-

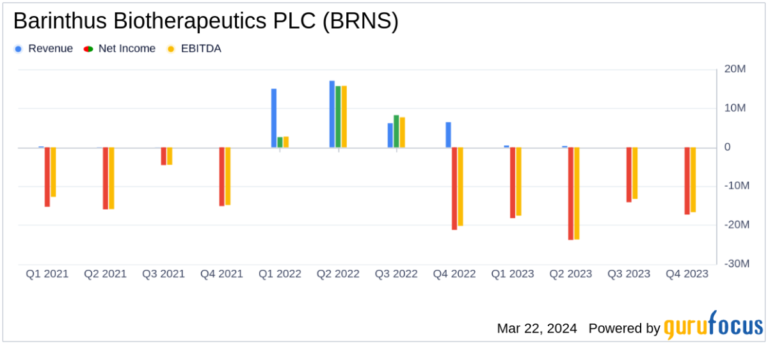

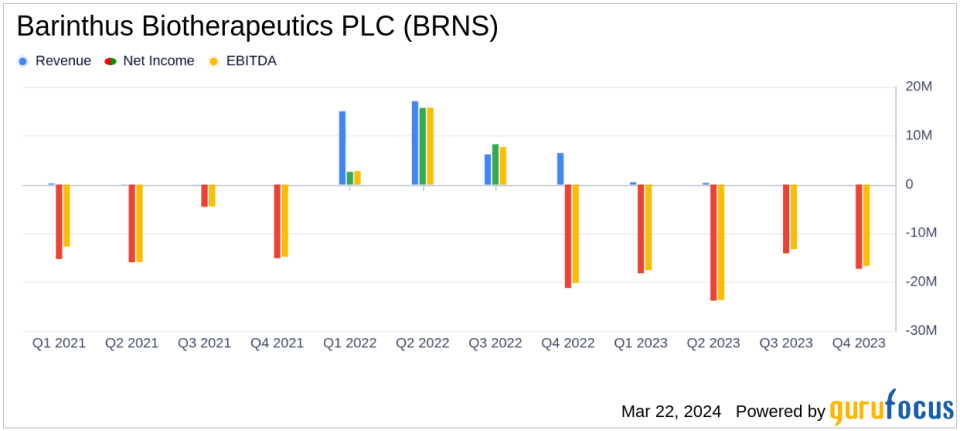

revenue: Decrease from $44.7 million in 2022 to $800,000 in 2023, mainly due to decreased sales of Vaxzevria.

-

net loss: Net income of $73.3 million ($1.91 per share), a reversal from the prior year’s net income of $5.3 million ($0.14 per share).

-

cash position: Decrease from $194.4 million at the end of 2022 to $142.1 million at the end of 2023.

-

Research and development expenses: Increased slightly to $44.9 million, reflecting ongoing clinical trials and pipeline development.

-

General and administrative expenses: A significant increase of $39.8 million was mainly due to foreign exchange losses.

Balinsus Biotherapeutics PLC (NASDAQ:BRNS) has been released 8-K filing A clinical-stage biopharmaceutical company known for its innovative T-cell immunotherapy candidates to tackle chronic infections, autoimmunity, and cancer was facing challenging financial conditions. Year. Despite these obstacles, the company has made significant progress in its research and development (R&D) efforts, highlighting its commitment to advancing its clinical pipeline.

Revenues were down significantly in 2023, with Balinsus Bio’s revenue coming in at just $800,000 compared to $44.7 million the previous year. This decline was primarily due to lower sales of Vaxebria from AstraZeneca, from which Balinsus Bio receives royalties. The company’s net loss widened significantly to $73.3 million ($1.91 per share), a reversal from the $5.3 million ($0.14 per share) net income reported in 2022. This financial deterioration was further exacerbated by the company’s cash position decreasing to $142.1. This was down from $194.4 million at the end of 2022.

Operational highlights and future prospects

Despite the financial setback, Balinsus Bio achieved several important milestones in its clinical development program. Notably, the company reported positive data from its HBV and HPV programs, began first patient visits in its prostate cancer program, and received up to 3,500 future orders from the Coalition for Epidemic Preparedness Innovations (CEPI) for its MERS program. The company secured funding of $1,000,000. These developments reflect the company’s strong research and development capabilities and potential to deliver innovative treatments for serious diseases.

Barinthus Bio expects 2024 to be a data-rich year, with final results from the Phase 1b/2 HPV APOLLO study and additions from an ongoing Phase 2 study in chronic HBV infection. Data is expected. The company’s SNAP-TI platform is also expected to enter the clinic for the first time in a Phase 1 trial in celiac disease, highlighting its diverse and promising pipeline.

Balinsus Bio’s 2023 financial performance highlights the volatile nature of the biopharmaceutical industry, where significant R&D investments are essential for long-term success. Despite declining revenues and increasing net losses, the company is poised for future growth with continued advances in its clinical programs and strategic financing arrangements. As Barinthus Bio advances its pipeline and addresses future challenges, it remains a company to watch for investors and stakeholders interested in the biotechnology space.

See the full 8-K earnings release (hereFor more information, please see the documentation from Barinthus Biotherapeutics PLC.

This article was first published on guru focus.