differences.

- In Bitcoin, when the 50-day moving average rises above the rising 200-day moving average, it is read as a bullish indicator. golden cross. When the 50-day moving average falls below the falling 200-day moving average, this death clothwhich may suggest that a bear market is imminent.

- Chande Momentum Oscillator is a technical momentum indicator similar to the Relative Strength Index and Stochastic Oscillator, except that it reacts faster to price changes.

- As the name suggests, Relative Strength Index – Exponential Moving Average Combine both metrics into a single metric.

Didi BAM price chart showing the BAM market indicator.

didi taifutu

Then there are intangible price influencers such as the moon phase.

“I can’t say that it will always affect the price of Bitcoin, but the moon does have a big impact,” said Thai Futu.

Taihuttu found that people tend to trade more during a full or half moon.

“They tend to buy more, they tend to sell more,” he says. “Maybe it’s a coincidence, but when you look at the graph, you’ll see that it dumps or pumps, mostly at full moons, depending on where you are in the cycle.”

Taihuttu added that moon phases are also usually synchronized with the opening and closing of Bitcoin’s monthly puts and options.

“If you are at the top of the Bollinger Bands in conjunction with a full moon, you will know we are going down,” Taihutu continued, suggesting a market downturn was imminent.

Lose dominance to ChatGPT

Taihuttu, who used to sell the Didi BAM BAM indicator to traders, said he will soon distribute the trading tool to selected Bitcoin evangelists to encourage adoption.

But he also admits that his business model is disappearing.

“Anyone in the world can go to ChatGPT and say, ‘Write a moving average and an indicator based on this or that cycle, and write a script that can be implemented in TradingView. You can create an indicator for ‘,’ explained Taiftu.

“Business is lost there.”

Thailand’s “Bitcoin Family”.

didi taifutu

Generative artificial intelligence is a specialized form of AI that can create content from scratch. The system takes input from users and feeds it into powerful algorithms that leverage large datasets to generate new text, images and videos in a near human-like way.

AI has gained a lot of attention following its widespread public adoption. OpenAI’s GPT language processing technology. ChatGPT, which uses a large language model to create human-like responses to questions, has sparked an arms race among some companies over what is seen as the next “paradigm shift” in technology. .

ChatGPT cannot provide the questioner with a trading algorithm in TradingView’s programming language, Pine Script, but the technology challenges the role of an investment advisor.

Goldman Sachs chief information officer Marco Argenti told CNBC in March that the bank is experimenting with generative AI tools internally to help developers automatically generate and test code. said.

Most recently, in May, Goldman spun off its first startup from the bank’s internal incubator. The company is an AI-powered corporate social media company. Louisa. The AI effort is part of a larger effort by CEO David Solomon to accelerate the bank’s digital transformation.

Morgan Stanley, on the other hand, uses it to notify its financial advisors when they have inquiries. So far, the bank aims to help about 16,000 advisors leverage Morgan Stanley’s research and data repository, according to Jeff McMillan, head of analytics and data at the bank. So far, they are testing a chatbot using OpenAI with 300 advisors. The company’s wealth management department.

Taihuttu himself uses ChatGPT, but more so for writing articles on subjects like Bitcoin and the Lightning Network. But while it’s a productivity hack, he points out that the results don’t necessarily rank high in search results.

“They would still find out it was ChatGPT,” he says. “Still, it saves us a lot of time.”

— CNBC’s Ryan Browne contributed to this report.