Indicating a more positive trend for consumers, data released this week by Kelley Blue Book show that November marked the third consecutive month in which new-vehicle average transaction prices were lower year over year. KBB said that the past three months mark the only time in the past decade that the monthly new-vehicle average prices did not increase year-over-year.

In fact, the average price for a new vehicle in November was up to $48,247, but that figure reflects an increase of less than 1 percent on a month-over-month basis, according to data released from KBB.

For electric vehicles, the prices rose slightly in November to $52,345, up from a revised $51,715 in October. On the other hand, EV incentives reached their highest point of 2023 at 8.9 percent of the average price; a year ago, EV incentives were less than 2 percent of ATP.

“In recent months, price parity between EVs and ICE has almost seemed possible,” added Stephanie Valdez-Streaty, director of Strategic Planning at Cox Automotive. “It is a complicated measure with plenty of variables, but newer products and higher discounts have brought down average EV prices, even before potential tax incentives. A year ago, the EV premium was more than 30 percent. Today, it’s less than 10 percent.”

The across-the-board application of discounting and incentives and rebates reduced the average manufacturer’s suggested retail price (MSRP) on vehicles to 98.3 percent in November, the lowest level since April 2021. That said, the average MSRPs increased nearly 1 percent from a year ago.

After retreating slightly in October, incentives increased further in November, reaching a new high for 2023 of 5.2 percent of the transaction price, and climbing above five percent of ATP for the first time in more than two years. Only a year ago, the average incentive package was 2.2 percent.

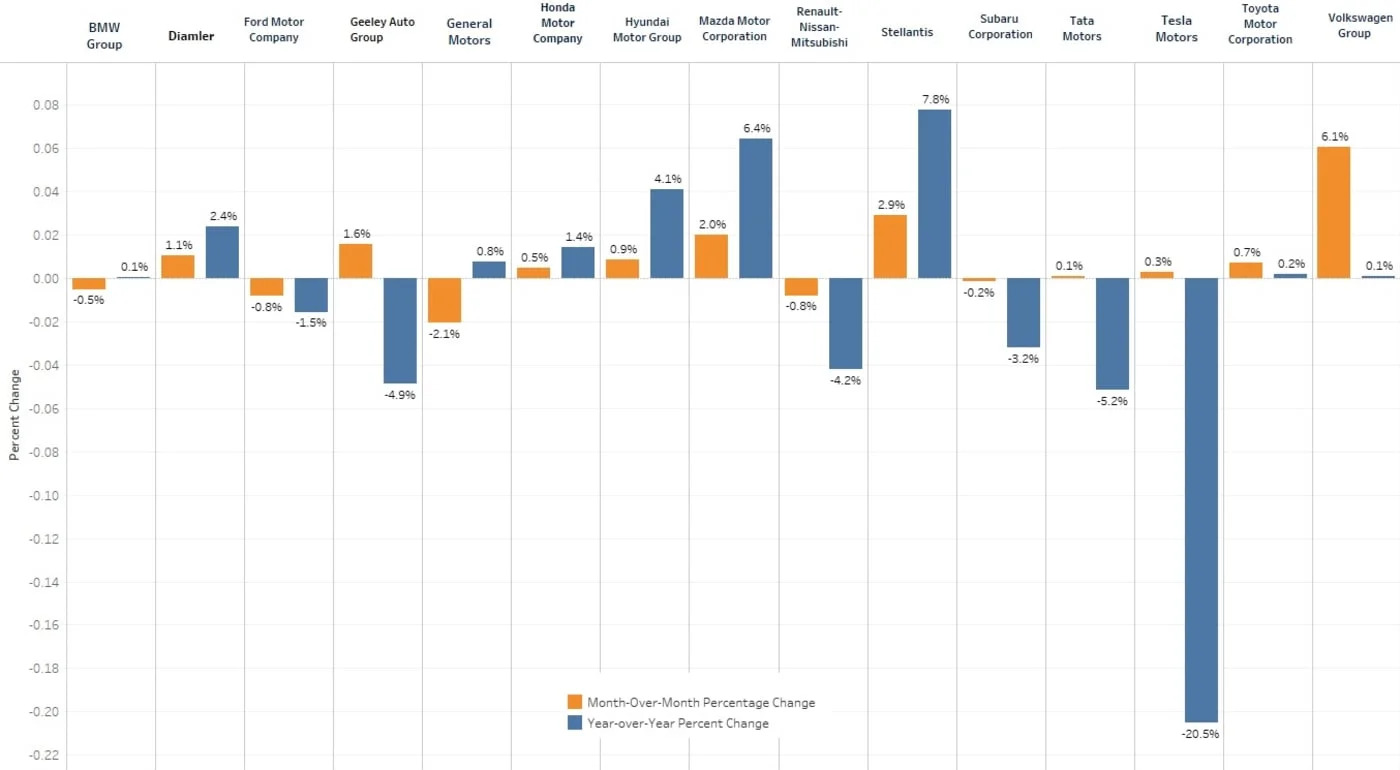

Of the 35 brands that KBB included in its November analysis, 16 had year-over-year price declines in November, with the largest declines recorded for Tesla (-20.5 percent), Buick (-6.4), Land Rover (-6.0) and Nissan (-5.7). The largest year-over-year transaction-price increases came from Dodge (+11.2 percent), Ram (+10.5), Audi (+7.8) and GMC (+7.8).

The sizzling luxury market last month posted an 8.4 percent year-over-year increase in sales, with sales jumping 19.6 percent year over year. In fact, luxury share of the U.S. market was above 20 percent for the first time on record, according to the Kelley Blue Book data.

Chalk up increased sales in that segment to a decrease in the average price of 7.5 percent year over year, thanks in part to an increase in inventory. The average price paid for a luxury vehicle in November was $63,235.

Luxury brand incentives averaged 5.8 percent of ATP in November, up from 4.6 percent in October and 5.4 percent in September. Tesla, Buick, Land Rover, Volvo and Acura had the largest ATP declines last month among luxury brands in the Kelley Blue Book database.