Massimo Giacchetti/iStock Editorial (Getty Images)

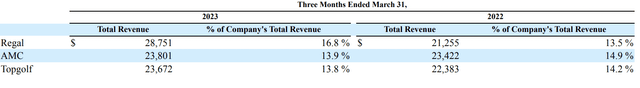

Missing EPR property (New York Stock Exchange: EPR) after a holding period of over 3 years that began at the start of the pandemic.It’s been a wild ride and the total return since then has been material. my first article. Covid-19 hit EPR Properties a strong buyexplains why the fear zeitgeist over the novel coronavirus has gone too far, and while this has proven to be true, the pandemic is likely to ultimately fuel the restructuring of Regal Cinemas and derail AMC Entertainment, now one of EPR’s biggest tenants.AMC). AMC’s responsibility is serious and the situation is dire. 13.9% Percentage of EPR rental income as of the end of Q1 FY2023.

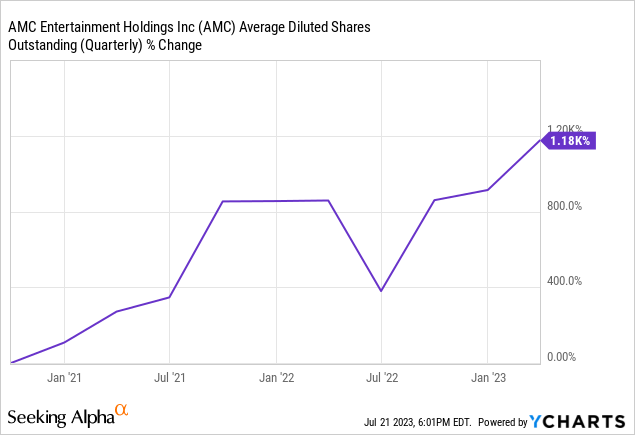

what changed? AMC has relied heavily on dilution to remain a going concern.America’s largest movie theater chain has increased its weighted shares outstanding by more than 1,000% in the last three years. AMC hit a cap on the number of shares it could issue and faced fierce opposition from a broad class of individual shareholders calling themselves “apes” to increase the limit. AMC has attempted to issue more common stock via a convertible preferred stock backdoor that is not subject to the cap.This was an objection from a shareholder lawsuit whose reconciliation was just right Delaware Judge Dismisses in Surprise Ruling. It would be arguable to say that theater chains essentially help fund rents to EPR by the most dramatic dilution of the private investor pool.

Ape Dilution Ends, Future Rent Payments Uncertain

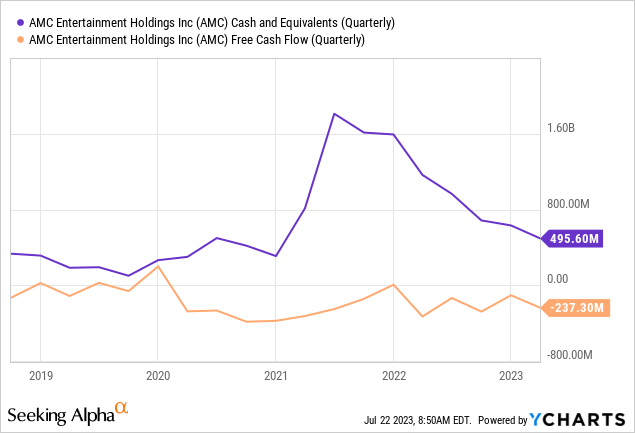

Just to be clear here, AMC does not intend to submit Chapter 11 next week. The company had $495.6 million in cash and equivalents at the end of the first quarter of fiscal year 2023. However, it was plagued with $4.86 billion of long-term debt and $237.3 million of free cash outflow. Additionally, the first quarter benefited greatly from cinema, boosted by Avatar: The Way of the Water, one of the top three highest-grossing films of all time. It also included several big-ticket releases, such as Ant-Man & the Wasp: Quantumania. AMC still lost a significant amount of cash despite a 35% year-over-year increase in the number of releases in the quarter.

EPR Properties Q1 2023 Form 10-Q

AMC faced interest expense of $90.7 million in the first quarter, up 10.6% year over year. And while AMC bulls will warn that the current Babenheimer hype is the kind of viral dynamism that puts theaters at the forefront of the post-pandemic entertainment world, the summer box office has fallen short of expectations. His two high-profile releases, Indiana Jones and the Dial of Fate and The Flash, were blunders. Therefore, the current negative viscosity of AMC free cash outflows is unlikely to ease, mainly as fluctuating debt balances move as the Fed Funds rate is raised to its highest level in more than a decade and is set to be raised by another 25 basis points at the upcoming FOMC meeting on July 26th.

Possibly 2nd of EPR’s top 3 tenants to apply for Chapter 11

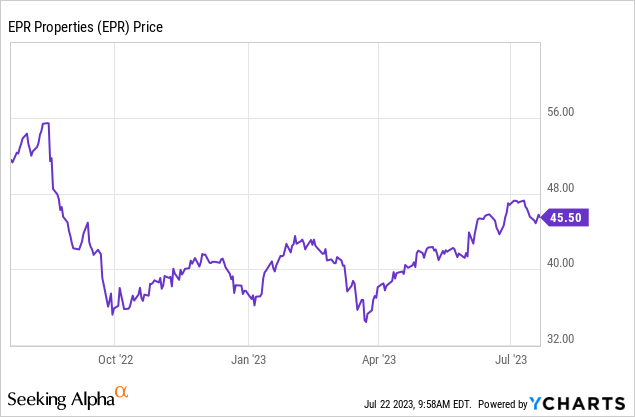

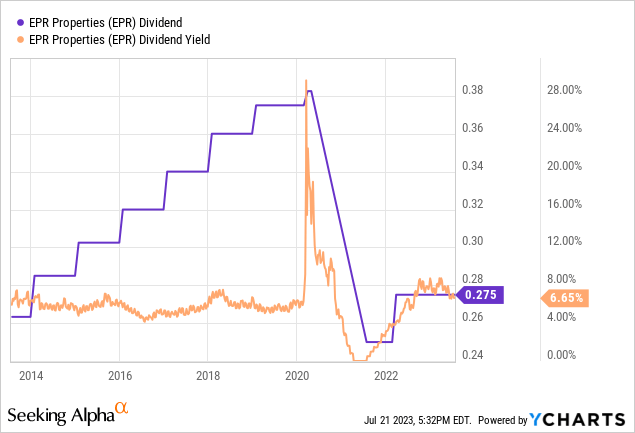

After Regal filed for Chapter 11 bankruptcy protection last September, its EPR fell sharply to $35 a share. If AMC needs to restructure its debt using the same tools, it’s possible the company will try these lows again. Importantly, AMC has about two quarters of cash runway to its current cash burn trajectory. This is not a clearly written funding runway and AMC may take more extreme options to reduce the funding burn. The company’s CEO, Adam Aaron, has navigated the ill-fated position the pandemic has placed on AMC and has proven to be very adept at doing what it takes to keep the company a going concern. It is believed that EPR has prepared for this in various ways. Finally, the REIT announced a monthly cash dividend of $0.275 per share in line with its previous payment, delivering an annualized future yield of 7.25%.

This is just below the monthly dividend announced for most of 2014. Regal, of course, confused the outlook for dividend expansion, but the REIT finally reported that he had $1.30 in adjusted funds under management per share for the first quarter. That was $0.11 above consensus expectations, up $0.14 from $1.16 AFFO in the same period last year. EPR’s payout ratio is about 63.4% for his three-month total of monthly dividends. Therefore, loss of rental income should not immediately be reflected in reduced monthly payments.

Fundamentally, EPR hasn’t been as aggressive in diversifying its non-theatrical revenues since the pandemic. Yes, bearish concerns about the disappearance of theaters were overdone, but the focus on Regal and AMC will always be a liability due to the pandemic. AMC’s financial health has been precarious since the stay-at-home days, and I would have hoped EPR would be more aggressive in rolling out its balance sheet and taking on more fixed-rate debt to acquire other experimental assets. Due to the uncertainty of AMC’s future, I have withdrawn from his EPR Properties. However, series G (New York Stock Exchange: EPR.PG) continue to offer more hedged exposure to REITs for those looking to maintain experiential real estate exposure. Will this movie have a bad ending? Probably not. But I’m not stuck to explore it.